Best PayPal Account Type for Freelancers (Complete Overview)

Looking for the best PayPal account type for freelancers? You may find that either the personal or business account might be worth it. Learn more here!

Freelancing used to be restricted to a few professions, but the end of the “one job for life” era has made it much more common. The Association of Independent Professionals & The Self-Employed (IPSE) estimate that 1.88 million Britons are freelancing in 2015.

Freelancing has many benefits, one of which is that freelancers aren't tied to one place. People taking advantage of this flexibility are known as “digital nomads” - able to work from anywhere as long as there's somewhere to charge their laptop. Choosing the right bank account is important when dealing with a fluctuating and variable income and running a small business - and we’ve put together a guide to give you some ideas of the sorts of things to look out for.

There is nothing to stop you* running a freelance business through your current account, and many people do. However, setting up a small business account can have other benefits - not least business advice from your bank. Although it might seem counter-intuitive to the idea of “keeping things simple” to have a separate business account, in actuality it can be much easier to keep your “personal” and “professional” money separately, especially when putting money aside for taxes.

Paying yourself a salary from one account to the other can be the most straightforward way to manage your money - especially if HMRC decides to audit you. *as a general rule - but check the terms and conditions for your specific current account.

Although it’s pretty unusual for a bank not to offer online and telephone support, make sure that you can do what you need to without having to visit a branch. As a freelancer your time is precious, and you can save hours a month with decent online banking.

Unlike current accounts, business accounts normally come with a whole raft of charges for standard transactions - so make sure you are aware of them. Small business accounts are often free to start with and then charge after this introductory period. Don’t let the expense automatically put you off though - it’s often better to pay a little for a really excellent service that might save you time and money in the long-run.

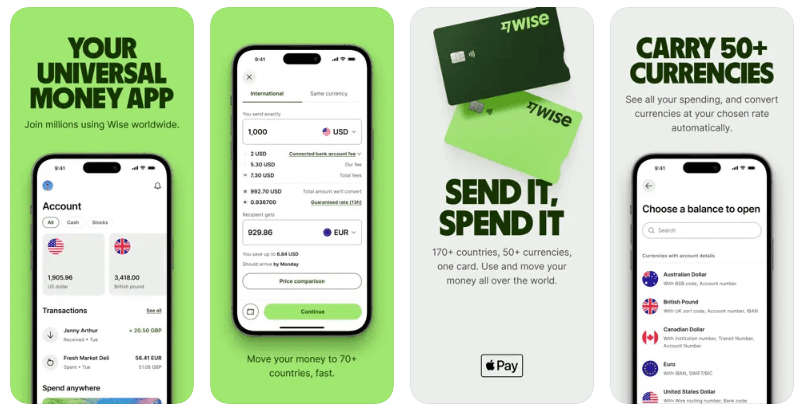

You can easily offset some fees as well - a secure money transfer service such as Wise can save on bank transfer fees when sending money abroad, which can really add up if you are travelling while freelancing and still running an account in the UK.

If you have international clients, you can use Request Money to save when getting paid. You'll save on fees plus get the real exchange rate. An online dashboard allows you to track your outstanding requests and you'll receive an email each time you receive a payment.

Some business and current accounts don’t offer interest at all, while others are more competitive. If your income is likely to be high then this is especially important.

Old-world bank accounts only work properly in one country. They hold money only in one currency. And it gets expensive when you try to use them across borders. Wise's new Borderless accounts solve all of this.

Now you can send, receive and organise your money internationally, without crazy fees or even-crazier exchange rates – just a small, fair charge when your money moves between currencies.

Currently the top three on the market for UK small businesses are:

Before you make a decision about whether to open a small business account, or just keep going with your current account, get some advice from other freelancing friends. Find out what their experiences have been and whether their bank or account might be a good fit for you. If you are planning on travelling while working, take a look at our top tips for working as a travelling freelancer.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for the best PayPal account type for freelancers? You may find that either the personal or business account might be worth it. Learn more here!

Embrace the flexibility of remote work with our guide on working remotely from another country. Gain insights into legal considerations and optimize your remote

Looking for a good time-clock app for your small business? No problem. Let's take a look at the best free and paid apps for you and your team.

Money-making apps consist of a few categories: Long-term freelancing apps, short-term task apps, delivery and taxi apps, and apps to sell your stuff.

1) Wise: Independent Contractor Account 2) Wonolo: Freelance Job Platform 3) TurboTax: Tax app 4) DoorDash: Deliver App 5) Fantastical Calendar: Free App

As long as you know how to market your skills and rates, you'll be able to profit quickly from Upwork. Let's jupm