How to open a bank account in Costa Rica as a foreigner: US guide

Learn all about opening a bank account in Costa Rica as an American, including costs, requirements, and alternatives.

Holding funds in a foreign currency savings account can be helpful if you want to diversify your investments, or if you transact frequently in foreign currencies.

This guide walks through how foreign currency savings accounts work, and takes a look at a few of the best banks for foreign currency savings account products to start your research.

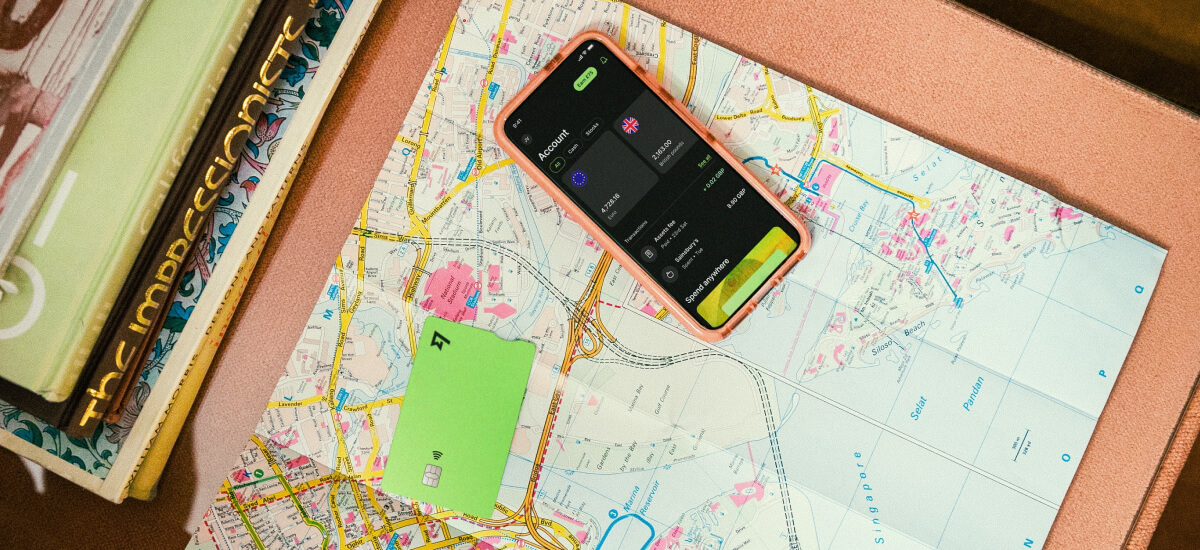

For flexible multiple currency accounts, check out Wise. Wise is a financial technology company and licensed Money Transmitter, which lets you hold 40+ currencies, send payments to 80+ countries, receive money in 9 different currencies with local bank details and spend on the Wise Multi-Currency Card in 150+ countries.

A foreign currency savings account is a savings account held in any currency other than USD. These accounts may be held with banks based in the US, with US branches of international banks, or with the international or expat banking divisions of global banking brands for example.

Foreign currency savings accounts offer customers the opportunity to hold funds in different currencies, which may mean you have access to a broader range of account types, and in some cases higher interest rates.

This means products like these are generally seen as an investment, and can appeal particularly to high wealth individuals looking to diversify assets across currencies.

Different foreign currency savings account options are available, including some from US based banks which come with FDIC protections, and some from overseas banks which can often have a high minimum deposit requirement.

While some currency accounts may offer higher interest compared to USD, it’s important to realize that the interest income you earn may be eroded by fluctuations in the exchange rates, fees and taxes at home and abroad.

It’s also particularly important to understand your tax liabilities if you have funds overseas, as you may find you have additional reporting responsibilities both in the US and in the country your account is based in. Get professional advice to make sure you’re complying with all legal requirements — and particularly check out FBAR¹ requirements which often mean you need to report your foreign currency holdings to the IRS.

| ✅ Pros | ❌ Cons |

|---|---|

|

|

Foreign currency savings accounts could be handy for people in different situations. For example, if you’re planning to move overseas and want to start to build savings in the currency you’ll need, you may choose to open a foreign currency savings account.

They are also popular with people looking to diversify investments across currencies — particularly high wealth individuals who can benefit from a lot of perks through expat and international banking services.

That said, foreign currency savings accounts aren’t right for everyone. You’ll often find high minimum balance requirements and fees, and there are inherent risks with holding your money in a currency other than the one you use everyday.

Your funds may be eroded by changes to the exchange rate, interest, taxes or fees, for example. Weigh up the pros and cons thoroughly before you decide to open a new account, and get professional advice if you’re unsure.

You’re unlikely to be able to deposit foreign currency directly into a regular US savings account.

Usually these accounts can hold USD only, so if you’re sending over a foreign currency, it’ll be converted to USD before being added to the account. This can mean paying a fee.

There’s no single best bank for foreign currency savings accounts — and you’ll be able to pick both US banks and expat and international banking divisions of popular global brands, depending on your preference.

Shopping around to find the best option for you is essential.

| Here are a few places to start: |

|---|

|

The process to open a foreign currency savings account will depend a lot on the bank you select. Some banks allow online account opening, but if you’re working with a bank based in the US you may still find you’re asked to attend a branch in person to get your account set up.

It’s also helpful to know that the eligibility rules — and therefore the paperwork you’re asked for — can be quite different compared to opening a regular US savings or checking account.

You’ll still need proof of ID and address, as well as tax information as you would with most accounts, but you may be asked for additional documents showing your income, assets or the source of the funds you’re depositing.

Double check what’s required before you start your application.

| Here’s how to open a foreign currency saving account, step by step: |

|---|

|

Looking for an alternative to banking to keep your money without a minimum balance? Wise has you covered.

| The Wise Account lets you: |

|---|

|

Get a Wise Account

in minutes!

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Be mindful that your foreign currency savings account may not work in quite the same way as your regular USD checking or saving account.

Particularly, the fees and features of your account may vary, and you may not benefit from the same deposit insurance you would in a normal USD saving product like a CD. Here are a few things to consider.

The costs that apply to your account may not be the same as other US based accounts you hold. You’ll need to be mindful of potential fees and requirements including:

|

|---|

Make sure you’re clear on the risks involved in opening any account you pick, including checking out protections that are in place. US accounts, even when held in foreign currencies, may benefit from FDIC insurance which protects customers — to a fixed limit — if the bank fails.

Accounts held in other jurisdictions may have different deposit protection schemes — or no protections at all. It’s up to you to complete due diligence checks so you’re confident your money is safe — getting professional help here can offer peace of mind.

It’s important to check the interest earning opportunity if you’re saving to build a nest egg, and also how that interest is paid.

The other factor that can impact how much money you can earn on your foreign currency account is the cost of converting and depositing funds in the first place, and withdrawing them back to USD when you need to.

If the bank charges a high fee to receive funds, including a conversion charge which is built into the rate used, this can eat into the amount you have — and you’ll have to pay it again when it comes time to remove your money, too.

Ask your bank if you can deposit foreign currency directly without incurring charges, and how the withdrawal process works, before you sign up.

Opening a foreign currency savings account can be helpful in a number of situations, and can usually be done either in person or online from the US.

With your new account you can hold and earn interest on foreign currencies, which may help you build a savings pot overseas, or offer benefits based on interest earnings.

However, there are costs and risks you’ll need to think about — and because of the broad range of different account types, you’ll need to shop around to make sure you’re getting the right one for you.

Take professional advice if you need it to make sure you get the best foreign currency savings account out there.

Sources checked on 07.23.2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn all about opening a bank account in Costa Rica as an American, including costs, requirements, and alternatives.

Learn all about opening a bank account in Monaco as an American, including costs, requirements, and alternatives.

Need to close Fidelity bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Need to close Capital One bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Need to close Santander bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.

Need to close PNC Bank account? Our guide covers requirements, fees, steps, timelines, and best practices to avoid errors and protect your money.