Should you close your foreign bank account?

Considering closing your foreign bank account? Discover the tax implications, benefits, and steps involved in making this decision. Learn more here.

These days, opening a new bank account doesn’t need to be a hassle. With the rise of online and mobile banks, it’s much easier.

But which is the easiest bank account to open online, for free? We’ll run through all of your best options right here in this guide. This includes the likes of Chase and Discover, along with neobanks such as Revolut, Current and Varo.

We’ll also show you an alternative, one which is super speedy to open online - the Wise Account.

Before we get started, let’s talk about an alternative option.

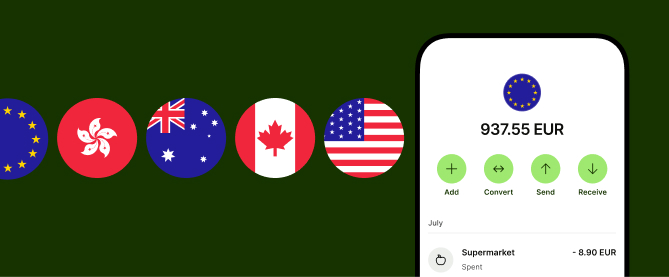

Wise isn’t a bank (it’s a Money Service Business or MSB), but it can be a great alternative to cover many of your banking needs.

You can easily open and manage a Wise Account online, in just a few steps. There’s no minimum balance requirement and no monthly fees. You’ll also get the following features:

There’s even a handy Wise app, so you can manage everything from your phone.

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

Your time is precious, so you don’t want to waste it filling in forms or visiting a branch, so you can open a new account.

The good news is that many US banks and money apps now let you open an account entirely online. In many cases, it takes just a few minutes and a couple of steps. You’ll have a new account up and running before you know it.

Here’s our pick of the easiest banks to open an account with online.

Digital specialist Revolut offers a choice of checking account plans, some of which have a monthly fee. However, it also has a free standard account.

All are among the easiest online bank accounts to open. You can do it in minutes, all from your phone, without any need to visit a branch or complete any paperwork.¹ You’re likely to need to verify your ID, but you can do that with your phone and a couple of photos/selfies.

Now, what does a Revolut account offer? The free Standard plan comes with the following features:²

Varo Money has both a checking account and savings account available, all managed online or through the dedicated mobile app. According to Varo, it should take you no more than 5 minutes to open an account online.³

The Varo checking account is fee-free, and offers the following features:³

You can apply for a Discover checking account online in minutes. Best of all, it has no impact on your credit score.⁴

Discover’s Cashback Debit account offers all kinds of benefits too, including:⁴

Digital bank Chime offers an online checking account that’s free to open. Even better, it also comes with no monthly fees.⁷ You can manage your money 24/7 through the user-friendly Chime mobile app.

When it comes to opening the account, it couldn’t be easier. Sign up within a couple of minutes on the Chime website with just your name, DOB, address and social security number. Then download the mobile app and start using your temporary virtual debit card right away.⁷

The Chime account offers the following:⁷

You can open a Chase Total Checking account online in just a few steps. You’ll need your social security number and ID. Simply set up your account preferences and start using your new account - it’s as simple as that.

But what’s actually on offer with the Chase Total Checking account? Let’s take a look at a few account features:⁸

The full-service online bank Ally offers a fee-free Interest Checking Account. It claims you can have a new account up and running in minutes, providing just a few personal details and making your first deposit.⁹

There are no maintenance or overdraft fees with this account, and you can withdraw cash for free at over 43,000 Allpoint ATMs. The bank also reimburses up to $10 per statement cycle if you’re charged fees at other ATMs within the US.⁹

Other features of the Ally Bank Interest Checking Account include:⁹

It’s easier than ever to open a bank account. With many banks, you can do it online, for free and in just a few minutes. You might only need to provide your mobile number to get started.

After reading this, you should have a good idea of the easiest bank accounts to open online. You can simply choose the one that suits your needs the best, and get started.

Also, if you’re looking for an alternative, you can always try out Wise. While it’s not a bank (it’s a Money Service Business or MNB), it can be a great to cover your banking needs.

Pretty much all the bank accounts we’ve covered above are easy and quick to open online. If you’re looking to sign up just using your mobile, check out the likes of Varo, Juno, Chime and Current.

Unless the account comes with monthly fees, all the banks we’ve included in this list offer free account opening. It’s not typical to charge a fee to open an account, although some do have monthly maintenance or service charges once up and running.

Banks and money apps such as Revolut, Varo, Chime and Ally offer checking accounts with no minimum deposit. This means you can open one without putting in an initial deposit, then move money over later when you’re ready.

If you’re looking for the easiest bank account to open online with bad credit, take a look at Discover. The bank lets you open an account without the application having an impact on your credit score.

Most bank accounts require at least a little processing time, but in some cases this could be just a few minutes. For example, with Chime, you can start using the mobile app and virtual debit card almost right away.

Sources used for this article:

Sources checked on 07-Jun-2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Considering closing your foreign bank account? Discover the tax implications, benefits, and steps involved in making this decision. Learn more here.

Learn how to close your ADCB account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.

Learn how to close your UAE bank account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.

Learn how to close your AIB bank account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.

Learn how to close your Emirates NBD account from abroad with this comprehensive guide. Discover the steps, required documents, and tips for a smooth process.

Closing an Indian bank account from abroad: everything you need to know