How to Open a Business Bank Account in Finland: A Guide for U.S. Entrepreneurs

Learn how to open a business bank account in Finland with this guide. Get essential info and steps for setting up your business finances.

There is no Discover business checking account, but the bank does have a personal checking account. This could be an option for small business owners.

Discover Bank offers a variety of personal bank accounts, from a Money Market to a Savings account.

The options are there if you’re willing to settle for something that isn’t strictly a business checking account.

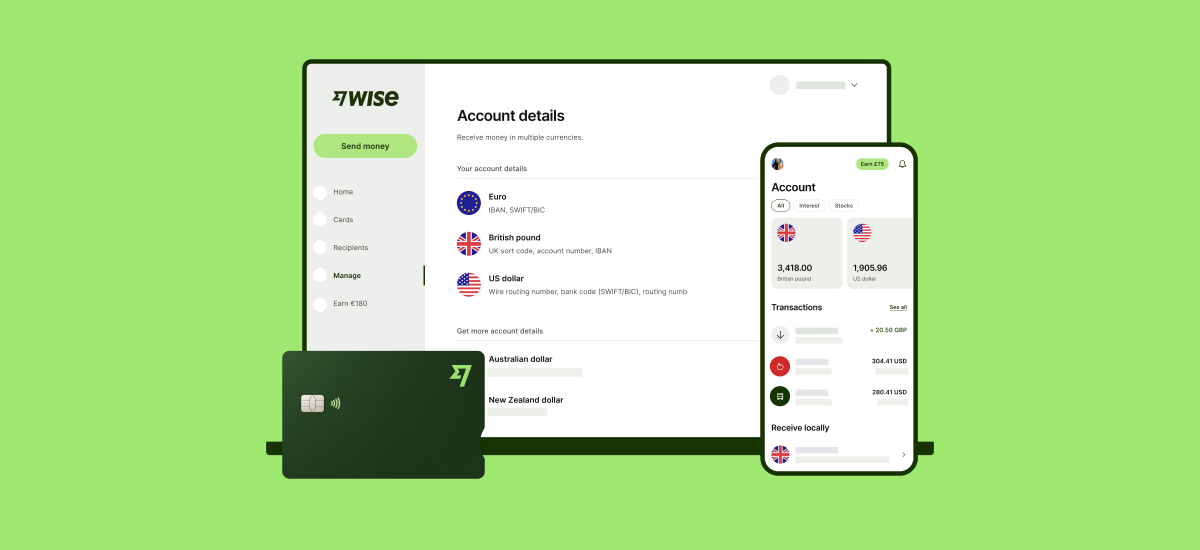

Check out Wise Business,

the no-stress international business account 🌎

| 📝 This article will cover: |

|---|

No, there is no Discover bank business checking account.

While Discover bank may not have a business checking account, it does have other accounts that can be suitable for business owners.

If you’re a small business owner, and you don’t need to separate your business earnings from your personal finances, then you can sign up for one of Discover’s many personal accounts online.

Discover has the following accounts available:

Discover has plenty to offer its customers in the way of convenience, especially given that is is an online-only bank.

You can make quick payments online and process wire transfers in a matter of minutes, all with the tap of your finger or the click of a mouse.

You can also access the bank and your personal account through the website or app wherever you are. So even if you frequently travel for business, you can still stay on top of your finances.

Several of the personal accounts, such as the Online Savings account, allow you to accrue interest on your money.

With the Online Savings account, Discover offers customers the opportunity to earn up to 0.4% APY, which is five times higher than the national average.¹

Yes, although there is no Discover business checking account, there is a Discover IT business credit card. By signing up for a Discover account, you will qualify for the bank’s business credit card.

The Discover IT business credit card grants customers unlimited 1.5% cash back rewards for every dollar spent and requires no annual fee.²

You can add employee cards, too, so you can incentivize purchases within the company and earn rewards for all of them. The rewards never expire, either, so you’re free to redeem them whenever suits you.

If you run an LLC, partnership, or corporation, then a separate business bank account is compulsory due to taxation.³

If what you’re after is a business checking account, then here’s an overview of some Discover alternatives which also offer online banking:

| Key features | Great for |

|---|---|

|

|

Fees:

The Wise Business account is free to set up. If you need international bank details to pay and get paid in the local currency, then there’s a one-time fee of $31.

There are no monthly fees and no minimum opening deposits.

Pros:

Cons:

Reviews from Trustpilot give Wise an overall score of 4.6 (This score is for Wise, the bank as a whole, not the Business account alone.)⁴

| Key features | Great for |

|---|---|

|

|

Fees:

No monthly fees, and a cap of 200 fee-free transactions, with $0.30 per item thereafter. Minimum opening deposit balance of $1,000.

Pros:

Cons:

Axos also offers a Business Interest Checking account, which has a $10 monthly fee and $100 minimum opening deposit, but allows customers to earn up to 0.81% APY.⁶

Axos bank has a Trustpilot score of 1.9 from 17 reviews, though bear in mind that this is for the bank overall, not the individual Business Checking accounts it offers.⁷

| Key features | Great for |

|---|---|

| The Tailored Checking account from LendingClub offers 0.10% APY, and no monthly fees with a balance of at least $5,000.⁸ | Earning interest on your income and using your bank with accounting software suites such as QuickBooks and Quicken. |

Fees:

There is a $10 monthly maintenance fee which can be waived with a balance of over $5000. There is a $100 opening deposit requirement.

Pros:

Cons:

The LendingClub bank has an overall rating of 4.8 on Trustpilot, though this score applies to the bank as a whole, not the Tailored Checking account specifically.⁹

Wise Business is more than just a business account. It offers a convenient way for you to take care of your invoicing and payroll needs, regardless of where your suppliers or employees are located.

There are low, transparent fees, which work out 19x cheaper than PayPal, and you always get the real mid-market rate.

You can also sync your QuickBooks or Xero account with Wise Business, which can make managing international payments a breeze.

With Wise Business, you can also have up to ten local account details, including IBAN, UK Sort code, or US routing number. And all this in one place. Nifty.

The Wise customer support team is available around the clock, and you can even contact them by phone to put your doubts to rest.

Set up your Wise Business account in minutes 🚀

Sources:All sources checked 17 September 2021.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a business bank account in Finland with this guide. Get essential info and steps for setting up your business finances.

Learn how to open a business bank account in Switzerland. Discover the essential steps to set up your business finances.

Learn how to open a business bank account in France. Get essential tips and steps for setting up your business finances.

Learn how to open a business bank account in Germany. This guide offers localized steps for setting up your business finances efficiently.

Is the Navy Federal Go Biz Rewards Card worth it? See our review of rewards, fees, benefits, and who qualifies for this business card.

Learn how to transfer money from your Bank of America business account to your personal account. Follow our step-by-step guide for secure transactions