How to open a foreign currency account in the US

Wondering how to open a foreign currency account in the US? Struggling to find information? Read on to find out what you need.

If you’d like to get your relief payment paid into your Wise account, it’s simple to locate your US bank details from your account and enter them in the IRS web portal. It’s quick to set up, free to receive payments, and it’s faster, more convenient and secure than a check.

In response to the coronavirus pandemic and its impact on the economy, last month the US government signed into law the Coronavirus Aid, Relief and Economic Security Act (CARES).

The law provides direct economic assistance for American workers and families, and it's expected that up to 150 million American citizens and eligible foreign residents will receive Economic Impact Payments as a form of financial support.

The lockdown caused by the coronavirus pandemic has put a significant strain on jobs, employers and the economy. In an effort to support people financially during this difficult time, the government is providing a one-off payment to help people weather the storm.

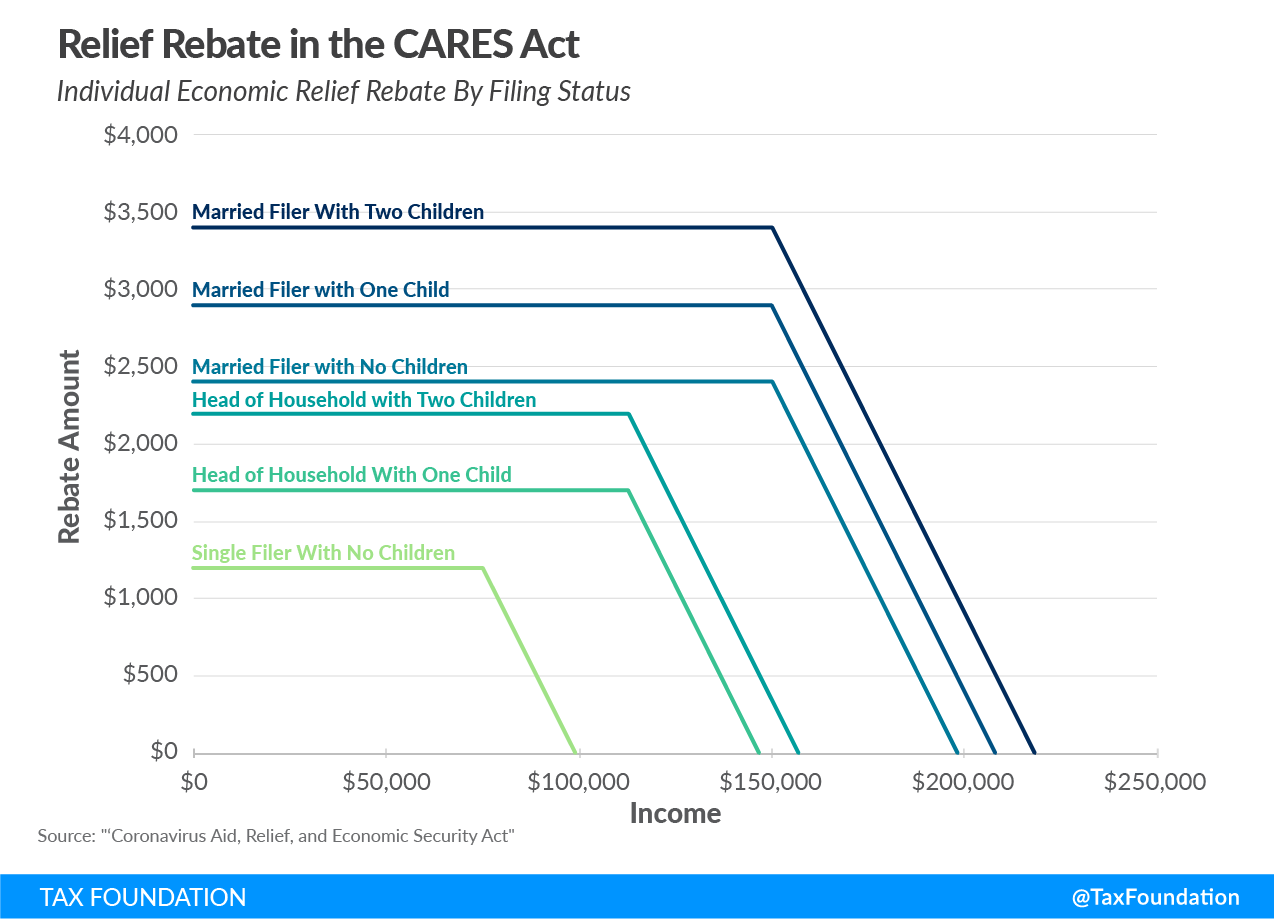

It depends on how much you earn, but the majority of American workers are eligible. However, high earners will not receive payments. Below is a breakdown of how the payments are calculated.

The rebate amount you are eligible to receive depends on your tax filing status and your earnings.

The starting point is that each adult will receive $1,200 and each child $500. However, above a certain income threshold the amount you receive will decrease by $5 for every $100 in additional earnings. The threshold for this phaseout depends on your filing status:

This graph from the Tax Foundation is a simple way of understanding how the payments are structured according to your income and tax status.

There are two ways to receive this rebate: Check or Direct Deposit to your account. However, where possible, it’s always faster and more convenient to use Direct Deposits.

The Internal Revenue Service (IRS) provides the information you need to track your payment or enter the details for the account into which you want to get paid. It varies slightly depending on whether you filed taxes recently or not:

1. Filed taxes in 2018 or 2019?

If you filed your taxes last year, there’s a good chance that you will automatically receive your payment without having to enter more information, if you haven’t already. Be sure to check your account carefully to see if any payments have been deposited there.

However, you can check your payment’s status on the IRS web portal. This portal also lets you update the account into which you would like to be paid, provided that your payment has not been completed or initiated (in which case it’ll be marked ‘pending’). If you’d like to get paid into your Wise account, scroll down for details on how to find your bank details.

2. Didn’t file taxes last year?

If you earned less than $12,200 ($24,400 for married couples), or were not required to fill in a tax return last year, there’s a dedicated web portal for you on the IRS website. Again, you can provide your Wise account details to get paid here. Scroll down to see how to locate them.

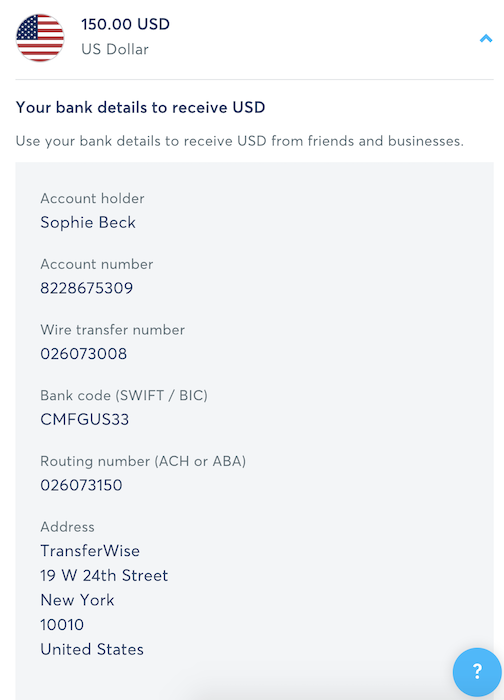

Simply log in to your Wise account and click on your USD balance. Here you will see your account number and your ACH/ABA number. These are the two you need to submit to the IRS web portal to receive a direct deposit. Be sure not to select the wire transfer number accidentally.

If you haven’t yet opened a USD balance yet, simply click on Open a balance, select USD, and click on Get bank details. You’ll need to add a top up to get started and send some basic information to verify your identity. Here’s a simple walk-through.

And if you haven’t created an account with Wise yet, click here to get started. It’s free and takes just a few clicks.

There’s more information about updating your bank account details and tracking your payment status on the IRS website. Scroll down to the section titled ‘Bank Account Information’ in their frequently asked questions.

For now, this is the only payment that has been announced by the government, although the situation remains subject to rapid change.

When it comes to managing your finances and international payments during this difficult time, we know how important it is to have predictable, reliable access to your money. We’re here to make sure that moving your money is one less thing to worry about right now.

| Wise helps 7 million customers manage their money across borders cheaply and easily. Sign up or at wise.com, or through our Android or iOS app. |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering how to open a foreign currency account in the US? Struggling to find information? Read on to find out what you need.

Use Apple Pay? Find out how to use the Apple Tap to Cash feature on your iPhone and Apple Watch.

Read on for everything you need to know about sending and receiving international payments with Swift Go.

Here’s all you really need to know about making international transfers with Ria. We've done the research for you, so kick back and read on.

Read on for everything you need to know about sending and receiving international wire transfers with Nationwide UK.

Here’s everything you need to know about sending money orders with Walmart. We cover fees and costs, limits, and how to fill one out. Read on to learn more.