IRS exchange rates: Guide to foreign currency conversion for US taxes

If you’re a US expat or have foreign income, you have to report your assets in USD. Find out how the IRS exchange rate works in this guide.

Looking for a way to save and earn interest, while still maintaining access to your funds? You may be wondering about opening a money market account from Chase®. Read on as we cover the key questions: does Chase bank have a money market account, and if so, what’s the Chase money market account interest rate?

Money market accounts can be a handy vehicle for some customers, with flexibility to access your money alongside decent interest earning opportunities. However, if you’re asking - does Chase have a money market account - at the time of writing, the answer is no.

Chase does offer a money market fund¹, which is a different type of investment vehicle, as well as some other products like savings accounts and CDs. We’ll look at some alternatives to a Chase bank money market account, later.

At the time of writing, the Chase money market account rate isn’t available as this product isn’t offered to new customers. However, Chase does have a couple of different savings accounts: Chase Savings and Chase Premier Savings², plus some Certificates of Deposit (CDs) available.

While interest rates do change, the Chase interest rates at the time of writing are as follows:

The Chase money market savings account isn’t currently available, but Chase does note in its financial information pages, that money market accounts typically have a high minimum deposit requirement⁶.

Other Chase products have their own minimum deposit requirements - Chase CDs have a minimum deposit of 1,000 USD⁷ for example.

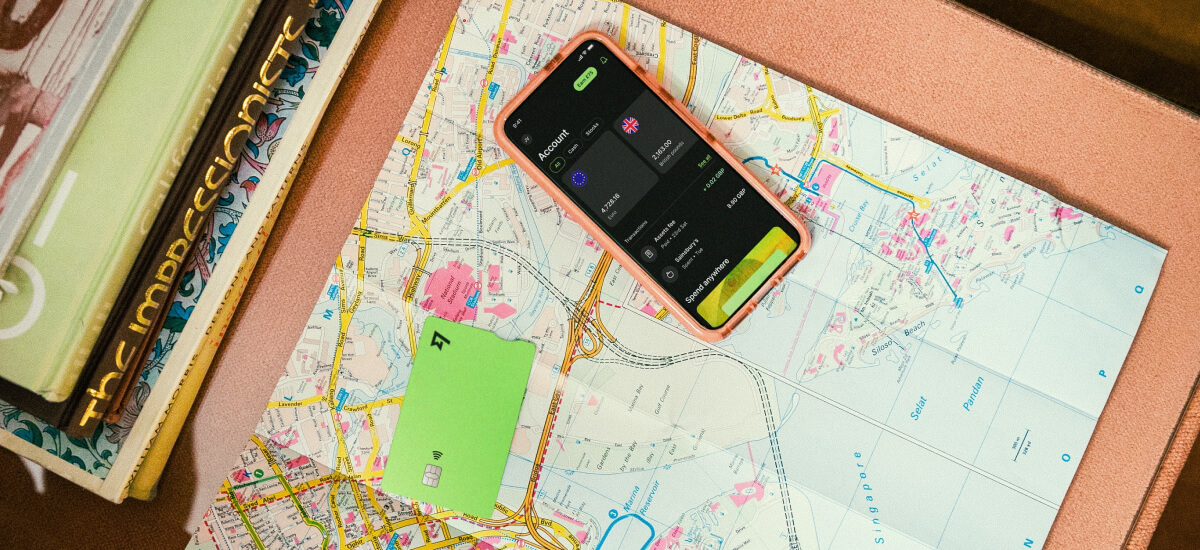

If you’re looking for a flexible way to manage your money across currencies, meet Wise. Wise is a Money Transmitter specializing in low cost currency conversion, international payments and multi-currency accounts you can operate with just your phone.

Wise accounts can hold and exchange 40+ currencies, with the mid-market exchange rate and low fees. Open your Wise account online or in the Wise app and start sending payments to 70+ countries, and receiving money to Wise like a local from 30+ countries - plus you can order a Wise Multi-Currency Card for easy spending in 150+ countries in person, and online.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

Although the Chase money market account isn’t available at present, there are plenty of alternatives that you might want to consider.

If you’re specifically looking for a money market account, you can still find alternative options from popular providers such as Sallie Mae®⁸ and Discover Bank®⁹. Alternatively, you might want to look at a high yield savings account, or a business savings account if you’re on the hunt for ways to manage your company finances more productively.

As we’ve also mentioned, Chase also has CDs which have varied yields depending on the amount you save, the term you select and whether or not you qualify for relationship status. Check out the full details, including the up-to-date terms and rates, over on the Chase desktop site.

While Chase has a pretty broad range of products including checking accounts you can use for day to day spending and to send and receive Chase international wires, plus Chase cards for easy spending, there’s currently no money market account from Chase bank.

Instead, check out money market accounts from alternative providers, or take a look at the other Chase savings products on offer. And don’t forget, if you’re spending, sending, receiving or holding foreign currencies, you could find your money goes further with Wise.

Savings interest rates change all the time, depending on a range of factors. To find the best rate available for your deposit, you’ll need to shop around and compare options across different savings vehicles and providers.

One drawback to a money market account is that you may be required to deposit a fairly high minimum deposit amount, and you’ll only be able to make a limited number of withdrawals from your account without facing possible penalties.

All sources checked on 24 July 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you’re a US expat or have foreign income, you have to report your assets in USD. Find out how the IRS exchange rate works in this guide.

Looking for Remitly alternatives? Explore other reputable competitors in the international money transfer industry & discover trusted platforms like Wise.

Learn more about how to pay and explore the top payment methods in Egypt

Learn more about how to pay and explore the top payment methods in Niger

Learn more about how to pay and explore the top payment methods in Norway

Learn more about how to pay and explore the top payment methods in Sweden