How to send money from PayPal to Wise

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

When you go abroad, your bank’s eyes light up. Why? Your foreign payments are a massive moneymaker for them—at your expense. Fortunately, there’s now a smarter, cheaper alternative.

Converting currencies is much more expensive than people realize. Banks charge a hidden cost, by applying a mark-up on the exchange rate they give you—meaning a chunk of your money goes missing when you swap currencies.

You get hit by this mark-up whether you're making a card payment while abroad or making a cash withdrawal from an overseas ATM. Picking up foreign cash from your bank or provider before you’ve left the country can be even more costly, since there are often larger mark-ups in-branch.

It’s hard to figure out how much this mark-up is, so it’s essentially impossible for the average consumer to compare the true costs between providers.

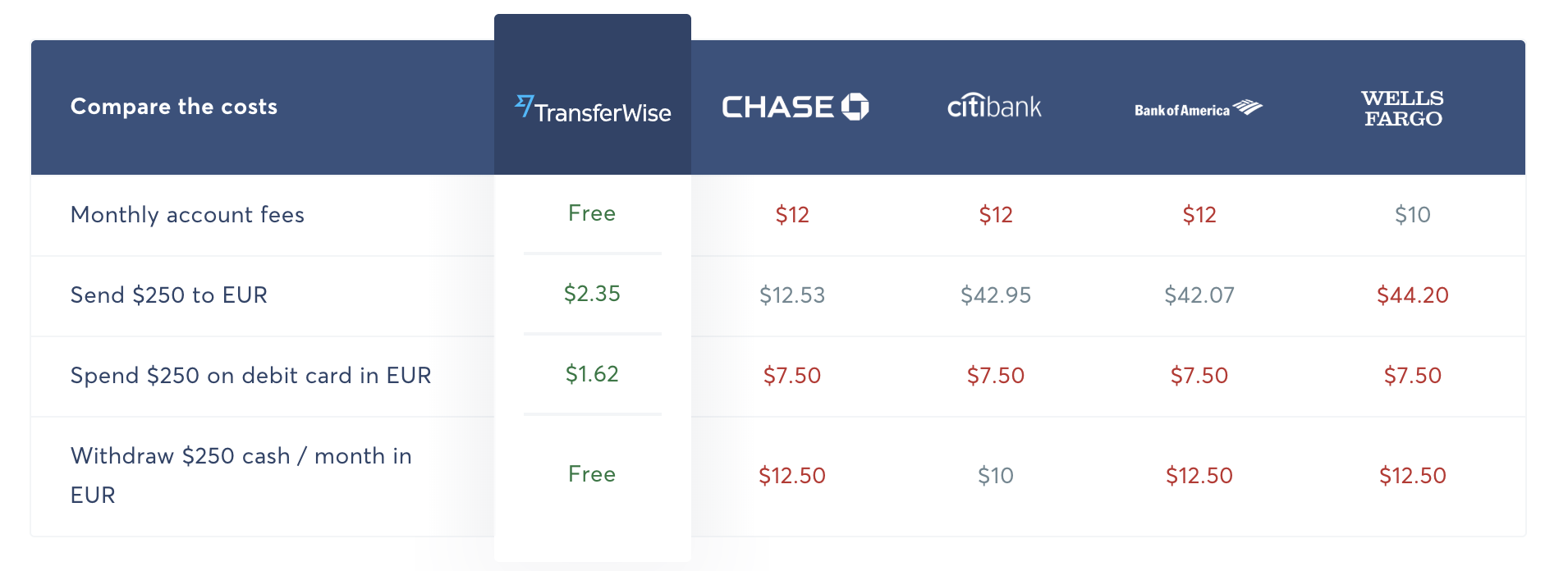

We know how hard it is because we actually made those payments through 4 different US banks, since there's no simple way to compare beforehand. Here’s what the results look like:

Learn more about this research here.

A simpler, cheaper alternative

At Wise, we’re eradicating all those unfair fees. Our Multi-Currency Card is the easiest, cheapest way to spend money internationally. Just sign up for a free account, top up your balance, and order our card to start saving.

We always give you the real exchange rate, with a simple upfront fee that works out at a fraction of the cost compared to a bank. You can also take out up to $250 fee-free, and you can manage your account easily in our app.

Here are some of the other advantages:

A free account with 40+ currencies, local bank details

The card is free and comes with an account, which allows you to hold over 40 currencies and convert between them instantly. You get local bank details for over 30 countries, too, so if you ever need to get paid, you can receive money for free.

A safer way to manage your money

You can freeze your Wise Multi-Currency Card in one click if you lose it, and it’s just one more click to unfreeze it. We also send push-notifications to your phone so you can track your payments and stay protected against fraud.

We help prevent you from overpaying

When you’re abroad, you may get offered the choice between paying or withdrawing from an ATM in either your home currency or the local one. Always pick the local currency. It’s much more expensive to use your home currency while abroad on a card.

The technical term for this is Dynamic Currency Conversion (DCC), and we’ve built a DCC detector to let you know if you paid in the wrong currency. We’ll give you a friendly heads up if you choose the wrong option, and we'll even tell you how much you could save by picking the local currency next time.

| Get your Wise Multi-Currency Card now and spend in over 40+ currencies anywhere. |

|---|

The best way to send money between bank accounts

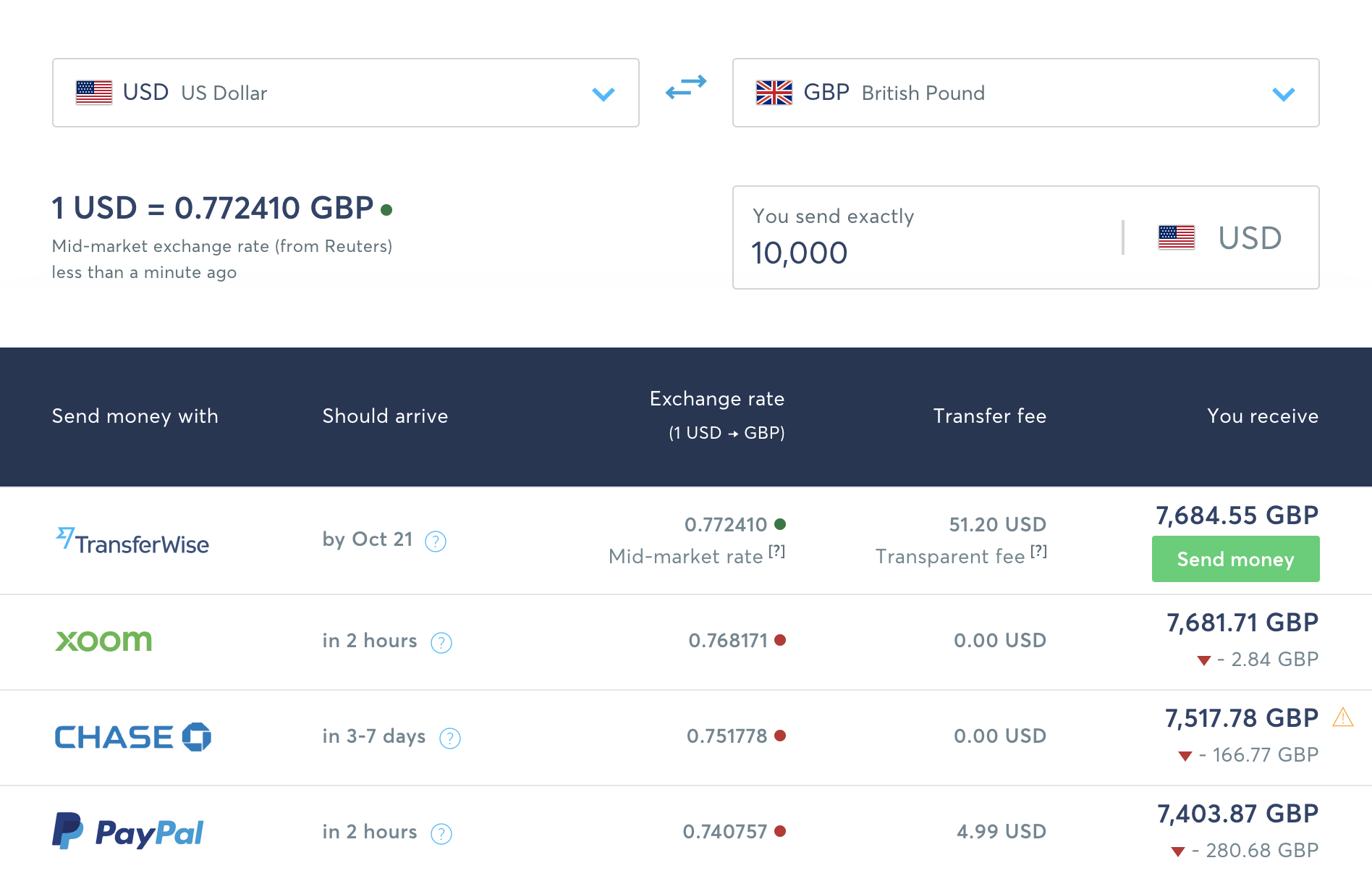

Sending money to an overseas bank account through a bank, PayPal or Western Union also comes with those costly exchange rate mark-ups. If you use Wise to make an international wire, you’ll always get the real exchange rate. Our small upfront fee means you know exactly how much money will be converted, and you'll pay far less than you would with a traditional provider.

We know this because we carry out live comparisons against our competitors – see how that looks here:

Find out more about this research here.

Sign up for your free account here, or learn more about our card and account here.

The Wise Multi-Currency Card® is issued by Community Federal Savings Bank, member FDIC, pursuant to a license from Mastercard International. Other features of the borderless account are provided by Wise Inc. pursuant to its state licenses.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

For many of us who are first-generation Americans, financial literacy isn’t something we learn from our parents - and we’re definitely not taught about money...

Everything you need to know about Discover It balance transfer limits.

Save when traveling to Europe by reading our guide on avoiding ATM fees.

Sendwave vs Wise: Comparing features, benefits, and more. Explore this article for insights on international money transfers.

Should I exchange money before traveling to Europe? Gain insights in this article for making informed decisions about currency exchange before your trip.