Which Singapore corporate tax rebates are important in 2024?

Not sure which corporate tax rebates in Singapore apply to your startup for Budget 2024? This guide has you covered for everything you need to know.

If you’re a business owner here in Singapore, you may need to employ or hire workers, contractors or freelancers based internationally to help you grow your company. Adding overseas employees to your team can help you connect to international markets - or simply mean you’ve got the biggest possible talent pool to look in when you’re making your next hire.

However, paying international employees can come with its own drawbacks, including navigating overseas tax and employment rules, and the practicalities of running payroll in different currencies.

If it’s time to grow your team overseas, this guide is for you. We’ll walk through things to think about if you’re paying employees based overseas, with an extra focus on paying US employees from Singapore as an example.

And to help you cut your international payroll costs and admin time, we’ll also introduce smart ways to pay in foreign currencies, with the Wise business account.

| Table of contents |

|---|

Working with people based overseas is easier than ever now, in our increasingly connected world. However, whether you’re bringing an employee into your business, hiring a contractor for a project, or getting some freelance support, you’ll need to figure out how to manage your payroll overseas.

From working out whether you need to withhold taxes, to agreeing who’ll shoulder the costs of converting currencies and sending money abroad, there’s a lot to think about. Here are the key things to consider when paying employees overseas, to kick start your research.

If you’re paying an overseas employee you’re going to need to do some research to check the employment or tax implications for you, based on the individual’s residence and employment status.

As an example, you might find that there are local rules in your employee’s home country around the number of hours an employee can work, or the amount of paid vacation they should be offered. As an employer you’ll need to honour these rules, as well as complying with any duty to withhold and pay taxes.

Whether or not your employee will be required to report their income to IRAS, and pay Singapore tax, will depend on the contractual agreement you have in place with them.

If your employee has signed an employment contract with your Singapore registered business, they may need to pay Singapore income tax, even if they work remotely and are paid in a foreign currency.

If they’re employed through a business registered in their home country - for example if you have an overseas subsidiary - their income may not be liable to Singapore tax. In the event that the employee is subject to tax in both Singapore and their home country, there may well be a double taxation treaty or agreement in place to make sure they don’t need to pay tax twice on the same income.

Because both local and international tax regulations are pretty complex, and depend on a number of factors, getting professional advice is a smart idea to make sure you stay on the right side of the law. You can also talk directly with an advisor from IRAS online, by visiting the IRAS website. This is recommended as the fastest way to get answers to your tax-related questions - well worth doing before you finalise your plans to take on foreign talent.

| Pay your international employees with Wise Business and avoid the hefty fees. Save up to 19x compared to PayPal and pay employees around the world in 50+ currencies. |

|---|

| Learn more! |

Your next step when paying overseas employees will be to look at the costs of international payroll. If you’re paying an employee or freelancer in a foreign currency you’ll need to take into consideration the costs of currency conversion and processing your international payment, as well as the risk of fluctuations in the exchange rate pushing up the amount you have to pay.

Having a multi-currency business account can be a good way to cut overseas payment costs, and manage your money across currencies. Many modern business accounts also come with options to allow you to make multiple payments in a range of currencies faster - such as Wise batch payments which let you process up to 1,000 payments at a time with a single spreadsheet. There’s more coming up on this, next.

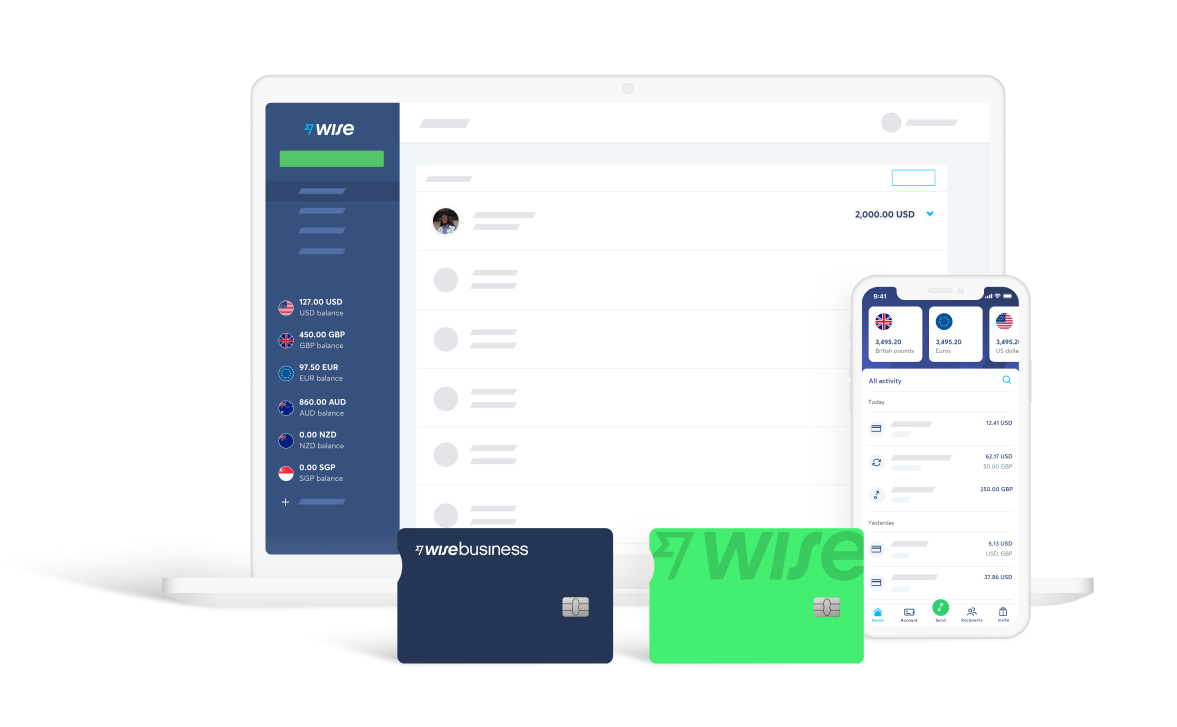

If you’re paying employees, contractors or freelancers overseas, you could find it’s cheaper - and faster - with the Wise business account.

Open your Wise business account for a one time fee of S$ 99, with no monthly costs or minimum balance. You’ll be able to hold and exchange 50+ currencies in your account, and send payments to 80+ countries. You’ll also get local bank details to get paid more easily yourself from 30+ countries - and linked international business debit cards for you and your team.

| 💼 Case Study: Learn how HR management solution Slasify uses Wise to save time and money when paying contractors and employees around the world in different currencies |

|---|

Because all Wise currency exchange uses the real mid-market exchange rate and low, transparent fees, your international payroll could work out up to 6x cheaper than with a regular bank - and up to 19x cheaper than using an alternative like PayPal.

You’ll also be able to cut down your admin time with great business friendly features like batch payments, a powerful API to automate workflow, and integrations with your favourite cloud based accounting software.

To help illustrate the things you need to think about when paying international employees let’s look at an example: paying US employees overseas.

If you’re a business owner or entrepreneur and have someone working for you who’s either a US citizen or a US resident, you’ll need to bear in mind US employment and tax rules - as well as obligations on the Singapore side - to stay legal.

Exactly what you need to do will vary based on the specific situation, including whether the person working for you is a US tax payer, and their employment status¹. It’s a good idea to get some independent, professional advice to navigate the process of paying US employees overseas as there are hefty penalties for getting it wrong. The IRS can impose fines and even criminal charges on businesses which appear to be trying to duck out of their tax obligations² - not something you want to risk.

A useful starting point is to make sure you’ve correctly classified any US person you’re paying for work as either an employee or a self employed contractor. As a business owner, your tax obligations are based on getting this classification right.

In most cases, if you’re paying someone who’s self-employed or an independent contractor, they’ll be responsible for filing and paying all their own taxes on any income. However, if the person you’re paying could reasonably be classified as an employee, you’ll usually be responsible as the employer, for withholding and paying taxes including income tax, social security tax and Medicare tax.

If you’re not sure whether someone you’re paying will classify as an employee or not, the IRS can step in to make the judgement for you. In this case, either you or the worker will need to complete and file IRS Form SS-8 to get a final decision.

If the person working for you in the US is considered to be an employee - and they’ve signed a contract with a Singapore registered business - they may also be liable to pay taxes on income in Singapore, as we noted above. However, in this case, tax agreements between the 2 countries should kick in to make sure they don’t actually have to pay tax twice on the same income. Get professional advice to make sure both you and your employee are complying with all the rules.

Bringing foreign talent into your team can give your business a boost - whether that’s by employing a local agent overseas to help you launch in a new market, finding the perfect freelancer for your project, or expanding your service team across time zones to provide seamless customer support around the clock. However, paying international employees can come with a few challenges - including navigating complex employment and tax regulations to keep yourself and your employee on the right side of the law.

Get some professional advice to make sure you’re clear on your obligations both in Singapore and in the home country of your new team member, to make sure their onboarding is hassle free. And then get yourself set up with a simple, low cost way to make it easier and faster to manage international payroll, with the Wise business account. Pay up to 1,000 people in just a few clicks, in dozens of currencies, with the real exchange rate every time. No hassle and no hidden fees.

Learn more about Wise Business

Sources:

Sources checked on 29.06.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Not sure which corporate tax rebates in Singapore apply to your startup for Budget 2024? This guide has you covered for everything you need to know.

Small business owner or ecommerce seller wondering how to find a supplier in China? Read more from our guide how to find vendors in China

Making a choice between Stripe vs PayPal? We reviewed what both platforms offer for Singapore ecommerce businesses.

Here's everything you need to know about PayPal Singapore business account. We cover fees, exchange rates, how it works and more. Read on.

Looking to use Wise to accept payments from Shopify? This guide walks you through how to add your Wise account details to Shopify.

Looking for an accounting software and deciding between Quickbooks vs Xero? We reviewed the benefits of both providers for Singapore businesses.