If you’re an ecommerce seller looking for the best ways to accept payments here in Singapore, and from customers around the world, you may be wondering about the benefits of Stripe vs PayPal. Both offer a great suite of services to business owners and ecommerce sellers - but their features and fees do vary, so doing some research will help you decide which is best for your specific needs.

This guide gives a full Stripe vs PayPal review - and we’ll also touch on how Wise Business can help you cut the costs of currency conversion, no matter which payment gateway you go with.

What is Stripe?

Stripe¹ is a payment processing provider (or payment service provider - PSP) which offers integrated, end to end support to help ecommerce sellers, retailers with physical businesses, subscriptions businesses, software platforms and marketplaces to take on and off line payments. Stripe services include processing transactions, helping companies prevent fraud, card issuing and business finance solutions.

One of Stripe’s biggest selling points is that it has fully customisable solutions so you can use it in exactly the way your business requires. Build apps, integrate yourself or with off the shelf solutions, or try no-code options instead. Read more from our full Stripe review.

What is PayPal?

PayPal² was a pioneer in ecommerce and online payments, and now has 340+ million customers around the world. PayPal has a broad range of commercial and merchant services, primarily based around sending and accepting online payments. You can use PayPal’s solutions to accept online, phone and email payments, send money and invoice clients, to help reduce and manage business risk, and to streamline operations and cut your costs.

One great feature about PayPal’s merchant services is that it’s available to all, even if you don’t have a great deal of technical knowledge within your team. Most PayPal solutions can be implemented using plug-ins and pre-prepared code, which reduces the need for developer support. Learn more from our PayPal Business Account review

Stripe vs PayPal Singapore - an overview

On the face of it, PayPal Business and Stripe may seem to be fairly similar. In fact, there’s quite a few differences in the way these businesses work - including both features and the fees involved with using them.

We’ll unpack this in more detail in just a moment - but first, let’s take a look at an overview of the key similarities and differences between Stripe and PayPal Singapore:

- PayPal has strong out of the box solutions, Stripe is very customizable but may require tech support to get started

- Both PayPal and Stripe allow online card payments, but Stripe has more available payment methods, including digital wallets and PayNow

- Stripe supports off line payments with their own POS terminals and card readers - PayPal Singapore does not support this service

- PayPal supports 25 currencies, Stripe supports 135+ currencies - both charge currency conversion fees when you receive overseas payments or switch currencies for withdrawal

- Both PayPal and Stripe are large, trusted global businesses with robust security and seller protections in place

Ultimately, whether PayPal or Stripe is right for your business will depend both on the type of services you need, and your own personal preferences. It’s well worth looking at each of them before you pick one, and considering their features and fees.

One thing you’ll notice is that both Stripe and PayPal have currency conversion fees which apply when you get paid from overseas, or convert a foreign currency to make a local withdrawal. This can eat into your business profits - but you can reduce the impact of currency conversion costs with a multi-currency account from Wise Business.

Use your Wise account to withdraw in a range of currencies, and convert with the Google exchange rate as and when you need to. More on that later.

PayPal vs Stripe comparison

While PayPal and Stripe are both payment processing services, they’re pretty different in where they specialise and the services that they offer. To help you get a feel for which may suit your specific needs, let’s take a more detailed look at a side by side comparison.

Both providers have a pretty expansive range of services - so if you don’t see the features you need listed here, do check on the provider’s websites or reach out to their customer service teams to see if they can help.

| Feature | PayPal | Stripe |

|---|

| Ease of use | Off the shelf solutions available which makes this an accessible solution, even without tech support | Full suite of customisable options, may be best suited to businesses with tech and developer support |

| Monthly fees | No monthly fee | No monthly fee |

| Fees to receive card payments | 3.9% + 0.5 SGD for domestic payments³ 4.4% + fixed fee based on currency for international payments Currency conversion fees may apply when you need to switch currency to withdraw or send on your funds | 3.4% + 0.5 SGD⁴ 3.4% + 0.5 USD for payments made in USD Currency conversion fees may apply if you receive payments from overseas |

| Payment options supported | Credit and debit cards, PayPal and PayPal credit, echeque, alternative payment methods (options vary), payment links | Credit and debit cards, digital wallets, PayNow, payment links |

| Invoicing options | Invoicing services available | Invoicing services available |

| Online payments | Available | Available |

| Off line payments supported | In person payments not available, but you can pay by phone and email | Off line payments solutions available |

| How to withdraw funds | 1 SGD to withdraw under 200 SGD to a local bank account, no fee for higher value withdrawals 1% fee to withdraw to a SGD card 3% fee for USD withdrawal | Free standard withdrawal to SGD bank account 1% fee for instant SGD withdrawal 1% fee for USD withdrawal |

| Fraud protection | Seller protections on offer | Radar Fraud Protection services available |

| Customer support | Online, in app and by phone | 24/7 phone, chat and email support, including developer support |

| Additional services | Risk management and operational support available | Business formation support, tax services and more |

Stripe fee vs PayPal fee

As we’ve already mentioned, both Stripe and PayPal have a pretty broad selection of services on offer.

To get a full rundown of everything you can do with both Stripe and PayPal you’ll want to spend a bit of time browsing their desktop sites. But to help you get an overview, we’ve picked out the key fees from each provider, for the services most ecommerce sellers and small businesses may need.

| Service | PayPal fee | Stripe fee |

|---|

| Receive card payments online and in person | 3.9% + 0.5 SGD for domestic payments 4.4% + fixed fee based on currency for international payments | 3.4% + 0.5 SGD - or 3.4% + 0.5 USD for payments made in USD |

| Receive digital wallet payments | Not available | 2.2% + 0.35 SGD for Alipay and WeChat Pay 3.3% for GrabPay |

| Receive payments with PayNow | Not available | 1.3% |

| Invoicing | PayPal commercial transaction rates, which vary based on whether the payment is local or international, are likely to apply | 0.4% |

| Card readers | Not available | 89 SGD - 299 SGD |

| Currency conversion | 3% - 4% depending on the transaction type | 2%⁵ |

Stripe vs PayPal - getting paid from overseas

We noted in the comparison above that Stripe and PayPal both have currency conversion fees. But what does that mean?

With Stripe you’ll need to set up settlement currencies, which are the currencies you use to withdraw funds from your Stripe account. To do this you link your bank account - or multiple bank accounts - or cards, to Stripe, and the currencies your accounts are denominated in become your settlement currencies. If you get paid on Stripe in a currency you’ve not enabled as a settlement currency, you’ll pay a 2% conversion fee to allow Stripe to deposit the funds into one of the settlement currencies you’ve set up.

PayPal may work a little differently, allowing you to receive payments to your PayPal Business account in up to 25 currencies. However, when it comes to withdrawing your funds you’ll only be able to withdraw to linked bank accounts or cards in SGD or USD. That means any other currencies you hold in your PayPal balance need to be converted to Singapore or US dollars to withdraw - which will involve paying a 3% currency conversion fee.

Avoid PayPal or Stripe’s currency conversion fees - exchange money with the mid-market rate with Wise Business

Both PayPal and Stripe have currency conversion fees, which are added onto the Google exchange rate to calculate the rate used to switch between currencies in your account. Stripe’s currency conversion fee is 2%, while PayPal will charge 3% - 4% depending on the transaction type.

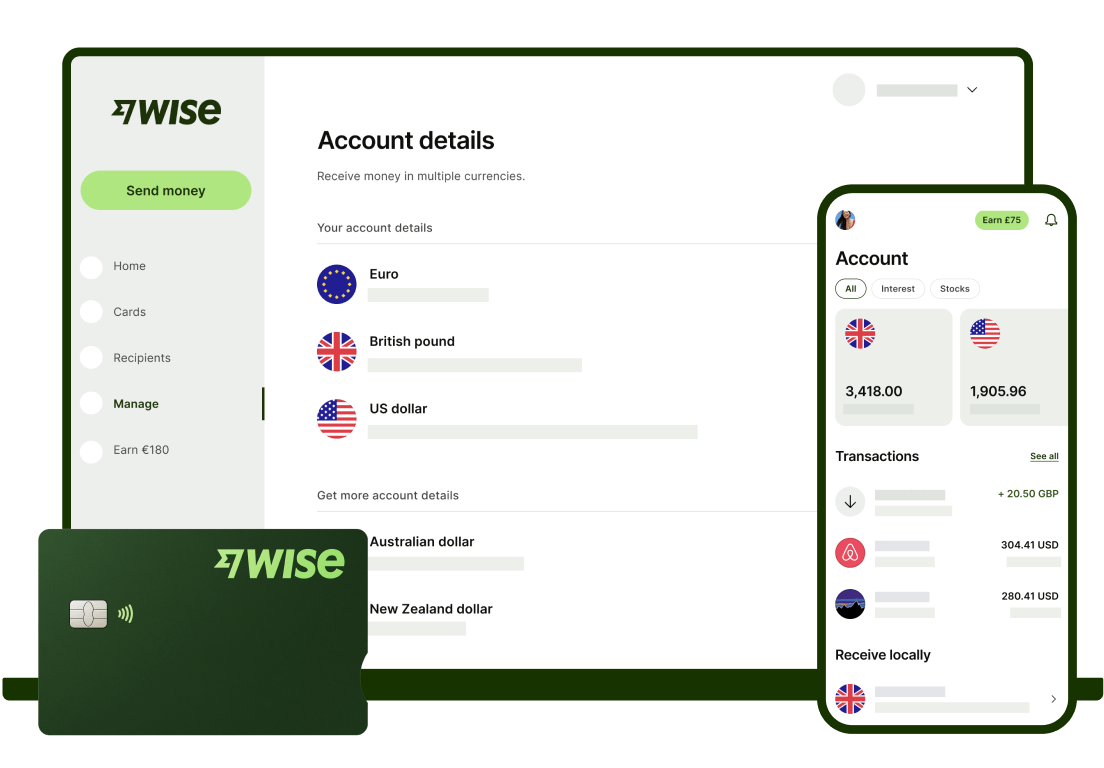

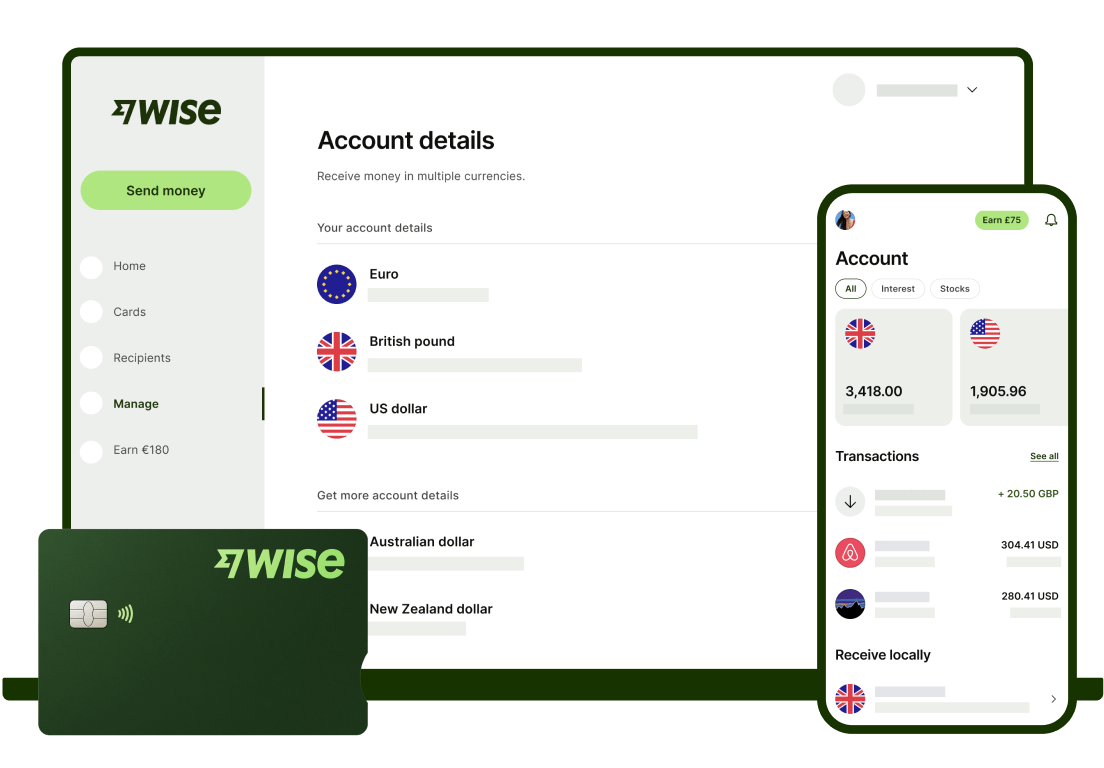

One way to cut the costs of currency conversion may be to get a multi-currency account from Wise Business.

Illustration of Wise Business products

Wise always uses the Google exchange rate with low, transparent fees from 0.41% - so you can withdraw currencies from your preferred PSP without converting them - and switch to the currency you need within your Wise account.

Alternatively, hold the currencies in your Wise account - 50+ currencies are supported - and use for paying contractors, suppliers or staff. Or you could get a linked Wise Business card for easy spending and withdrawals whenever you need them.

Wise offers feature rich accounts for freelancers, entrepreneurs and business owners, with no minimum balance and no ongoing fees to pay. See if Wise can help you grow your business, today.

Learn more about Wise Business

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Stripe vs PayPal Singapore: the bottom line

Both Stripe and PayPal have some really handy features for people selling online. Stripe also has options for in person payments through their card readers and POS terminals. While their features may look pretty similar on the surface, there are some key differences which means these providers may be better suited to particular business types.

PayPal can be a great option if you’re an ecommerce seller and need simple ways to sell online, which you can set up with only a limited amount of technical knowledge. PayPal’s brand is trusted and popular, and offering PayPal as a way to pay can boost customer conversion.

Stripe on the other hand may be your top pick if you’re both an on and off line seller, and need a broader selection of ways for customers to pay. Stripe’s fully customisable package can be a bit overwhelming if you don’t have a technical background, or someone in your team who can help with development - but it can also mean you can build your perfect suite of services.

Compare both Stripe and PayPal to see which suits your business best. And don’t forget to check out Wise Business as a useful tool to let you receive foreign currency payments, without losing out on high currency conversion charges.

Sources:

- Stripe Singapore

- PayPal Business Singapore

- PayPal merchant fees

- Stripe pricing

- Stripe currency conversion

Sources checked on 16/02/2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.