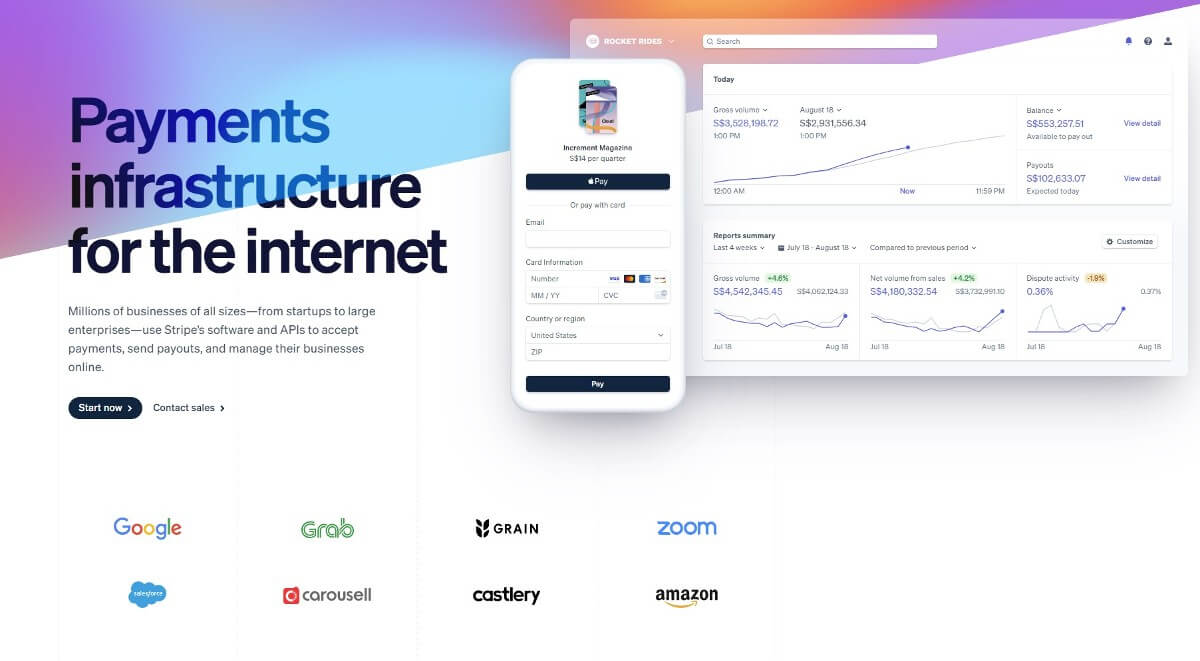

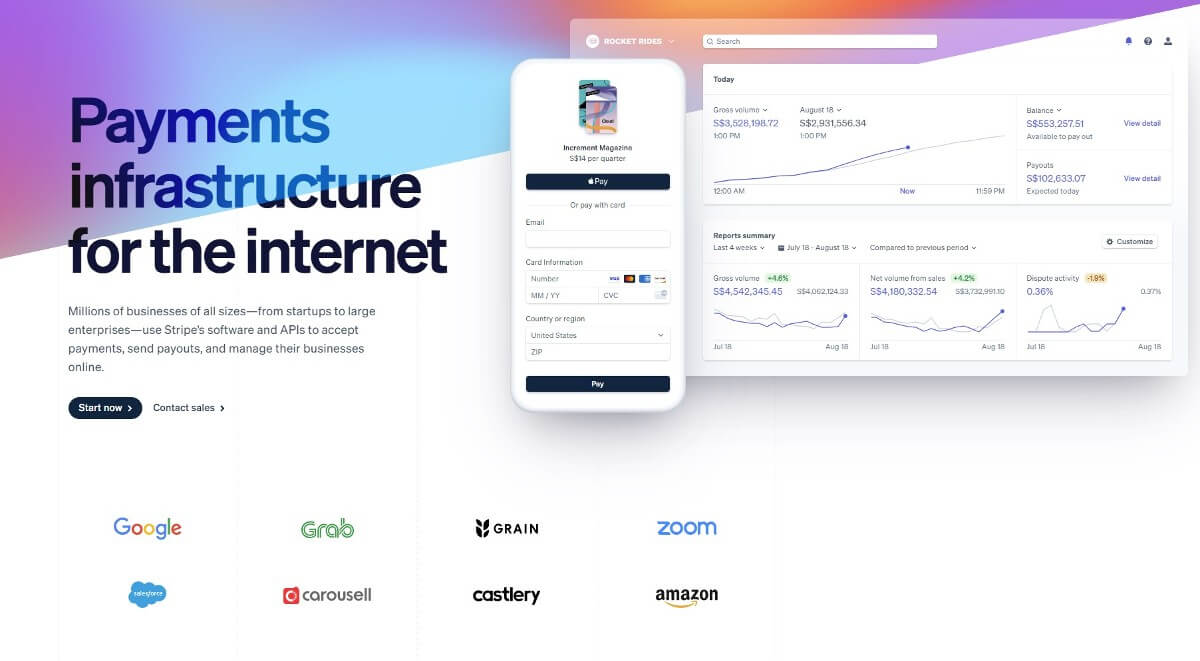

Stripe is a popular financial technology company, which offers payment processing software and services through APIs, allowing online and mobile businesses to get paid easily from customers around the world.

This guide covers all you need to know about Stripe in Singapore, including Stripe fees for different services, and the Stripe conversion rate when you get paid in a foreign currency. We’ll also cover Wise as a way to save money on currency exchange fees, so you can protect your profits when you trade internationally.

Wise payment gateway

Made for ecommerce with low fees and local currencies. Coming soon.

Register for updates

What does Stripe do?

Founded in 2010, Stripe¹ is a well established presence in the field of payment processing and ecommerce services. Stripe offers a really impressive range of services, with a focus on supporting businesses which take payments and make payouts, digitally, all around the world.

Stripe’s performance generates some staggering stats:

- 135+ currencies supported for payments

- 35+ countries with local acquiring

- 90% of US adults have bought something via Stripe (even if they didn’t know it)

- Up to 13,000 Stripe API requests are generated every second

For business owners in Singapore, there are plenty of Stripe services available, including:

- Prebuilt and customisable payments pages for online businesses

- Payment links and payments for platforms

- Invoicing services for offline payments

- Billing

- Terminals for in-person payments

- Fraud and risk management services

- Reporting and tax support

- Business services including incorporation

- Accounting integrations

Is Stripe safe?

Stripe is safe. Stripe is a global business which uses cutting edge security technology, and is certified to the highest levels in the payments industry, through regular audits. Stripe uses automated and manual tools to ensure customer safety, including thorough encryption and account verification processes².

How Stripe works in Singapore - how to use Stripe to accept payments

If you register for a Stripe Singapore account you can easily integrate Stripe services into your ecommerce site with pre-built solutions, APIs (Application Processing Interfaces) or low-code options. This gives the tools to customise your site as you wish, and based on the level of technical knowledge and experience you and your team may have.

Stripe supports businesses across ecommerce, subscriptions, SaaS platforms, marketplaces and more, all from a unified platform. We’ll dive into the details of some key Stripe services next.

Stripe Payment Gateway

Stripe Payment Gateways³ can be implemented to a website in several different ways, to get paid from customers easily. You may choose a fully prebuilt, hosted payment solution - Stripe Checkout - or use Stripe’s prebuilt components to design your own user experience and integrate it to your site through APIs.

We’ll look at Stripe Checkout in more detail in a moment. If you’re looking to create your own customer built Stripe integration, you’ll have access to developer tools like:

- Stripe sample code and examples

- CLI for development and testing

- Versioned Stripe API changes

- Webhooks

- Stripe test environment

- Metadata support

Accepted payment methods in Stripe

Stripe offers a flexible range of payment options so you can connect with more customers around the world. Stripe payment options include⁴:

- Card payments on all major card networks

- Payment to e wallets like Apple Pay, Google Pay and Alipay

- Bank debits and transfers

- Bank redirects - like PayNow in Singapore, or FPX if you’re getting paid from Malaysia

- Buy now, pay later services

Stripe Checkout

Stripe Checkout⁵ is a prebuilt payment page which has been optimised to convert customers and deliver a frictionless payment journey in a range of currencies, with plenty of payment methods to choose from.

In fact, Stripe states that users saw a 46% increase in sales after using this option to enable local payments. Throw in support in 30+ languages and 135+ currencies and it’s easy to see how Stripe can help you sell more, and reach more customers.

Stripe invoicing

Depending on the type of business you run, adding a checkout to your website may not be your best option. For companies dealing with clients directly, particularly when selling in bulk or providing specialist services, issuing a customer invoice is much more the industry norm. Here too, Stripe can help.

Stripe offers invoicing services⁶ which you can create and customise without needing to understand coding, which can be sent to clients directly. Stripe invoices also have other neat features like optimising automatically to the device the customer is using, to make it easier to read - and get paid.

And if ease of use isn’t enough, Stripe’s product promotion information includes the impressive claim that 70% of its invoices are paid within 24 hours.

Stripe fees in Singapore

Let’s look at the range of Stripe charges you can expect to see, depending on what services you need. Here’s a rundown of Stripe fees Singapore, for the most popular and common Stripe products and requirements.

| Service | Stripe pricing⁷ |

|---|

| Integrated payments | 3.4% + 0.5 SGD per card transaction |

| Customised payment services | Tailored to the business needs |

| Payments in USD | 3.4% + 0.5 USD per card transaction |

| Digital wallet payments | Alipay and WeChat Pay - 2.2% + 0.35 SGD GrabPay - 3.3% |

| PayNow | 1.3% |

| Invoicing | 0.4% per paid invoice |

| Stripe payouts | Standard payouts are free Instant payouts - 1% (minimum 0.5 SGD0 USD payouts - 1% (minimum 5 USD) |

| Currency conversion charge | 2% |

Stripe’s currency conversion rate

Where Stripe has to complete currency conversion, there’s an extra fee to pay in the form of a 2% markup on the exchange rate used. This applies, for example, when a customer pays in one currency, but you need the funds to be paid out to your bank account in another currency.

Adding a currency conversion fee is very common. However, it does eat into your profits if you’re doing business internationally. Depending on your business type, you might well find you can save money by using a multi-currency business account to get paid through payment gateways and platforms in the currencies your customers prefer. More on how to cut currency conversion costs with Wise, next.

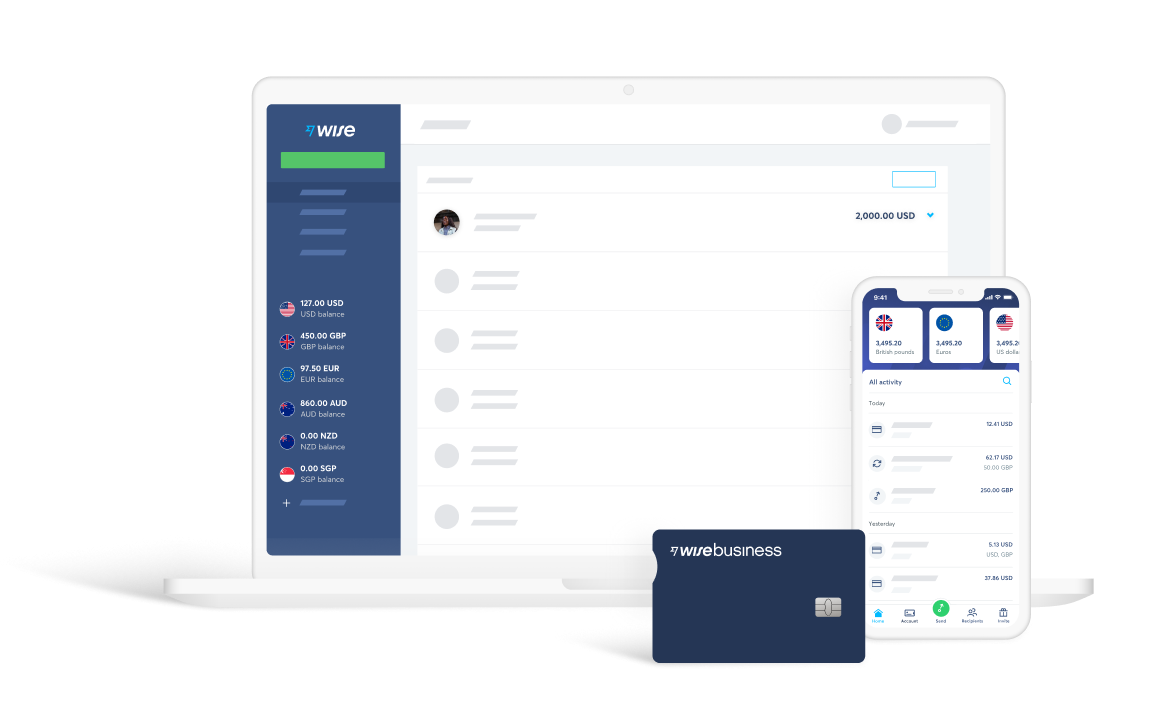

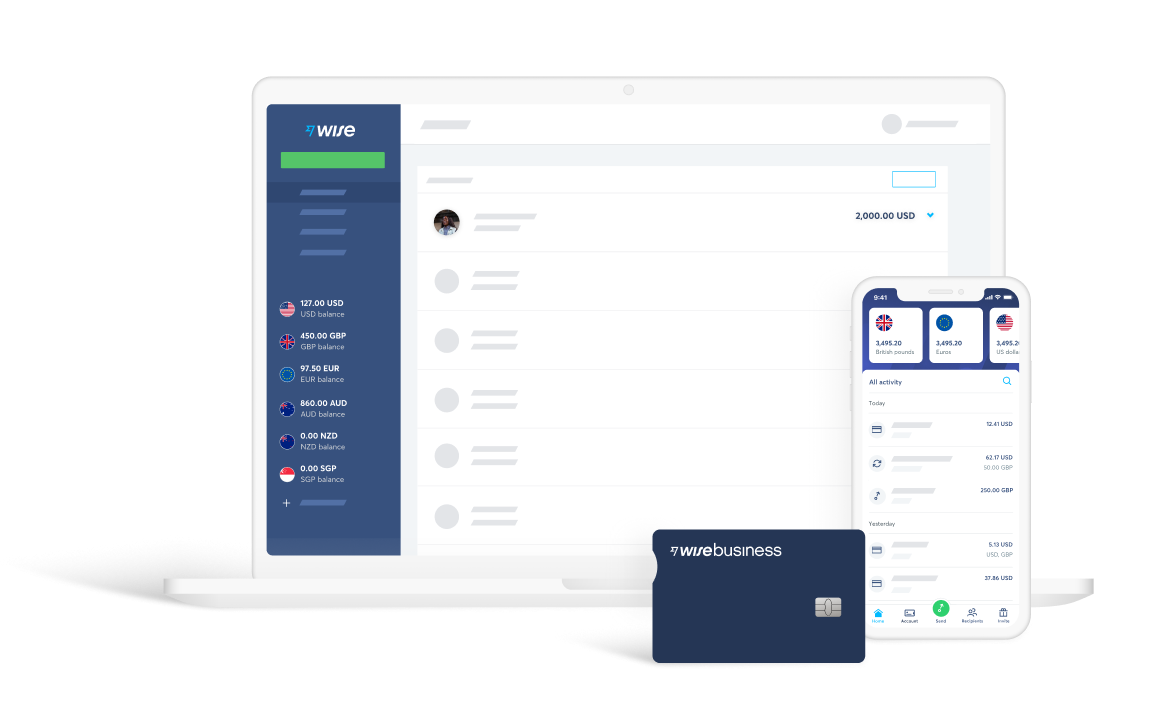

Avoid conversion fees when getting paid - receive locally in 9 currencies and exchange with the real exchange rate with Wise Business

Open a Wise Business account to cut the costs of getting paid internationally, and receive money from payment gateways and platforms in 9 different currencies, including SGD, USD, AUD, EUR and more. Hold your funds in your Wise account, use your money to pay overseas suppliers, contractors or staff - or exchange it back to SGD with low costs and the mid-market exchange rate, to withdraw when you need it.

Illustration of Wise Business products

Wise business accounts can hold and exchange 50+ currencies, and make payments to 80+ countries. You’ll also be able to get linked international debit cards for you and your team to make it easier to manage your business spending and employee expenses day to day.

See how much you can save with Wise Business, today.

Learn more about Wise Business

Payment gateway comparison - Stripe vs PayPal vs Airwallex

Let’s move onto a look at how Stripe payments Singapore measure up against a couple of other alternative payment gateways. Here’s a runthrough of some key features, looking at Stripe vs PayPal, and also Airwallex vs Stripe.

Learn more about the PayPal business account here, or get our full guide to Airwallex Singapore here, to see if either may fit your business needs.

| | Stripe Singapore | PayPal | Airwallex |

|---|

| Available currencies | 135+ currencies | PayPal operates in over 200 countries and territories, and accepts a broad range of currencies | Currencies available vary based on a range of factors |

| Payment methods accepted | Visa, Mastercard, China UnionPay debit cards | Debit and credit card, PayPal balances, specialist local payment options, PayPal credit and similar services | Debit and credit card, e wallets, prepaid vouchers, local payment methods⁹ |

| Integrated payment platform | 3.4% + 0.5 SGD per card transaction | 3.9% + fixed fee for domestic payments⁸ 4.4% + fixed fee for international payments | 3.3% + 0.5 SGD per transaction - this fee may vary based on the payment type¹⁰ |

| Currency conversion | 2% markup is applied per card transaction | Fee depends on the currencies involved - 3% - 3.5% is typical | 2% |

Summary

Payment gateways are extremely useful for all types of business - and crucial if you’re running an ecommerce store and want ways to connect with customers around the world professionally, without needing to build an entire team of developers.

Stripe in particular has a broad range of services on offer, from prebuilt solutions which require little to no technical understanding, to APIs which need some development support, and everything in between. You can also access other business services like invoicing and tax support.

If you’re using Stripe to get paid from around the world it’s worth keeping an eye on the costs of accepting foreign currency payments. You might find you can save by taking payments in your customers’ local currencies, withdrawing to a Wise Business account, and converting there to the currency or currencies you need.

Sources:

- Stripe Singapore

- Stripe Singapore - security

- Stripe - payments

- Stripe - payment options

- Stripe Singapore - checkout

- Stripe Singapore - invoicing

- Stripe Singapore - pricing

- PayPal Singapore - merchant fees

- Airwallex Singapore - payment methods

- Airwallex - fees

Sources checked on 24.08.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.