How to migrate to New Zealand from Singapore: Everything you need to know

Here’s everything you need to know about moving to New Zealand from Singapore including cost of living, how to get a job, and more.

Pay2Home is a remittance service in Hong Kong and Singapore. Singapore users can send money to a handful of countries, including Malaysia, China, Australia, and the Philippines for a flat fee. But this flat fee can end up being more expensive than other money transfer services for regular transfers below S$ 5,000. Let’s take a deeper look into Pay2Home and how it works.

| If you want an online money transfer service that that lets you transfer to 59+ countries at the real mid-market rate, check out Wise |

|---|

| Table of contents |

|---|

Pay2Home offers a money transfer service to residents of Singapore and Hong Kong. Using it, you can send money to a number of countries across Southeast Asia, including China, Indonesia, Vietnam, and Malaysia. You can also send money to the UK, Australia, Europe, and New Zealand. Read on to get answers to common questions about using Pay2Home.

To open a Pay2Home account you will have to sign up online or visit one of their branches. First, you will have to register on the website and fill out your personal details. You will need to create a username and password, and then verify your email address. You will be also prompted to fill out an eKYC during this process, so keep copies of your government issues IDs available for upload.

Once registered, you can use the online dashboard or app to add beneficiaries and make transfers. Depending on your transaction’s destination you will have a few different options of delivery. It can be sent directly to a bank account through a bank transfer, delivered to a home address, pick up at a branch or affiliate office, or door-to-door cash delivery.¹

Pay2Home has an interesting fee structure. It offers a clear flat fee no matter the amount you are looking to send. The fee is only dependent on where you are sending money to. Here is how the flat fee looks when you’re sending S$ 1000 to different countries:

| Singapore to... | Pay2Home flat fee |

|---|---|

| Australia | S$ 20 |

| Malaysia | S$ 9 |

| Indonesia | S$ 6 |

| China | S$ 8 |

The flat fee starts to be economical once you are sending large amounts using Pay2Home and if you are not in a rush. But for smaller payments of S$ 1,000- S$5,000, other providers like Wise can be significantly cheaper.²

There are no minimum or maximum limits when you send money by Pay2Home. But if you are sending more than S$ 15,000, you can give their concierge a call to get a privileged exchange rate.³

Once you have paid, it can take anywhere from a few seconds to 1-3 business days for the money to reach, depending on the country and delivery method. Transactions to Thailand, Malaysia, the Philippines or Europe can take up to 3 days, while transactions to Vietnam, the UK, Australia, Indonesia, China, India, and Bangladesh can take 2 days. You can also make use of Pay2Home’s express service that can get your payments to your recipient within seconds. Check with Pay2Home express service for the transfer time for your particular country.⁴

You can check the status of a transfer by logging into your account on the Pay2Home website, selecting “Transaction Tracker” on the app or by visiting a branch. You can also get real-time updates when you make a transaction by requesting SMS or email updates. You and your beneficiary will both be updated when the full payment is complete.⁵

If your transactions are stuck you can reach out to Pay2Home’s customer service a few different ways any day of the week. You can reach them on weekdays between 9am-7pm at 6372 2474 or anytime by email at customerservice@pay2home.com. You can also walk into the different branches across the city on the during the week and on Saturday and Sunday as well.⁶

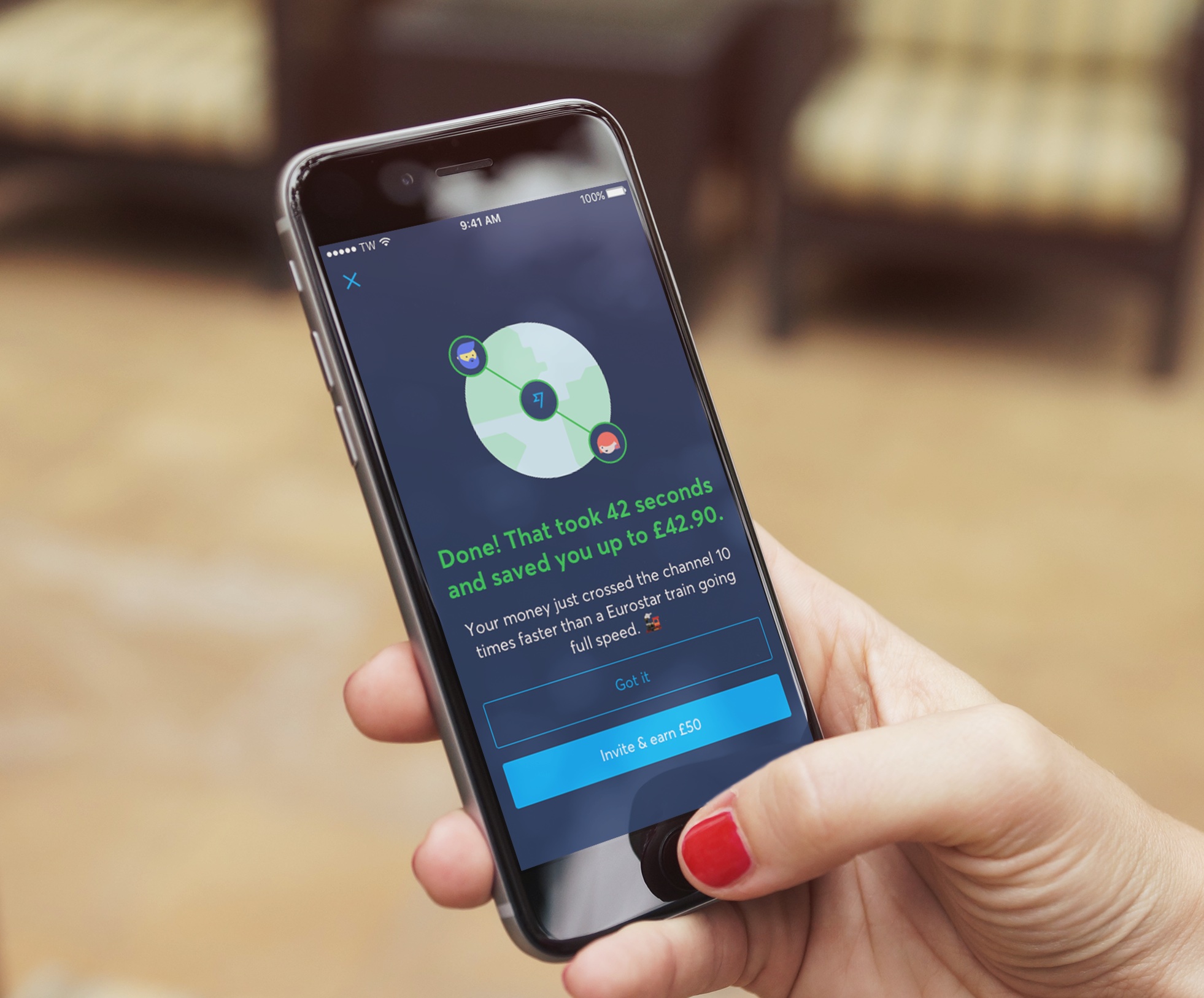

When you’re trying to send money around the world, get yourself a partner that is truly global and cheaper. With Wise you can send money to 50+ countries and do so on average 12x cheaper than the banks.

So how much would it cost you to use Pay2Home versus other providers? Let’s take a look. Using the same S$ 1,000 transfer example from earlier, let’s compare it to TransferWIse’s fees for the same amount and to the same countries.

| Singapore to... | Pay2Home fee | Wise fee |

|---|---|---|

| Australia | S$ 20 | S$ 4.87 |

| Malaysia | S$ 9 | S$ 6.57 |

| Indonesia | S$ 7 | S$ 6.39 |

| China | S$ 10 | S$ 14.64 |

While Pay2Home is quite competitive in fees, Wise is cheaper in its fees, especially to Australia and Malaysia. Pay2Home is cheaper when it comes to transferring money to China and Indonesia.

Now if we look at the exchange rate, Pay2Home sets its own exchange rate which differs from the transparent mid-market exchange rate. The mid-market exchange rate is the rate you see on Google and is the same one Wise uses. So what Pay2Home does is actually set your exchange rate to be weaker than the mid-market rate to take a slice of profit off of every conversion. That means more money out of your wallet.

While Pay2Home can look like a good partner for remittances, in actuality it may be more expensive and slower than it appears. Wise has lower fees for regular-sized transfers and will always give you the transparent mid-market exchange rate.

There are no extra or hidden markup charges here. On top of that, Wise can be faster in many regular transactions. Wise has an award-winning app to make transfers seamless and fast. Plus, with a process that doesn’t require going to a bank, you can quickly join the 6 million users around the world that choose Wise for global money transfers.

Sources used for this article:All sources checked as of 4 May, 2020

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Here’s everything you need to know about moving to New Zealand from Singapore including cost of living, how to get a job, and more.

Explore the best international schools in Singapore offering diverse curricula, languages, and quality education from our review.

Studying abroad is a big financial investment for students. Research carried out by Wise, the global technology company building the best way to move money...

Everything you need to know about the DBS multi-currency debit card, including ✓features ✓fees and ✓perks. Learn more 📣

Buying a property in Malaysia? This article focuses on buying Malaysian property as a Singaporean, and the specific issues you might need to know about.

Can a foreigner open a bank account in Singapore? Yes, read more here about bank accounts in Singapore also available for foreigners.