Startup SG Tech Grant: Benefits, Funding, and Application Process

Get complete details about the Startup SG Tech Grant, including POC/POV funding, eligibility, and how to apply. Perfect for Singapore tech startups.

OFX¹ is a global specialist in international payments, business account services and currency risk management products. Singapore businesses can access OFX currency exchange when sending one off or recurring payments, or choose an OFX Global Currency Account to receive, hold and send payments in a range of foreign currencies.

This guide walks through all you need to know about OFX Singapore’s business services. And if you’re wondering whether to choose OFX or Wise, we’ve also got that covered. To help you pick the best service for you we’ll also compare OFX to Wise low cost payments and business accounts.

If you're interested about using OFX for personal use - we also reviewed OFX for personal international transfers here.

| Table of contents |

|---|

OFX can save Singapore business customers money when they transact internationally, thanks to its competitive exchange rates and innovative account options. But if you’re wondering if OFX is too good to be true, you don’t need to worry. OFX is a legit business, regulated by the Monetary Authority of Singapore (MAS), and also covered by other regulatory bodies around the world. That means OFX services are safe to use.

Here’s an overview of what Singapore businesses can do with OFX:

Let’s take a look at some of the key OFX services available for businesses in Singapore.

Business customers and online sellers can open an OFX Global Currency Account² to pay and get paid in a range of foreign currencies. You’ll be able to open local currency accounts in USD, EUR, GBP, CAD, AUD, SGD, HKD and JPY, and get paid directly in these currencies by your customers, and through payment gateways and marketplace sites. You can then hold your balance in foreign currencies, use it to pay taxes and suppliers, or switch it to the currency you need and withdraw to your regular account.

Global Currency Accounts also offer automated payments and integration with Xero accounting software, which makes it easier to reconcile accounts across a range of currencies.

With OFX business customers can also set up one off or recurring international business payment transfers, with better exchange rates than banks usually offer. Payments can be made online, in the OFX app, or by phone through a broker service.

There’s a minimum transfer amount of 150 USD or the equivalent, and fixed transfer fees as follows³⁴:

| OFX transfer type | OFX transfer fee |

|---|---|

| Payment under 10,000 AUD (about 10,200 SGD) | 15 AUD (just over 15 SGD) + exchange rate markup Third party charges may apply |

| Payment over 10,000 AUD | No transfer fee - exchange rate markup will still apply Third party charges may apply |

The OFX exchange rate will include a small markup on the exchange rate applied - we’ll cover this in more detail a little later. You may also find that intermediary fees apply if your transfer is processed using the SWIFT network. These costs are deducted as the payment passes through the system, and are not credited to OFX.

Another handy OFX feature for Singapore businesses is the ability to make batch payments. This involves paying multiple people at the same time, and can be done simply by uploading a single spreadsheet. OFX business customers can pay up to 500 employees or suppliers at once, in a range of currencies - saving you admin time, and letting you get on with your work.

Finally, OFX offers a range of specialist currency risk management products such as forward contracts and limit orders. These are handy for businesses which want to minimise risks involved in currency exchange rate fluctuations.

Forward exchange contracts allow you to lock in an agreed exchange rate for between 2 days and 12 months. If you know you’ve got a big payment to make in a foreign currency and want to confirm the exchange rate ahead of time, this may be useful. However, once you’ve agreed the rate you can’t benefit from positive changes to the exchange rate over the period of the contract.

An alternative is to set up a target rate order in which you agree a specific exchange rate for your transfer, which will then automatically be processed when that rate is achieved. All currency risk management solutions are offered through the OFX broker service, which means you’ll be able to talk through your requirements - and the costs and risks involved - with a broker before you commit.

Sending an international business payment with OFX is pretty easy - and if you choose to open a Global Currency Account you’ll also be able to easily receive money to OFX in a range of currencies.

Whenever you send a payment in a foreign currency, or convert a balance from one currency to another, the OFX exchange rate will apply. This rate is calculated by adding a small margin to the mid-market exchange rate - the rate that you’ll find on Google or using a currency conversion app.

The margin used by OFX is usually smaller than the margins added by regular banks, which can mean you save money using OFX or another specialist service. However, it’s important to note that this margin is still a fee - and to figure out exactly how much you’re paying for your transfer, you’ll have to compare the OFX rate to the mid-market rate yourself. That’s not transparent - and it’s a hassle you probably don’t need.

Not all international money transfer providers add a markup to the exchange rate. Wise, for example, uses the mid-market rate and clearly splits out the costs of making your payment so it’s easy to review and compare. More on Wise and how OFX vs Wise match up, later.

Here’s how to get your OFX account up and running:

The verification process may vary based on your business entity type, and where it’s registered, but a member of the OFX team will be able to guide you through the process over the phone.

OFX is a good option for businesses in Singapore looking for currency exchange and international payment services. However, they’re not the only provider out there, and depending on exactly what you want from your account you might find there’s a better option. To help you decide, we’ll take a look at how OFX and Wise measure up across some key business account and service features:

| OFX | Wise Business | |

|---|---|---|

| Regulation | Monetary Authority of Singapore + global regulatory bodies as required | Monetary Authority of Singapore + global regulatory bodies as required |

| Business multi-currency account services available | Yes | Yes |

| International business debit card | No | Yes |

| Available currencies | Payments can be made to 50+ countries, accounts come with local receiving account details available for 8 currencies | Accounts can hold, send and exchange 53 currencies, with local receiving account details available for 9 currencies including SGD, USD, AUD and more |

| Minimum payment value | 150 USD (about 210 SGD) | No minimum |

| Maximum payment value | Unlimited | Usually based on the equivalent of around 1 million GBP |

| Transfer fee | Under 10,000 AUD (about 10,200 SGD)- 15 AUD (just over 15 SGD) Over 10,000 AUD - no transfer fee | Low, transparent fees based on destination and payment value |

| Exchange rate | Exchange rates include a markup on the mid-market rate | Mid-market exchange rate |

| Available payment methods | BPay or electronic bank transfer | Bank transfer, credit or debit card, PayNow |

| Delivery time | Usually within 24 hours for major currencies - up to 5 days for exotic currencies | 45% of payments are instant, 80%+ arrive in 24 hours |

| Accounting integrations offered | Xero | Xero, QuickBooks, FreeAgent |

| Batch payments offered | Yes - 500 maximum simultaneous payments | Yes - 1,000 maximum simultaneous payments |

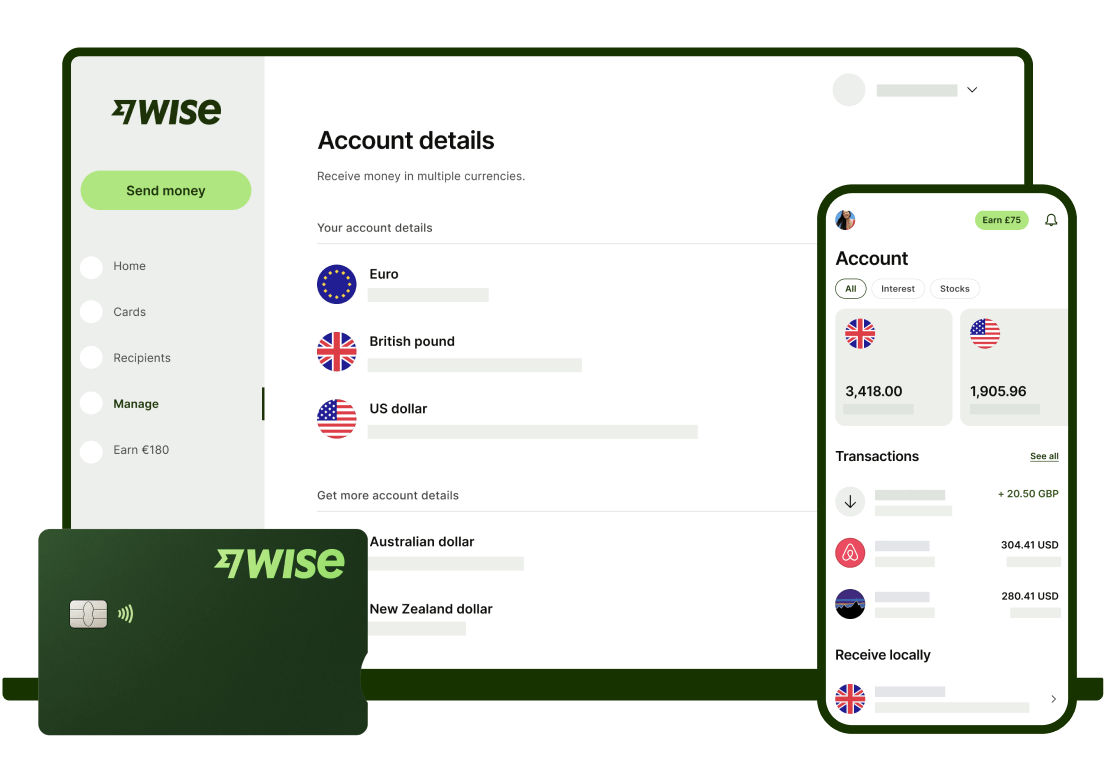

Whether an OFX or Wise business account is best for you may well depend on how you want to use it. Wise has a couple of benefits compared to OFX, including linked international debit cards which allow you and your team to spend and make cash withdrawals around the world. If you don’t have the currency you need in your account, the Wise auto convert feature will make sure you always get the lowest possible fee when you spend, with Wise’s mid-market exchange rates every time.

Illustration of Wise Business products

Wise also has no minimum payment amount, which may be helpful if you need to make low value transfers, as well as more local bank details to let you receive currencies fee free. There’s no ongoing fee and no minimum balance to maintain your Wise account - making this an option well worth looking at.

Learn more about Wise Business

Having an international business account makes a lot of sense, and can drive down the costs of transacting internationally. OFX offers some good options in Singapore for online sellers and business owners - but whether or not they’re the best provider for you will depend on your specific requirements. Compare OFX with the Wise business account to see which is the best fit.

Sources:

Sources checked on 15.07.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Get complete details about the Startup SG Tech Grant, including POC/POV funding, eligibility, and how to apply. Perfect for Singapore tech startups.

Learn all about the Startup SG Founder Grant including its eligibility criteria, grant amount, benefits, and the application process.

Read our Adyen Payment review to learn what Adyen does, the fees you’ll pay, and whether or not it will suit your business.

This ultimate guide to corporate travel management gives you the essentials to help streamline your business travel processes.

Business travel insurance can protect your company financially when corporate trips are involved. Explore the best policy options in Singapore in 2025 here.

Learn the essentials of Singapore’s withholding tax rules, including applicable rates, situations when it's required, and exemptions.