Wise Business account requirements in New Zealand

Find out what you need to open a Wise Business account in New Zealand. Check required documents, steps, and how to get started online in minutes.

Identifying the best business bank account is a daunting task. The challenge is to find an account that aligns with your unique business needs without charging eye-watering fees.

In this post, we’ll examine the Bank of New Zealand’s (BNZ) different transaction and savings accounts. We’ll also outline how to open an account, the required documentation, and the associated interest rates and account fees.

If your company trades worldwide, a banking alternative can deliver affordable cross-border solutions. For example, Wise Business could offer cheaper international transfers than your current bank.

| Table of contents |

|---|

BNZ offers a range of banking services to small businesses, agribusinesses, and large institutions.

From accounts to loans, meeting rooms, consultations, cards, overdrafts, and payment solutions, BNZ is a one-stop business banking shop.1

Its institutional wing caters to corporates, financial bigwigs, and the government. A team of 30+ specialist bankers provides services such as corporate finance, transactional banking, syndicated loans, and sustainable finance. BNZ can also help with capital and financial markets, as well as market research.2

As a large, well-established bank and one of the Kiwi Big 4, BNZ works with a wide range of sectors. Dedicated partners can provide industry expertise in agribusiness, healthcare, technology, professional services, government, real estate, non-profit organisations, and franchising.3

BNZ also has a Māori business team to guide indigenous initiatives, and an Asia Business team to provide tailored advice for trading in this rapidly advancing region.3

BNZ has two transaction accounts to suit businesses of different sizes.

The bank also has two savings accounts with varying interest rates and conditions.

Let's dive deeper to under each business account type and the features offered.

The Business First Transact is the go-to BNZ transaction account for smaller Kiwi businesses. Key benefits include low fees, 24/7 accessibility, and overdrafts up to a pre-approved limit.

The account is only available to Kiwi SMBs with a turnover of under $5 million per annum.5

The BNZ Big Small Business Package complements Business First Transact and appeals to budding young companies. Its vast selection of benefits makes BNZ among the best banks for small businesses in New Zealand.

The BNZ Current Account is specially designed for medium-to-large businesses operating in New Zealand. This account generally would allow businesses to customize their banking features and get access to what is most fruitful for them. The bank doesn’t publish details on its website, and encourages would-be applicants to contact one of its Partner Centres for discussion.4

This BNZ savings account must be held jointly with a transaction account and pays an interest on your balance of 1% p.a.6 You can access money whenever you like without affecting the interest rate. Managing the account is easy through internet banking and the mobile app.

This higher-interest savings account may appeal to business owners not intending to make many monthly withdrawals. It pays 2.55%6 interest p.a., and you get one free withdrawal per month. Subsequent withdrawals are possible for a fee.

| Service fees in NZD | Business First Transact55 |

| Send international payments |

You may be charged fees for other services on some accounts. International ATM providers may also charge a fee for using their services.

| 👆Read more about BNZ international transfer: fees, rates and transfer times |

|---|

Here's a comparison of fees between the two business saving accounts offered by BNZ:

| Fee/rate | Business First OnCall | Rapid Save |

|---|---|---|

| Credit interest rate p.a. | 1.00%. | 2.55% |

| Monthly account fee | None | None |

| Withdrawal and deposit fees | None | One free withdrawal per bank month, $3 afterwards |

| Unarranged overdraft fee | $5.00 for any bank month overdrawn | $4.00 for any bank month overdrawn6 |

You can start the process of opening any BNZ account online. You will need to gather documentation and fill out an online form with details on yourself and your business, such as its structure, annual turnover, and legal trading name.

While this part of the process is quick and easy, you won’t finish the entire application online. Once you’ve submitted your form, a BNZ representative will call you to help set up the account. The team member will also let you know what documentation you must provide.

After this phase, you will receive your BNZ business account login.

The following entities can begin the account creation process online if it’s incorporated or operating in New Zealand.8

The required documentation depends on the structure of your business. Some of documents you might need:

Business banking alternatives, such as Wise Business, might prove more cost-effective for Kiwis sending money overseas.

When making a regular SWIFT international transfer, you end up paying a separate fee to the sending bank, receiving bank, and intermediary bank, plus a hefty FOREX fee. That makes moving money across borders quite pricey.

When your business operates on the world stage, navigating international payments can become a complex and costly part of your operations. While a local bank account is essential, managing overseas transactions doesn't have to mean dealing with correspondent bank fees and marked-up exchange rates.

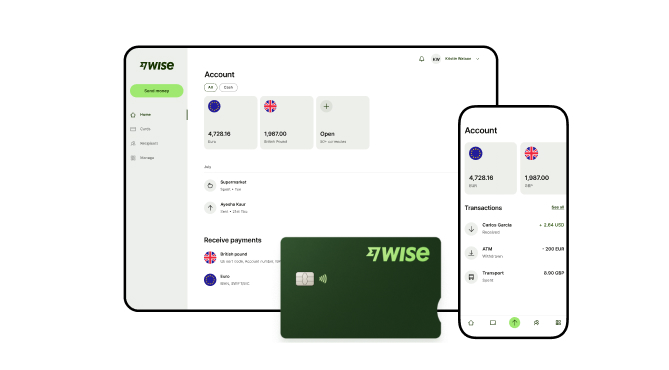

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find out what you need to open a Wise Business account in New Zealand. Check required documents, steps, and how to get started online in minutes.

Looking for a multi-currency business account for your startup in New Zealand? Read this guide before you apply.

Learn what documentation you need to open a business account online, the steps you must follow, and which New Zealand banks offer online setups.

Learn what to look for when comparing low-cost business bank accounts and discover the top free options available in New Zealand.

Learn who needs a business account, its benefits, how to open a business bank account in NZ, and compare top options for effortless tax and record-keeping.

Wise Business vs Wise Personal: Understand the differences between Wise Business and Personal accounts in New Zealand. More on price and feature comparisons.