The only business account you need to go global

Everything you need to grow your business and operate internationally — without the high fees, hefty admin, and headache of a local bank.

Pay people in one click – and save money

Make international payments and save money with Wise. Choose from 70+ countries and pay overseas staff or suppliers, with no hidden fees or exchange rate markups.

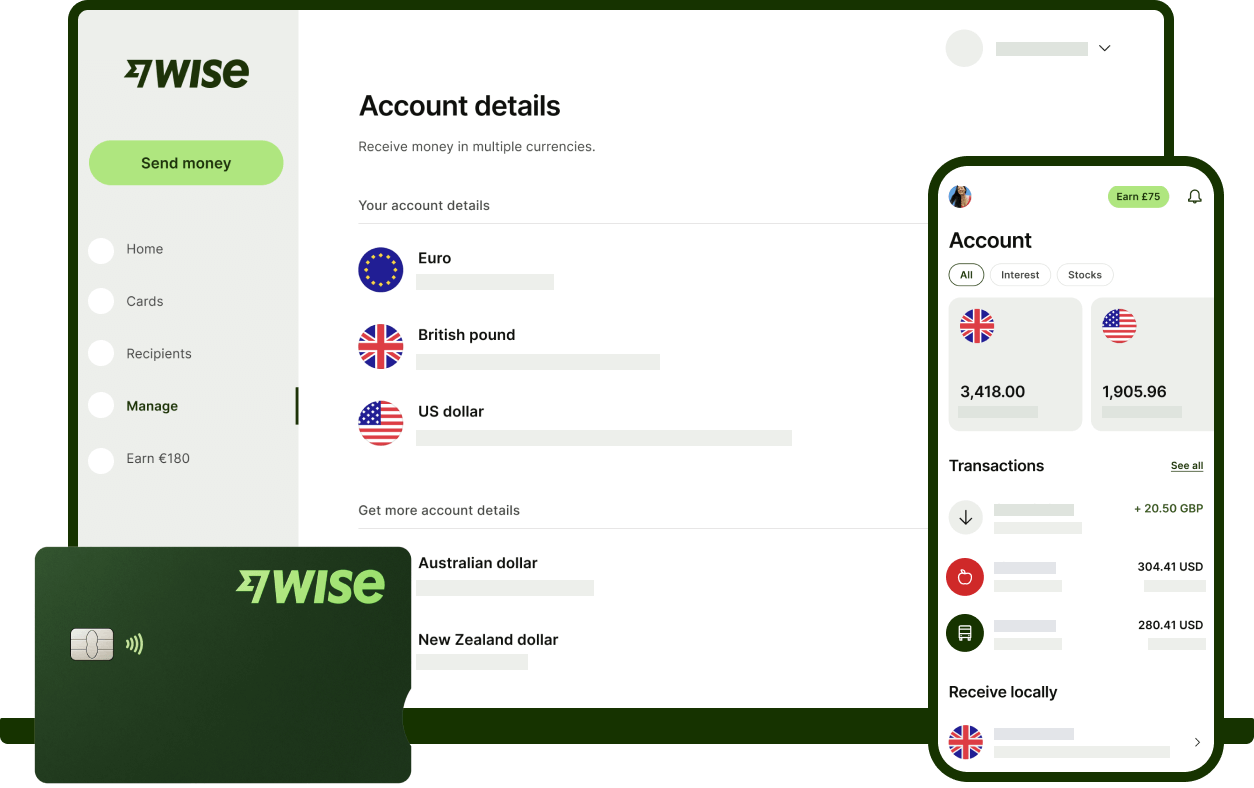

Get paid faster.

With Wise Business, you can get local account details for 9 different currencies. Give them to your customers for an easy, free way to get paid. 50% of payments are instant or arrive in an hour.

Collect money seamlessly

Easily withdraw from Amazon, Stripe, and more in up to 9 currencies.

Create clever invoices

Add your local account details to invoice templates to get paid on time and for free — like a local.

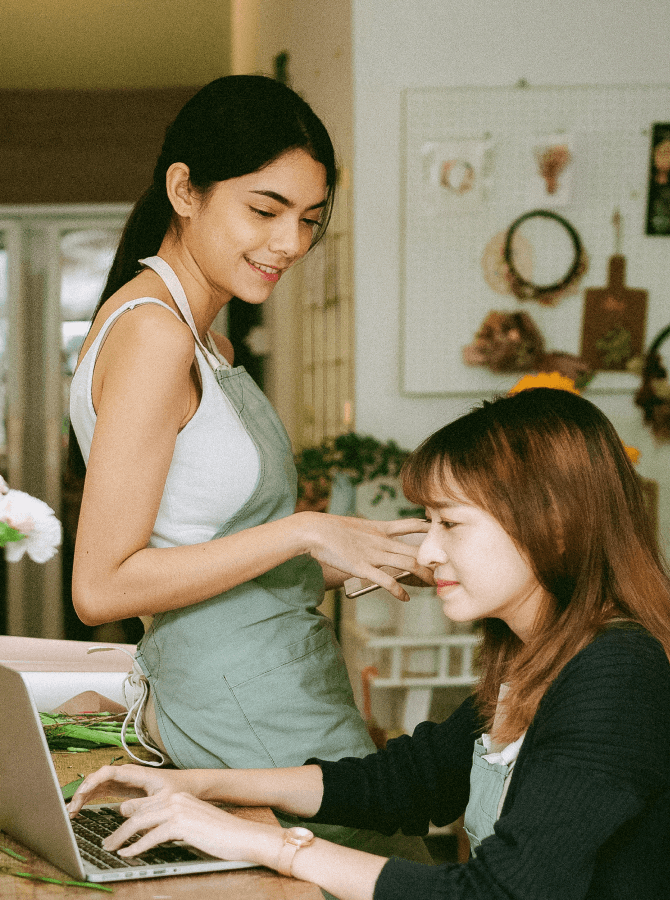

Smarter workforce collaboration.

No more back-and-forth over paying bills, and managing expenses, and cash flow. Give your accountant and team access to Wise, and control their permissions.

Faster reconciliation

Connect currency accounts to Xero or QuickBooks in real time to save time on manual admin.

Make batch payments

Pay up to 1,000 people in one click. Just upload a spreadsheet with details for each transfer and submit one payment.

All in one place.

Move money between currencies in seconds, always with the real exchange rate and without high conversion fees. See up to 54 currencies from one easy to use account.

Connect your apps

Integrate with platforms like Xero to see all your money together.

Cash flow control

Keep your international money in one place for full visibility.

Overseas expenses, sorted.

Pay expenses online or in-store without foreign transaction fees. Stay in control of team spending in real time and reduce admin.

Stay in control cash flow

See all your expenses in one place. Track your team in real time with controlled spending limits.

Take the expense out of expenses

Save on conversion fees for foreign currency expenses. With no monthly subscription.

No hidden fees or monthly subscriptions

Free yourself from monthly bank charges. Open a Wise Business account for a one-off fee and get access to all our banking features to use at the real exchange rate. Learn more about Wise Business fees.

"We used Wise to convert our USD revenue to GBP and saved £75k in the first nine months after switching from our bank."

-Alternative Airlines

Medium or large sized business?

Our team of experts can help your team scale and grow globally. Get in touch to hear how Wise Business can work for you.