Wise Business account requirements in New Zealand

Find out what you need to open a Wise Business account in New Zealand. Check required documents, steps, and how to get started online in minutes.

Owning a business can be a rewarding venture, both financially and on a personal level. But it does come with a myriad of tricky decisions, including choosing a business bank account that aligns with your unique needs.

In this article, we’ll examine the top business bank accounts in New Zealand and cover some key considerations.

| Table of contents |

|---|

A business bank account is in the name of a business entity rather than a person. The primary purpose is to separate personal and business expenses, which simplifies bookkeeping and taxes.

Banks include a slew of other business-friendly benefits, such as accounting software integration, business debit and credit cards, payment acceptance solutions, insurance, loans, consultations, and cash flow management tools.

Low-cost or free business bank accounts appeal to cash-strapped start-ups. Not big on paperwork? You can open some business accounts online in a matter of minutes.

Common challenges include high fees, complex residency conditions, lengthy registration processes, minimum balance requirements, and confusing loan conditions.

The Big 4 and other Kiwi brick-and-mortar banks aren’t the only options.

Wise Business, for example, is a business banking alternative targeting Kiwi SMBs that frequently send money overseas. Low, transparent pricing and the mid-market exchange rate help customers save on international transfers.

Keep the following in mind when weighing up the options.

Accounts with no fees or a modest one-off cost will save you a significant sum in the long run. Other ongoing costs include fees for in-branch services and overdrafts.

International transfer fees can get expensive, with separate fees charged by the sending, receiving, and intermediary banks. You’ll also face a poor exchange rate that includes a hidden, built-in markup. If you send money abroad frequently, look for a banking alternative offering better rates.

How complicated is the sign-up process, and can it be completed online? Visiting a brick-and-mortar store can be challenging if you live in a remote area. Furthermore, foreigners may find it impossible to meet residency requirements — a banking alternative can help here. They allow businesses to register online by opening accounts from their home region and offer access to account details in local currencies.

Sign up for the Wise Business account! 🚀

The best banks offer a myriad of support channels, including telephone, live chat, in-person, and email support. Look for a bank that rapidly provides accurate responses in clear, easy-to-understand English and has support staff working extended hours.

If you deal with cash, you’ll want a nearby branch or a suitable ATM for deposits and withdrawals. Banks with a vast network might appeal to Kiwis who travel or plan to expand.

Interest rates are crucial when considering a loan. Review the rates and payment terms if you plan to borrow.

For short-term cash flow issues, some businesses prefer a business credit card. But if you can’t repay the debt in full before the interest-free period lapses, you’ll get stung by a nasty interest rate; lower interest rate cards can soften the blow.

Likewise, overdrafts can help you escape tricky financial situations. Review fees and limitations to ensure they meet your needs.

The best business credit cards offer many perks. Low-interest cards can help balance delicate cashflow issues, while rewards cards offer points on every dollar spent, perfect for high-volume businesses. Business debit cards protect against overspending.

Accounts that allow multiple cards let you authorise key personnel to spend up to a pre-determined amount.

All banks have online banking these days. But not all offer the same features, and some mobile apps function better than others. Explore the online services available through your preferred institution.

Kiwis don’t carry much cash these days. If you’re running an in-person business, you’ll want a Point of Sale (POS) system that accepts mobile wallets and other contactless payments.

The best accounting software can automate tedious tasks such as payment reconciliations and cross-checks. But these powerful programs won’t work properly unless they integrate with your business bank account.

Some banks require a minimum deposit to open an account. Determine whether this restriction applies and if you have the liquid capital to comply.

Some business accounts have inbound and outbound transfer limits, which can disrupt day-to-day operations. Find an account with a higher limit than you need today to allow for future growth. This can largely affect how businesses make financial transactions, especially when dealing with large amounts.

Even if you’re a part-time sole trader, a business account separates personal and work-related expenses, making tax time a whole lot less hassle.

From the Big 4 to locally-owned operators and alternative solutions, we’re comparing different business accounts available in New Zealand. We’ll summarise a selection of key features to help you make an informed decision.

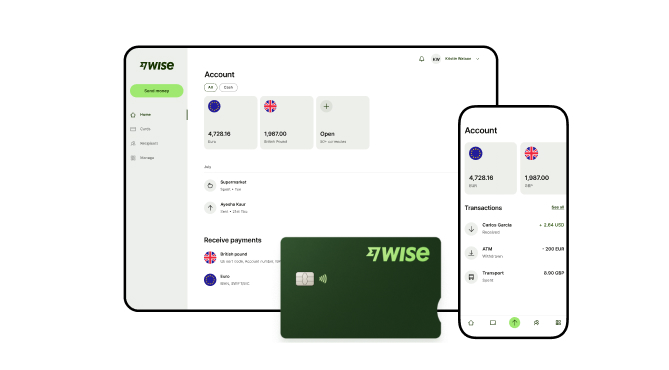

An alternative to the brick-and-mortar banks, Wise Business is an authorised online financial services provider specialising in low-cost international transfers. Clear, transparent pricing and the mid-market exchange rate help Kiwis save when paying overseas suppliers.

Who it’s good for:

Businesses and freelancers transacting abroad.

Account Fees:

Signing up is free. A one-time fee of unlocks local accounts in 8+ currencies.

Pros

Cons

Main features:

Wise Business lets you store 40+ currencies in a single account, and create local business account details accounts in 8+ currencies, including NZD, AUD, USD, and EUR, to send and receive money like a local.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

The Australia and New Zealand Banking Group Limited (ANZ) is a large, award-winning bank offering a range of business-related services, including digital banking tools, foreign exchange, fast deposit bags, and accepting payments.¹

Who it’s good for:

Businesses primarily operating within New Zealand, as well as start-ups and non-profits seeking account fee relief.

Account Fees:

Main features:

The ANZ Business Current Account lets you manage funds online, over the phone, or in an ANZ branch.³ Businesses still relying on cash often choose ANZ for its wide ATM/branch network – this is New Zealand’s biggest bank. ANZ also offer overdrafts, loans, and business credit cards with competitive interest rates.³

If you run a start-up or non-profit, ANZ offers transaction and monthly account fee relief for the first two years of service.³ Nonprofits may also be exempt from paying certain fees.

Pros

Cons

The Bank of New Zealand (BNZ) is a well-established, long-standing institution with a commitment to sustainability, community, inclusive banking, fair conduct, and innovation.⁴ Its core offering is Business First Transact, which is designed to help small businesses manage their cash flow.⁵

Who it’s good for:

Small businesses primarily operating within New Zealand and experiencing cash flow challenges.

Account Fees:

Main features:

The BNZ Business First Transact Account offers 24/7 access to its online banking portal and Mobile Business banking app, allowing you to transfer money, authorise payroll, make tax payments, and pay bills at any time. Telephone banking services, ATMs, and EFTPOS also run 24/7.⁵

To resolve cash flow woes, you can obtain a pre-approved overdraft limit or use a business credit card.⁵

Pros

Cons

Read more on our guide to business bank accounts with BNZ

Kiwibank is a proudly New Zealand-owned and operated institution that keeps every cent of profit within the country.⁶ Its primary offer is Business Edge, an everyday business account with a range of perks.⁷

Who it’s good for:

Patriotic Kiwis who prefer to support local companies and would like to avoid the Big 4.

Account Fees:

Main features

A low monthly account fee, 25 free in-branch deposits per month, and free electronic transactions (excluding bulk payments) help keep trading costs low. Owners get a Visa Debit Card, and can apply for additional cards for employees, provided they’re account signatories.

Business Edge integrates with accounting software like Xero and MYOB. Overdrafts are available.⁷

Pros

Cons

Read more on business banking with Kiwibank

ASB began trading in 1847 and currently serves 1.3 million personal, business and rural customers. The innovative institution introduced online banking to New Zealand and was the first to offer mobile payments.⁸

Who it’s good for:

The ASB Business Account⁹ suits small businesses seeking a fee-free account.

Account Fees:

Main features

The ASB Business Account has no monthly or transaction fees, perfect for small start-ups seeking a low-cost banking solution. Designed for day-to-day cash management, the account offers in-depth statements, MYOB/Xero integration, payment solutions, quick transfers with FastNet Business, and overdrafts.⁹

Account holders can apply for a business Visa debit or credit card, as well as Saver and Term Deposit accounts.⁹

Pros

Cons

Read more on business banking with ASB

Another of New Zealand’s banking Big 4, Westpac has a range of personal and business products. For everyday business banking, the go-to option is the Business Transact Account.

Who it’s good for

Businesses or sole traders that primarily trade within New Zealand.

Account Fees:

Main features:

With a Business Transact Account, you can manage finances 24/7 using Smart ATMs, Business Online banking or Westpac One.¹⁰

An optional debit Mastercard is available, as well as overdrafts to manage cash flow.¹⁰ Westpac offers various ways to accept payments, including direct debit and EFTPOS/credit card. Users can pay multiple payees through various methods using Westpac One digital banking.¹⁰

Pros

Cons

Every business is different. An account that works for a sole-trading sparkie mightn’t suit an online e-commerce entrepreneur. Work out what you need most–nearby branches, low fees, debit/credit cards, overdrafts, or low-cost international transfers–then sift through our suggestions to find the best option.

Do I need to maintain a minimum balance to avoid fees?

A minimum balance is often required to avoid fees, but it depends on the bank and specific account.

What are the standard transaction fees, and how many free transactions do I get per month?

Transaction fees usually cost around $0.25, although some banks include a limited number for free each month (i.e., 100), or don’t charge for them at all.

How easy is it to add or remove signatories on the account as my business grows?

Adding or removing signatories is usually quite an easy online process, although it depends on the bank.

If I already bank with someone personally, is it better to open my business account with them too?

Dealing with one bank for personal and business use can make life a little easier. However, your personal bank won’t necessarily offer the best business account for your needs.

What happens to my account history if I switch banks?

When switching banks in New Zealand, you may need to request a bank statement from your old bank, as your transaction history won’t always be carried across.

What is the process for closing a business bank account?

To close a business account in New Zealand, ensure your balance is zero, cancel any upcoming debits or credits, and call your bank to finalise the process.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find out what you need to open a Wise Business account in New Zealand. Check required documents, steps, and how to get started online in minutes.

Looking for a multi-currency business account for your startup in New Zealand? Read this guide before you apply.

Learn what documentation you need to open a business account online, the steps you must follow, and which New Zealand banks offer online setups.

Learn what to look for when comparing low-cost business bank accounts and discover the top free options available in New Zealand.

Learn who needs a business account, its benefits, how to open a business bank account in NZ, and compare top options for effortless tax and record-keeping.

Wise Business vs Wise Personal: Understand the differences between Wise Business and Personal accounts in New Zealand. More on price and feature comparisons.