USA GST rates 2021

What is GST tax in the USA?

The tax applied on the final sale of a product or service in the US is called Sales Tax. Unlike VAT or GST, sales tax is not a flat rate that is applied to your invoices across the board; it differs from state to state and product to product. Sales tax may be added to the cost of buying goods and services at US retail locations. The amount paid varies by locality. Some 45 states, plus the District of Columbia use state-wide base sales tax rates - while there are 5 states with no sales tax at state level.

Some areas also have local sales tax rates on top of these charges. Consumers pay the combined state and local sales tax rate when they shop. However, certain products - like groceries, clothing and raw materials - may be exempt from sales tax.

Business owners are responsible for collecting sales tax from customers and then remitting it back to the state, either monthly or quarterly.

Wise is the cheaper, faster way to send money abroad.

If you need to make payments abroad to pay international invoices, suppliers or freelancers, you could be better off with Wise.

With Wise you get the real mid-market exchange rate every time, with no markups and no hidden fees. There’s just a low , transparent charge which can work out much cheaper than your regular bank, or alternatives like PayPal.

Payments are secure, fast, and arranged online for convenience. Try Wise today, to see how simple it is to access international payments for less.

Wise business accounts are not yet available for companies registered in India. However we hope to expand our service in future.

Sales tax rates by state.

Sales tax rates by state.

| State | Rate range | State | Rate range | State | Rate range |

|---|---|---|---|---|---|

Alabama | 4% - 11% | Louisiana | 4.45% - 11.45% | Oklahoma | 4.5% - 11.5% |

Alaska | 0% - 7.5% | Maine | 5.5% | Oregon | 0% |

Arizona | 5.6% - 11.2% | Maryland | 6% | Pennsylvania | 6% - 8% |

Arkansas | 6.5% - 11.5% | Massachusetts | 6.25% | Rhode Island | 7% |

California | 7.25% - 10.25% | Michigan | 6% | South Carolina | 6% - 9% |

Colorado | 2.9% - 11.2% | Minnesota | 6.875% - 8.375% | South Dakota | 4.5% - 6.5% |

Connecticut | 6.35% | Mississippi | 7% - 8% | Tennessee | 7% - 10% |

Delaware | 0% | Missouri | 4.225% - 10.1% | Texas | 6.375% - 8.25% |

District of Columbia | 6% | Montana | 0% | Utah | 4.7% - 8.7% |

Florida | 6% - 8% | Nebraska | 5.5% - 7.5% | Vermont | 6% - 7% |

Georgia | 4% - 9% | Nevada | 4.6% - 8.265% | Virginia | 4.3% - 7% |

Hawaii | 4% - 4.5% | New Hampshire | 0% | Washington | 6.5% - 10.4% |

Idaho | 6% - 9% | New Jersey | 6.63% | West Virginia | 6% - 7% |

Illinois | 6.25% - 11% | New Mexico | 5.125% - 9.0625% | Wisconsin | 5% - 5.6% |

Indiana | 7% | New York | 4% - 8.875% | Wyoming | 4% - 6% |

Iowa | 6% - 8% | North Carolina | 4.75% - 7.5% | Puerto Rico | 10.5% |

Kansas | 6.5% - 10.6% | North Dakota | 5% - 8.5% | ||

Kentucky | 6% | Ohio | 5.75% - 8% |

How to find the right sales tax.

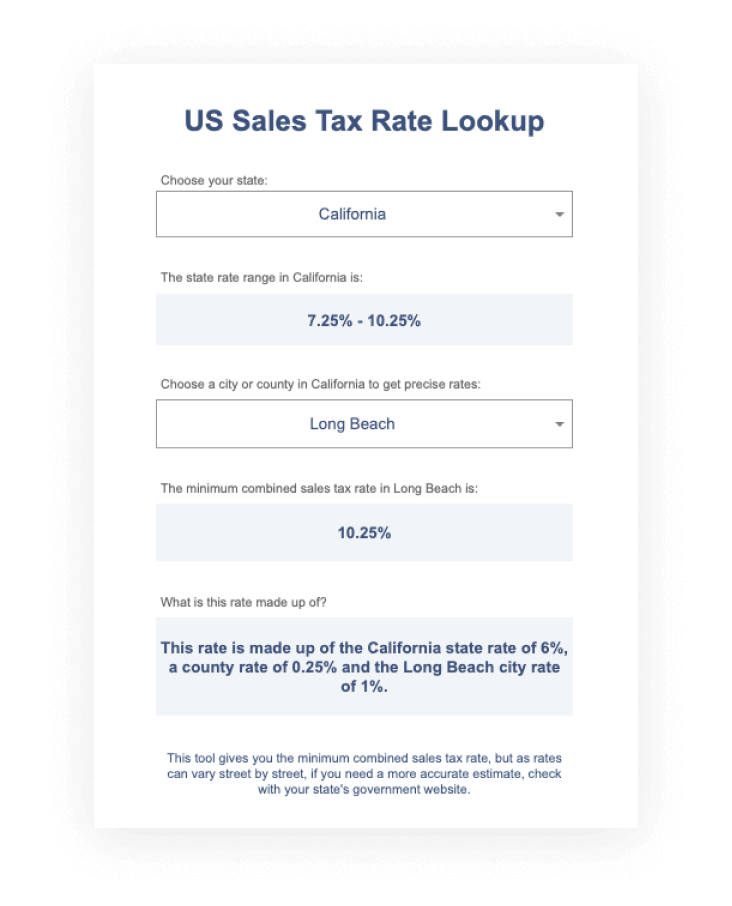

Sales tax varies by state. Local tax rules can mean further differences by county and city too. To find the right sales tax you’ll often have to calculate a combined state and local sales tax rate.

Wondering how to find sales tax detail for your locality? We know taxes are nobody’s favorite thing, so we’ve done the hard work for you with our downloadable sales tax lookup tool.

Simply enter your state, and county or city to find the rate you need.