Complete Guide to Student Discounts on International Flights from India

Complete guide to student discount on international flights from India. Discover how to get the best deals and save on your study abroad journey.

Going abroad to study can be an exciting time and the start of a new chapter in life full of new experiences, friends and learning. But whether you are going abroad, or your son or daughter is, the process to pay for tuition can feel complicated and expensive.

And the tuition payments don’t even cover all the other cash and expenses that occur once you are there. But a good thing is that you do have multiple options for payment methods compared to the past.

You can make payments abroad with forex cards, wire transfers with banks, and money transfer providers.

Let’s break down how each one of them works and where you could save money on your next payment abroad. Plus, check out the section below on what factors to consider when choosing the best payment method for you.

Forex Cards are a practical and smooth way to spend like a local overseas. With a swipe of the Visa or Mastercard, or the participating payment company, you can make payments locally and the corresponding money will be deducted from the account.

But Forex Cards for students are far from considered the cheapest way to go. They often come with annual fees, issuance fees and minimum balance and activity requirements. Let alone a hidden exchange rate fee. These additional fees can take a strong bite out of your wallet.

Plus, Forex Cards are not all created the same. For instance, some have limited currency options, so if you want to travel to a neighboring country, your Forex card may be out of luck.

And even if it does work in other countries, you may have to pay a cross currency fee for non-supported currencies. Forex cards also tend to have cash-withdrawal fees that are applied every time you are at an ATM.

In the end, while Forex Cards can feel simple and easy, they are usually tied to multiple additional fees.

One of the more traditional ways to send money abroad is through a bank wire transfer. Most banks in the world use the global SWIFT system that allows them to send money to other countries.

Wire transfers with banks are usually best for large lump sums. Ideally, the wire transfer can be done through the online banking portal your bank offers, but some Indian banks will require you to go physically to a branch.

Using the SWIFT system, you will need to provide exact details of the bank it is being sent to, and the exact amount. And the system usually takes 3-5 business days, but could be longer depending on your exact bank.

As for fees, banks tend to charge a SWIFT fee and an outward remittance fee for money being sent abroad. Inaddition you can face a hidden exchange rate fee with the rate the bank gives you.

If the exchange rate does not match the one you see on Google, you can bet that the bank has tucked away a fee in every rupee you convert.

The bottom line is that wire transfers from banks are an available option for specific or infrequent payments. But on the same token, they often aren’t the smoothest or fastest if you are looking for a way to send or pay money regularly.

Money transfer providers can be a more accessible and easier way to send money instead of banks.

And some money transfer providers let you send cash too.

But choosing the right money transfer provider is important. They vary across the spectrum where some will require you to physically come to a branch for a transfer while others use smart technology to send money online and globally in minutes.

As for fees, most money transfer providers have a transfer or service fee they charge. Then depending on how they set up their exchange rate, they can give you the mid-market exchange rate or sneak in a fee with a marked-up exchange rate.

They can be faster than a regular run-of-the-mill bank and provide deals or offers to make the transfers cheaper. But in most cases, you will have to keep a sharp eye on the currencies they provide, the delivery time, and ensure there aren’t extra fees on your transfers.

Wise offers a transparent and cost-effective alternative to send money abroad from India. Here's what Wise offers:

Send Money from India with Wise 🚀

Whether you are paying for classes in Los Angeles or a semester abroad in London, or full year’s tuition in Berlin, Wise makes it easy and cheap to make payments to local bank accounts from the comfort of your own home or directly from your mobile.

With different options available, how do you decide which one is best for you and your family? While it is a personal decision based on your priorities, there are a few broad areas to consider when sending money abroad.

The cost of a transfer can totally depend on how you are planning to send it. Different services have differing fees. Whether it is called a transfer fee, or service fee, there is usually always a charge by the provider for the service.

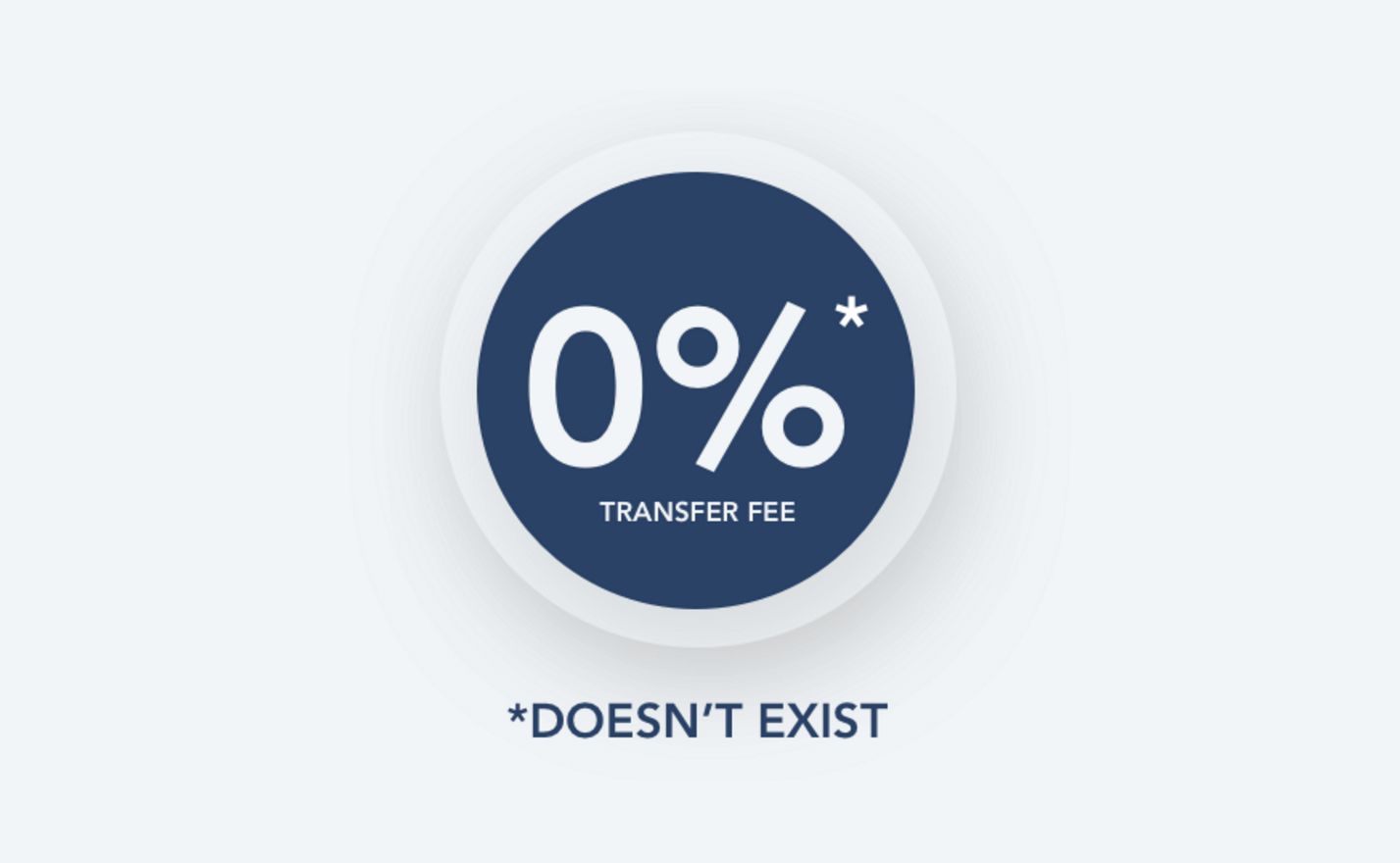

But then, there is the case of the exchange rate. The real exchange rate is the rate that the banks use themselves and is the same one you see on Google.

Often providers will make their rates weaker than the mid-market exchange rate to sneak in a fee in every rupee or dollar you convert. And then pocket that difference as profit.

So look closely at the exchange rate and compare it to the one you see on Google to see if you are losing money in a hidden exchange rate fee.

On top of the transfer fee and a possible exchange rate fee, you also may face other additional fees and charges. Always read the fine print and do your research to make sure you are getting the cheapest way possible to send money abroad

How fast do you need the money to get to the destination? This can play a big factor in which provider you use if you need to send money in an emergency or if the tuition payment deadline is around the corner.

Wise can have money from abroad deposited in an Indian bank account often within a matter of minutes. But not all providers are the same.

Assess how fast you need the money to arrive and which provider will help you get it there when you need it. Often if you don’t mind a few days, you can get a better deal with other providers or the bank.

To make global money transfers easier on yourself, find a provider that works the way you bank. If you like to send money in person at a branch, identify the providers or banks that will fit seamlessly into the way you handle your finances.

If you would rather prefer a digital experience where you can send money at a touch of a button, make sure that your provider has an app or a website that is easy to use and navigate.

Convenience can also mean in terms of currencies and use too. If your son or daughter has the travel bug, save yourself some money on fees by getting a truly global multi-currency card that can be swiped everywhere they go.

With education on the line, you want to make sure your payments are completed and received by the date they are needed. Let alone at the cost that you were told.

This is where trust comes in. You need to choose a provider that you can trust will get your money where it needs to go and are true to their word.

Tools like customer reviews and Trustpilot can help you choose the right provider. So if there are any hiccups, that support and help are there when you need it. Whether online or over the phone.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Complete guide to student discount on international flights from India. Discover how to get the best deals and save on your study abroad journey.

Compare the best travel insurance options for Indian students traveling to studying abroad. Learn about coverage, options, and requirements.

Compare the best health insurance options for Indian students traveling to studying abroad. Learn about coverage, options, and requirements.

Complete Guide to baggage allowance for Indian students traveling abroad. Learn more about extra allowance for international students.

Navigating cash allowances for Indian students traveling to the USA. Know the limits, declarations, and smarter ways to manage your finances abroad.

Understanding TCS on education loan remittances from India. Learn how to minimize TCS and save money with Wise, a convenient option to send money abroad.