American Express Platinum Travel Card Review: Fees, benefits and is it worth it?

Thinking about getting the Amex Platinum Travel Card? Explore its fees, rewards, perks, lounge access, and overseas charges.

The popular DBS Bank provides their online banking services through Digibank. And, one of those services is sending money abroad from India.

And while DBS does offer attractive no-fee transfers and same day delivery for global money transfers, these perks are only to a little over a handful of specific countries and currencies.

Plus, if you aren’t a DBS bank account holder, this may not be the best choice for you.

Read on to learn more about DBS’s digibank remit and how it works, especially if you already bank with DBS.

| If you want an easy way to send money abroad or to India, Wise helps you send money to 60+ countries 💸 |

|---|

Open your free Wise account now

DBS has set up Digibank to be an easy to use app and website that you can use right from your mobile.

And while you can do most of your DBS banking from the Digibank app, you will have to go to the Digibank Internet banking website on a computer to complete any overseas transfers.

Once you’re in Digibank, all you have to do to get started on your transfer is hit Overseas Transfer on the top of the page.

Keep in mind that you will still need to follow FEMA (Foreign Exchange Management Act) rules and regulations if you are an Indian resident sending money abroad.

That means that money can only be sent overseas if the amount you send is below the currency equivalent of $250,000 USD over the course of 1 year, and the transfer is done for the following reasons:

|

|---|

If you are in India, you can use DBS’s Digibank Remit to send money abroad in 40 different currencies. But not every currency is treated equally.

There are 7 currencies that get added benefits with Digibank. Including US Dollar, they are:

| Hong Kong Dollar | Euro | British Pound |

| Singapore Dollar | Canadian Dollar | Australian Dollar |

With these 7 currencies including US Dollars, there is no transfer fee from DBS and you can get same day delivery if you complete your transfer before the cut off time that day.

Unfortunately if you have to send any other currencies to other parts of the globe, your transfer can take 1-4 working days and you will have to pay a fee for the transfer.¹ Check out the charges and fee section below.

But first to get started with an overseas transfer, you will need to open a DBS account.

To use Digibank from DBS for overseas transfers, you will need at least a savings account open with DBS bank.

Once you have opened a DBS account or if you are a DBS account holder, you can get started with Digibank through the DBS website.

You can download the app and register, or register directly through the DBS website.

Opening the DBS savings account is important as your transaction amounts will be debited from the savings account you have at DBS. There isn’t any option to pay from a different bank or using a different account.²

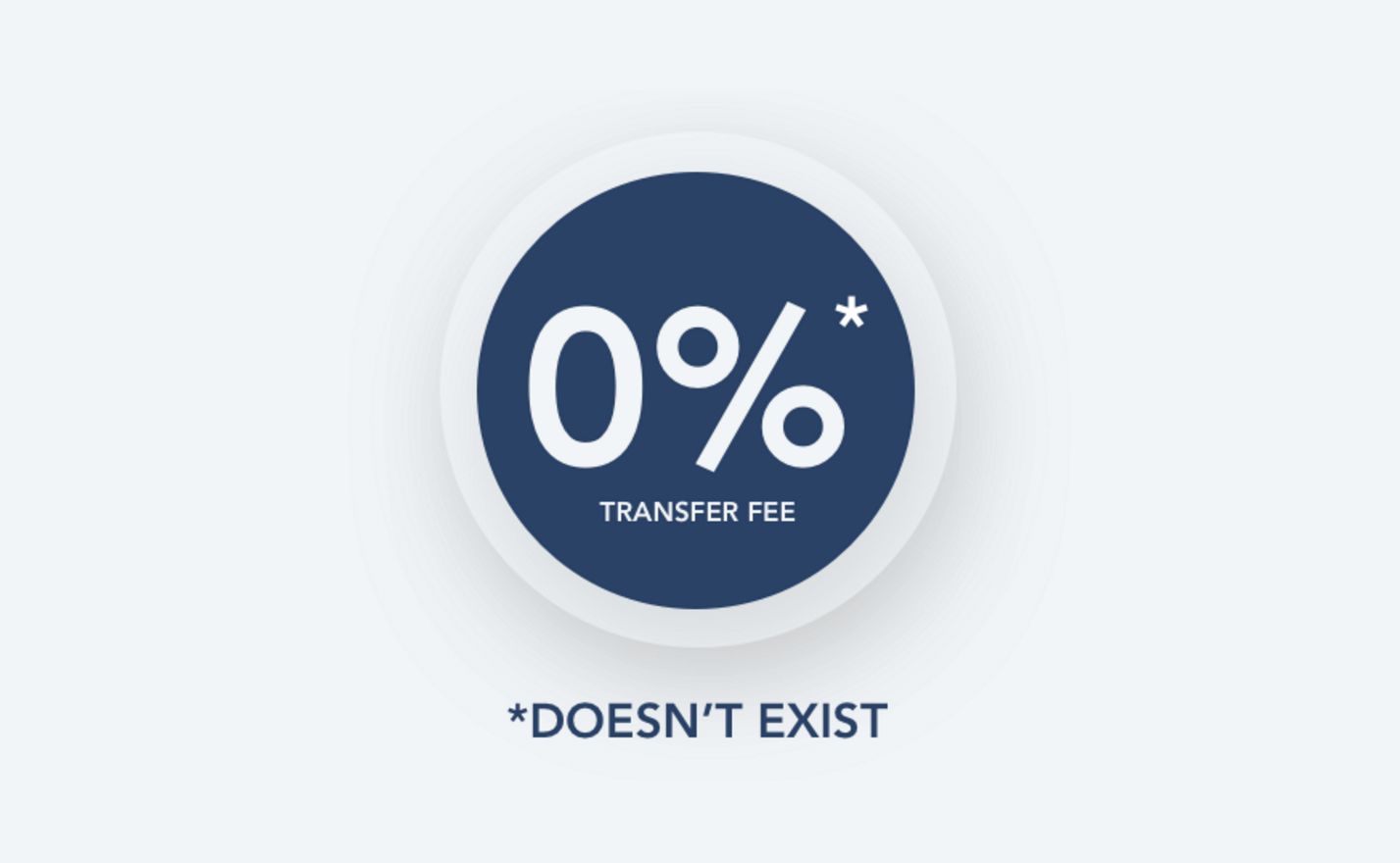

There are three main fees to expect with DBS. The first is a bank fee, the second is an agent fee, and the last is a hidden fee in the exchange rate. But not all fees are applicable for every currency.

If you are sending money with one of the 7 preferred currencies, you won’t have to pay a bank fee or an agent fee.

But if you are sending money in any currency that is not USD, AUD, CAD, SGD, HKD, EUR, or GBP, you will have to pay a bank fee of ₹ 500.

Depending on the currency you are sending, you may also need to pay an agent fee as well.³

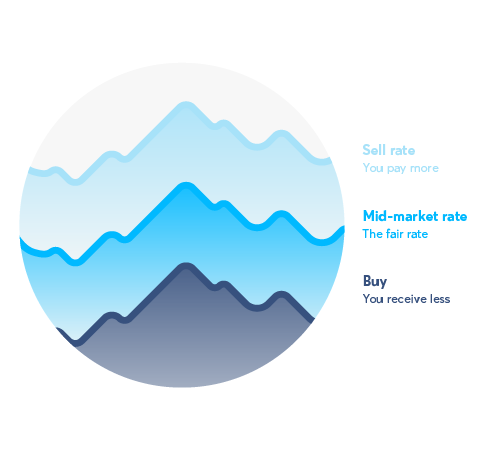

Last but not least, an exchange rate fee can sneak up on you in your transfer too. DBS sets its own exchange rate, which makes it weaker than the real exchange rate that the banks use between themselves.

So in that difference, DBS is able to hide a fee that they are able to pocket on every rupee that you convert. Take a look at the cost of international transfers section to see how this can add up.

The minimum you can send with DBS is $10 USD or the currency equivalent. The most you can send in one transaction is the equivalent of $25,000 USD. The $25,000 USD is also the most you can send over the course of one day. ⁴

And, as mentioned, with FEMA regulation, you can’t send more than $250,000 USD per year.

But as far as transactions go, you can send as many as you want with DBS as long as the total falls below the amount limits.

For the US, Canada, Australia, the Eurozone, Great Britain, Hong Kong and Singapore, if you meet the cut off times for that day, you can get same day delivery of your funds. Otherwise it will be deposited the next day.

For any other countries, the transaction can reach your beneficiary anywhere between 1-4 days.⁵

Keep your current bank and send money easily with Wise. You can sign up for Wise for free online and send money to over 150 local currency bank accounts using your bank account, debit card or credit card. It is that simple.

DBS’s Digibank remit service can be a good option if you are an existing DBS account holder and are sending money to their common currency corridors.

But if you are not in either case, there may be better options for you out there.

The ₹ 500 transfer fee plus the possible agent fee can make sending money expensive. And this is on top of having to open a DBS account, and a hidden fee in the exchange rate.

And in that small difference is where DBS has added an extra fee. It can seem small at first, but with a bite taken out of every rupee converted, it can add up to a significant amount.

In total, with all the fees that DBS has, it is hard to say how much your total will be without signing up for DBS in the first place.

So save yourself on fees and with switching banks, by joining the 8 million people around the world that use Wise. Wise is easy to use and has an award winning app so you can transfer money quickly, easily and cheap when you're on the go.

Want to send money directly to bank accounts around the world at the real exchange rate? Try Wise.

Even if you are sending money from India, or to India, you can send money in a snap with Wise. And the money is deposited right into the local bank account so your beneficiaries can just sit back and relax.

Wise is free to sign up and makes it super easy to pay for your transaction, no matter what bank you use. You can also know how much your transaction will cost and when it will be delivered before your sign up.

Sources used for this article:All sources checked as of 6 October, 2020

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking about getting the Amex Platinum Travel Card? Explore its fees, rewards, perks, lounge access, and overseas charges.

Wondering which Thomas Cook Forex Card is right for your next trip? We break down the benefits and charges of each variant to help you decide.

Considering the Scapia Federal Bank credit card? Get a full review of its zero forex, rewards, and fees. Find out if it’s the right travel card for you.

Thinking about getting an Axis Bank Forex Card? Here’s a breakdown of its benefits, charges, and how it works so you can choose what works best for your trip.

Heading abroad? In our HDFC Regalia ForexPlus Card review, we break down the benefits, charges, and compare with the Wise Travel card to help you choose.

Considering the Orient Exchange Forex Card? Here’s what to know about its features, benefits, and charges, before you decide if it’s worth it.