Best Bank for Indian Expats in New Zealand: Indian Banks in NZ and Alternatives for NZ NRIs

Review of the best banking choices and alternatives for NRIs in New Zealand with our guide for Indian Expats living in New Zealand.

When you are on a trip and there are any emergencies, accidents, or even loss of luggage or documents, travel insurance can help cover costs incurred. Just like other types of insurance, travel insurance can safeguard you and your family - and in some cases, even provide coverage for business trips or students going abroad. And more than anything, it can give you peace of mind. So let’s take a look at the best travel insurance options in India and see which one can be best to prepare you for your next adventure.

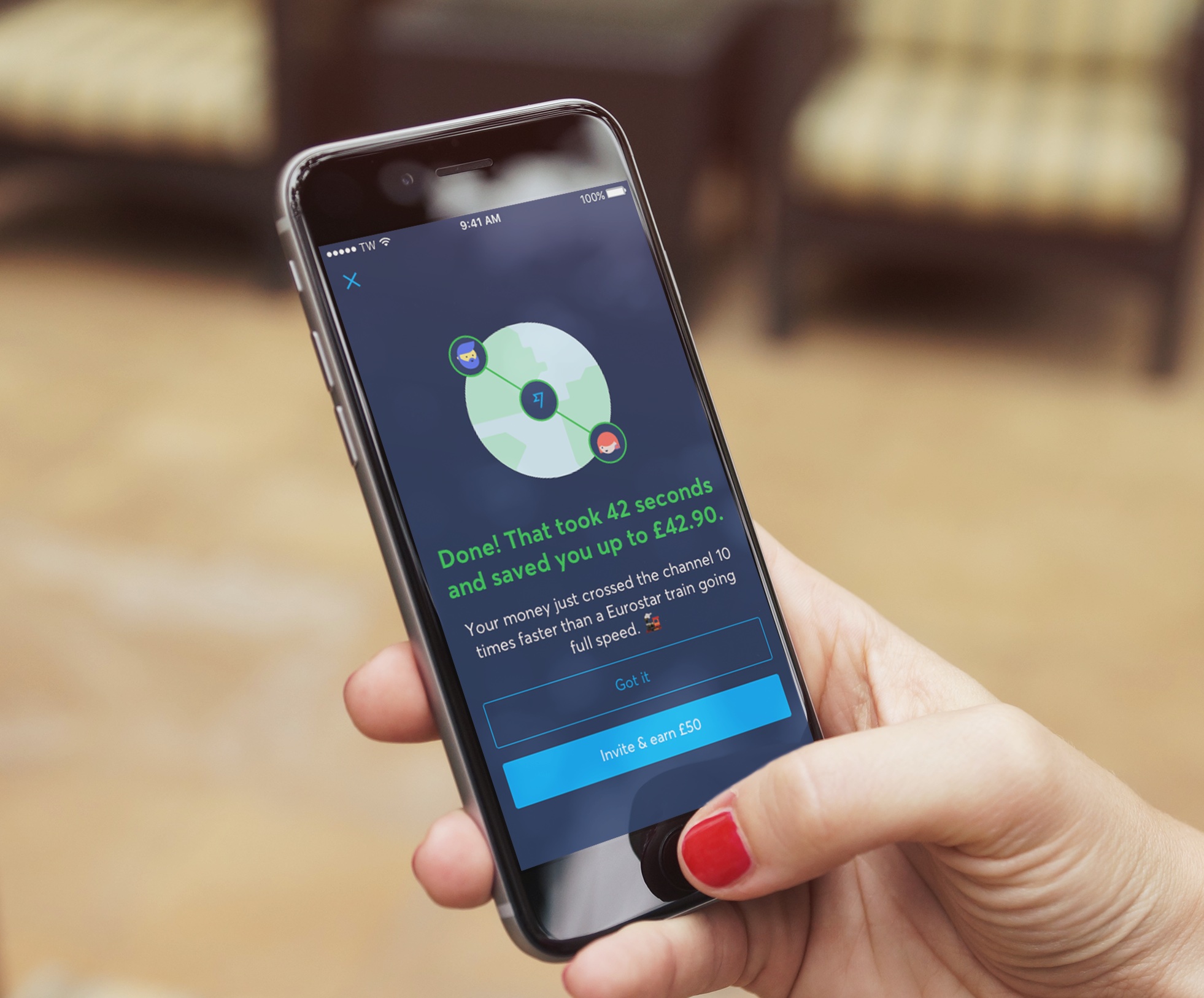

Want to make money transfers one less thing to worry about? Check out Wise. Whether you want to send money from India to friends and family abroad, or they want to send some to you in your local Indian account, it can all happen easily, quickly, and cheaply. Wise gives you a free account that lets you transfer money in over 60+ currencies around the world at the real exchange rate and just one low fee.

Open your free Wise account now

| Table of contents |

|---|

Bharti AXA travel insurance offers plans that depend on where you are going and the type of traveler you are, and provides coverage for medical expenses up to $200,000 USD, and for burglary at home back in India.

|

|---|

Bharti AXA travel insurance offers coverage through different plans for worldwide travel (minus the US/ Canada), worldwide including the US and Canada, Schengen, and Asia. And each destination plan offers tiers that you can choose from. In most cases, the traditional coverage options such as medical expenses, dental, personal accident, trip delay, baggage loss, and more are covered. Although different plans may have differing policies, for instance only travelers up to 60 years can get coverage for Schengen countries. For non-Schengen countries, the max-age is 85 years old. You can also get additional coverage for your home from burglary, fire, legal expenses and under certain conditions, pet care .¹

Bajaj Allianz offers 17 different travel insurance plans to choose from that are traveler specific, and with built-in support, you can feel safe as you travel.

|

|---|

Bajaj Allianz travel insurance offers plans for whether you are an individual, family, or a senior citizen traveling, plus corporate and student plans too. Bajaj Allianz also provides on-call support if you are in trouble during your trip, and has an in-house team to help with claims. The variety of plans provide coverage for medical expenses abroad, loss of baggage or passport, and flight delays to name a few. Plus, trip cancellation coverage for unforeseen issues that don’t allow you to travel. And depending on the plan you choose the coverage can scale up or down. Bajaj Allianz also provides an option for emergency cash advances in the case of an emergency on your trip.²

HDFC Ergo travel insurance has medical, baggage, and journey coverage in the plans on offer, as well as worldwide, Schengen countries, or Asia-specific plans.

|

|---|

You may be familiar with HDFC Ergo medical insurance, but they can also be an option for travel insurance on your next trip. HDFC Ergo provides plans that cover the type of traveler you are, also with destination-specific options. If you are a frequent traveler you can get an annual multi-trip plan that provides worldwide coverage for up to 45 days per trip. With HDFC Ergo’s plan coverage, you can expect emergency medical expense coverage, disablement or personal accident, loss of check-in baggage, and financial assistance in case of theft. However pre-existing conditions, cosmetic surgeries, occurrences under intoxication, adventure sports, or self-injury are not covered.³

IFFCO Tokio’s travel insurance covers the basics of travel, but with fewer customizable options, it can leave travelers wanting additional options and coverage versus other providers.

|

|---|

IFFCO Tokio travel insurance covers medical expenses, dental treatment, personal accident, personal liability, loss of checked-in baggage or passport, and hijack distress. The coverage comes in the form of 5 plans in total, Bronze, Silver, Gold 100, Gold 250 and Gold 500. All plans cover destinations worldwide, except Bronze and Silver plans do not cover any trips to the US or Canada. And with every plan, except Bronze, you can get a hospital daily allowance as well. However, customized plans and add-ons, such as home burglary coverage when you are abroad, are noticeably absent from IFFCO’s policies.⁴

Aditya Birla travel insurance provides coverage for your standard options for family and individual plans, so if you want more customized benefits and coverage, this may not be the best option.

|

|---|

Aditya Birla travel insurance provides coverage for hospitalizations and medical expenses, trip delay and cancellations, disablement, personal accident, loss of baggage, and medical emergency assistance. However, if a physician had advised against traveling and you do despite the advice, medical issues that arise during your trip are not covered. And, any issues that arise in the country you are going to that were known in advance, like weather, riots or even rising health issues, and that affects your trip may also not be covered. To get more information or buy an Aditya Birla travel insurance policy you will have to give them a call at 1-800-270-7000.⁵

Open your free Wise account now

While it may not be easy to travel, you can still send and receive money from around the world with Wise. Whether it is for gifts for special occasions, expenses, or family support, Wise can help you save money on global money transfers. Wise is used by over 7 million people globally to send low-cost, easy, and fast money transfers to local accounts. And with an award-winning app and easy-to-use website, you can transfer money across the world from your living room.

Wise uses smart technology to keep costs low and pass the savings on to you. With every transfer, you will always get the real mid-market exchange rate. Your only fee will be the one low fee you’ll see upfront. That’s it.

So open your free Wise account today right from your phone or computer. You won’t even need to leave the house to start saving money on global money transfers. Check out Wise today and see how much you can save.

Sources used for this article:All sources checked as of 29 June, 2020

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Review of the best banking choices and alternatives for NRIs in New Zealand with our guide for Indian Expats living in New Zealand.

Complete guide to TCS applicable when remitting from India to cover foreign travel such as for overseas tour packages. We go over the TCS rate and how to claim.

Complete guide to TCS and remitting for foreign education expenses from India. Our guide covers the applicable rates, how to claim TCS, and tips to avoid them.

Sending money abroad from India? Check out our guide to TCS charged on foreign remittances, with an overview of rates and how to claim it back with your ITR.

Discover the range of Union Bank of India NRI account options for Indians living abroad with their seamless banking services tailored for NRIs.

Explore the wide range of Standard Chartered NRI account options and services tailored for Indians living abroad.