What are the world’s scariest airports? Check out the top 10

Discover the world’s scariest airports and why landing or taking off there takes some nerve. Read before you fly.

Planning a trip abroad and thinking about the best way to manage and spend your money? One option is the An Post Foreign Currency Card.

In this article we’ll take a look at whether the An Post card works abroad, what the charges to use it are, and how the exchange rates work.

We’ll aso let you know about the Wise card, another option for multi currency spending.

Spend in +40 currencies

with the Wise card 💳

The An Post card is a prepaid travel money card that’s backed by Mastercard.¹ You can use it to spend money mostly everywhere (few countries are restricted³), having the option to pay in person, online and using contactless. It’s also possible to withdraw cash from an ATM.

On the card you can store money in 15 different currencies:

- Australian dollars (AUD)

- British pounds (GBP)

- Canadian dollars (CAD)

- Czech koruna (CZK)

- Euro (EUR)

- Japanese yen (JPY)

- Mexican peso (MXN)

- New Zealand dollars (NZD)

- Polish zloty (PLN)

- South African rand (ZAR)

- Swedish krona (SEK)

- Swiss francs (CHF)

- Turkish lira (TRY)

- United Arab Emirates dirhams (AED)

- US dollars (USD)

It’s also possible to spend in other currencies, but more on that in a minute.

As you would expect there are fees for using an An Post card. These are the fees that specifically apply to using it as you travel.

We'll also add the fees for the Wise card (also available in Ireland), so you can compare and check another option too.

| Service | An Post Currency card² | Wise card |

|---|---|---|

| Spend in a currency you hold | Free (15 currencies available) | Free (+40 currencies available) |

| Spend in a currency you don't hold | 5.75% (Foreign exchange fee) | Variable conversion fee starting from 0.33% based on the currency |

| ATM withdrawals fee | Flat fee that varies per currency + 5.75% (Foreign exchange fee) | |

| Exchange rate | Mastercard exchange rate | Mid-market exchange rate (the one you normally find on Google) |

* An Post Foreign exchange fee: This is fee charged for using the card for a transaction in a currency which is not available on the card or when you don't have enough balance in the transaction currency and the rest is taken from another currency wallet.

* Wise ATM withdrawals: Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks.

Depending on what you’re doing with the An Post currency card, the foreign exchange rate either comes from An Post or Mastercard.² This table can help you keep track of which rate is going to be used when.

| Activity | Exchange Rate Used |

|---|---|

| Initially load or top up the card at a post office for currencies other than the Euro | Ask the post office for the rate |

| Initially load or top up the card online or through the An Post mobile app for currencies other than the Euro | An Post rate shared before the top up or load happens |

| Moving money between currencies in the wallet | An Post rate shared before the money is moved |

| Paying or withdrawing in a currency you don’t have enough of in your wallet | Mastercard foreign exchange rate |

With Wise you don’t need to keep track of the type of activity you’re doing to figure out which exchange rate you'll get, it’s just the mid-market rate for everything.

If you haven’t heard of the mid-market exchange rate before, it’s simply the middle of the buy and sell points on the foreign currency exchange market.

Wise determines the rate using bid and ask data provided by independent sources, updating their rate in real time, every minute that the currency trading market is open. For you, this means the peace of mind of knowing that there’s no mark ups or profit margin hidden in the exchange rate, meaning Wise doesn't make money on the exchange rate.

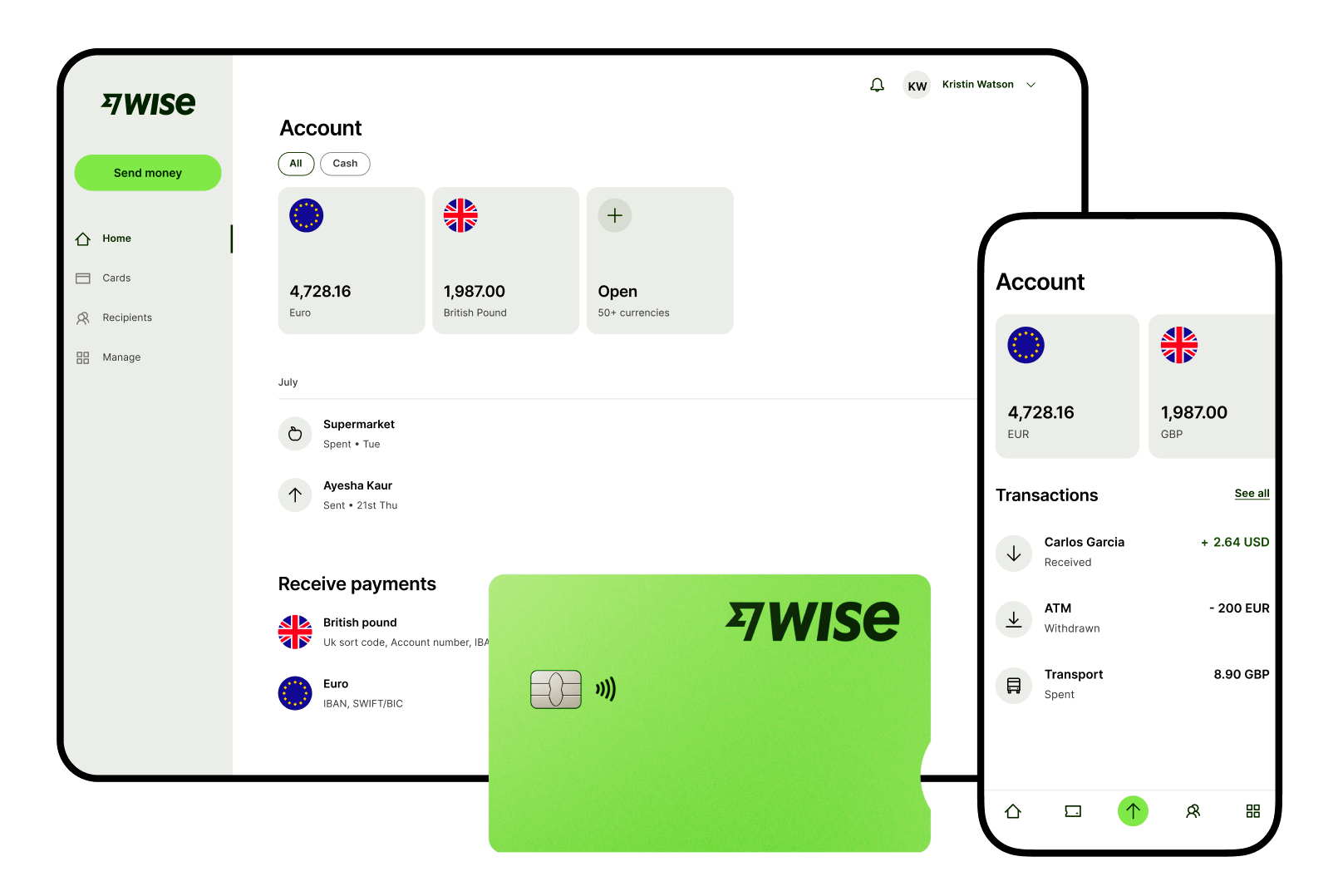

To get a Wise card you need to start by opening a Wise Account. It’s free to do for personal accounts and there’s no account maintenance fees to worry about.

With a Wise Account you can hold 40+ currencies, get local account details for 9+ currencies and exchange money anytime you like at the mid-market exchange rate. And then you can also get yourself a Wise card.

You can order the Wise card online via the website or through the app, and deliver it to your home.

With the card you can pay in over 40 currencies in more than 150 countries around the world. You can also withdraw cash as you need.

If you’re paying in a currency you have a balance in, the card will automatically draw from that first. If the balance is too low to complete the payment, the card uses smart technology to convert money from another currency to complete the payment. This is all done in an instant, leaving you free to focus on your trip.

Other benefits of the Wise card:

- No maintenance fees for the card, just a one-off fee of 7 EUR when you apply

- You can create up to 3 virtual cards for free to organise your expenses

- Add your card to the digital wallets of Apple Pay or Google Pay

- The virtual card number is different from the number on your physical card - which adds an extra layer of security

- Receive real-time notifications of your spending in the Wise app

- Freeze and unfreeze your Wise card whenever you want

Open your Wise Account

for free 🚀

Sources:

Sources checked on: 2 September 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the world’s scariest airports and why landing or taking off there takes some nerve. Read before you fly.

Discover the top 10 largest airports worldwide: see which impress most for size, structure and connectivity.

Read if Revolut works in South Africa and what are the fees for using the account and card in the country.

Did your Ryanair flight get delayed? Discover your rights and how to apply for compensation.

Is it possible to use a Swirl card abroad? How much are the fees and how does that work? Read all about it here.

Here's all you need to know when using your AIB debit card abroad. Check out the changes when paying and also withdrawing in an ATM.