Send money to Hong Kong from New Zealand

Fast, low-cost, and secure online money transfers to Hong Kong from New Zealand.

Bank transfer fee

0 NZD

Our fee

3.83 NZD

Total included fees (0.38%)

3.83 NZD

- You could save up to 44.41 NZD

Should arrive by Friday 05:00

Save when you send money to Hong Kong from New Zealand

The cost of your transfer comes from the fee and the exchange rate. Many high street banks offer “no fee”, while hiding a markup in the exchange rate, making you pay more.

At Wise, we’ll never do that. We only use the mid-market exchange rate, and show our fees upfront. This table compares the fees you’d really pay when sending money with the most popular banks and providers, or with us.

How do we select providers and collect this data?| Sending 1,000 NZD with | Recipient gets(Total after fees) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 4,353.12 HKD | ||||||||||

Transfer fee 3.83 NZD Exchange rate(1 NZD HKD) 4.36986 Exchange rate markup 0 NZD Cost of transfer 3.83 NZD | |||||||||||

| 4,301.09 HKD- 52.03 HKD | ||||||||||

Transfer fee 0 NZD Exchange rate(1 NZD HKD) 4.30109 Exchange rate markup 15.74 NZD Cost of transfer 15.74 NZD | |||||||||||

| 4,273.59 HKD- 79.53 HKD | ||||||||||

Transfer fee 5 NZD Exchange rate(1 NZD HKD) 4.29506 Exchange rate markup 17.12 NZD Cost of transfer 22.12 NZD | |||||||||||

| 4,270.72 HKD- 82.40 HKD | ||||||||||

Transfer fee 5 NZD Exchange rate(1 NZD HKD) 4.29218 Exchange rate markup 17.78 NZD Cost of transfer 22.78 NZD | |||||||||||

| 4,268.60 HKD- 84.52 HKD | ||||||||||

Transfer fee 5 NZD Exchange rate(1 NZD HKD) 4.29005 Exchange rate markup 18.26 NZD Cost of transfer 23.26 NZD | |||||||||||

How to send money to Hong Kong from New Zealand in 3 easy steps

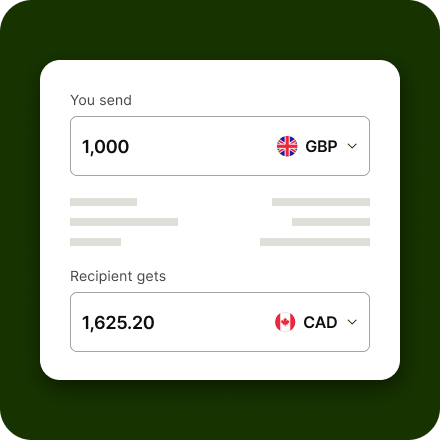

Enter amount to send in NZD.

Pay in NZD with your debit card or credit card, or send the money from your online banking.

Choose recipient in Hong Kong.

Select who you want to send money to and which pay-out method to use.

Send NZD, receive HKD.

The recipient gets money in HKD directly from Wise’s local bank account.

What you’ll need for your online money transfer to Hong Kong from New Zealand

Register for free.

Sign up online or in our app for free. All you need is an email address, or a Google or Facebook account.

Choose an amount to send.

Tell us how much you want to send. We’ll show you our fees upfront, and tell you when your money should arrive.

Add recipient’s bank details.

Fill in the details of your recipient’s bank account.

Verify your identity.

For some currencies, or for large transfers, we need a photo of your ID. This helps us keep your money safe.

Pay for your transfer.

Send your money with a bank transfer, POLi, or a debit or credit card.

That’s it.

We’ll handle the rest. You can track your transfer in your account, and we'll tell your recipient it's coming.

How much does it cost to transfer money to Hong Kong from New Zealand?

Pay a small, flat fee and percentage

To send money in NZD to Hong Kong from New Zealand, you pay a small, flat fee of 1.14 NZD + 0.27% of the amount that's converted (you'll always see the total cost upfront).

Fee depends on your chosen transfer type

Some transfer types have different fees which are usually tiny.

No hidden fees

No big fees, hidden or otherwise. So it's cheaper than what you're used to.

How long will a money transfer to Hong Kong from New Zealand take?

A money transfer from New Zealand (NZD) to Hong Kong (HKD) should arrive by Friday 05:00. Sometimes transfer times can differ based on payment methods or verification changes. We’ll always keep you updated, and you can track each step in your account.

On many popular routes, Wise can send your money within one day, as a same day transfer, or even an instant money transfer.

Your transfer route

Should arrive

by Friday 05:00Best ways to send money to Hong Kong from New Zealand

Bank Transfer

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money. Read more how to use bank transfers as a payment option.Debit Card

Paying for your transfer with a debit card is easy and fast. It’s also usually cheaper than credit card, as credit cards are more expensive to process. Read more about how to pay for your money transfer with a debit card.Credit Card

Paying for your transfer with a credit card is easy and fast. Wise accepts Visa, Mastercard and some Maestro cards. Read more about how to pay for your money transfer with a credit card.Apple Pay

If you’ve enabled Apple Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Apple Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.Google Pay

If you’ve enabled Google Pay on your phone, you can use it to pay for a transfer with Wise. Paying with Google Pay is a convenient and quick way to send money abroad. If you’re using a credit card, watch out for extra charges. Some banks consider these payments as cash withdrawal, and they may charge you extra fees.

Protecting you and your money

Safeguarded with leading banks

We hold your money with established financial institutions, so it's separate from our own accounts and in our normal course of business not accessible to our partners. Read more here.

Extra-secure transactions

We use 2-factor authentication to protect your account and transactions. That means you — and only you — can get to your money.

Data protection

We’re committed to keeping your personal data safe, and we’re transparent in how we collect, process, and store it.

Dedicated anti-fraud team

We work round the clock to keep your account and money protected from even the most sophisticated fraud.

Send money to Hong Kong from New Zealand with the Wise app

Looking for an app to send money to Hong Kong from New Zealand? Sending money is easy with Wise app.

- Cheaper transfers abroad - free from hidden fees and exchange rate markups.

- Check exchange rates - see on the app how exchange rates have changed over time.

- Repeat your previous transfers - save the details, and make your monthly payments easier.

Wise works nearly everywhere

- United Arab Emirates dirham

- Australian dollar

- Bangladeshi taka

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Chilean peso

- Chinese yuan

- Costa Rican colón

- Czech koruna

- Danish krone

- Egyptian pound

- Euro

- British pound

- Georgian lari

- Hong Kong dollar

- Hungarian forint

- Indonesian rupiah

- Israeli shekel

- Indian rupee

- Japanese yen

- Kenyan shilling

- South Korean won

- Sri Lankan rupee

- Moroccan dirham

- Mexican peso

- Malaysian ringgit

- Nigerian naira

- Norwegian krone

- Nepalese rupee

- New Zealand dollar

- Philippine peso

- Pakistani rupee

- Polish złoty

- Romanian leu

- Swedish krona

- Singapore dollar

- Thai baht

- Turkish lira

- Tanzanian shilling

- Ukrainian hryvnia

- Ugandan shilling

- United States dollar

- Uruguayan peso

- Vietnamese dong

- West African CFA franc

- South African rand

See why customers choose Wise for their international money transfers

It’s your money. You can trust us to get it where it needs to be, but don’t take our word for it. Read our reviews at Trustpilot.com.