How to use GCash in mainland China? Is GCash available in China?

Learn how to use GCash in mainland China - Alipay+ QR payment steps, GCash Card acceptance and ATM withdrawal limits, plus fee considerations.

Alipay is known throughout China as one of the safest ways to make mobile payments and online financial transactions. Millions of Chinese people rely on Alipay as an easy and quick way for online shopping, daily transfers, and mobile phone top-ups.

If you’re an expat using Alipay to help manage part of your money or even run a business in China, though, you might still wonder how safe Alipay is and how it keeps your account and data safe from hackers or fraudsters. Read on to learn about Alipay’s privacy policies and transaction protections. We also compare Alipay vs WeChat Pay in terms of security.

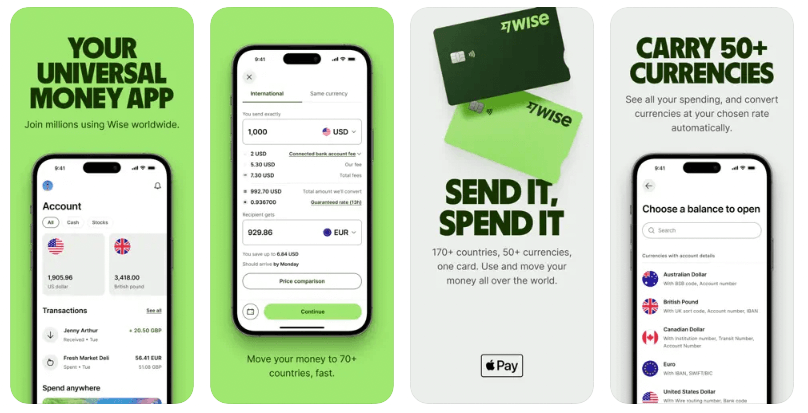

If you’re looking for a safe and reliable cross-border payment solution, simply open an account with Wise. A Wise multi-currency account can help you send money out of China cheaply and hold 40+ different currencies. Wish to spend like a local in China? You just need a Wise debit card that automatically converts other currencies to Chinese Yuan at the mid-market exchange rate.

Alipay (China) Network Technology Co., Ltd. has been committed to the construction and development of an open platform for digital payments since its inception in 2004. In May 2011, Alipay was awarded the first batch of Payment Business Licenses by the People's Bank of China¹.

Alipay has developed innovative payment technologies such as Barcode payment, Facial Recognition Payment, QR Code Payment, etc. to meet digital payment needs in different scenarios.

Alipay is widely used by both individuals and merchant users in China and around the world, and now provides payment service protection for more than 1 billion users and 80 million merchants, while helping the real economy to flourish.

Generally, Alipay consists of three main areas: commercial payments, convenient everyday payments and transport payments¹.

First of all, Alipay provides different payment solutions for merchants in different industries such as catering, and retail. Secondly, PayPal opens up convenient solutions based on mobile phone payment, and credit payment, for government affairs, medical and healthcare, local daily life, education, etc. In addition, the Alipay payment solution is available for transportation such as taxis, parking, share bikes, buses, metro, online car rental, and high-speed trains.

Yes it is.

Alipay is developed and operated by Ant Group, which is a financial technology company owned by Alibaba. Alipay has implemented multiple security measures to protect users' funds and private data. Besides this, Alipay has partnered with financial institutions to implement a stringent fund supervision system. Moreover, Alipay also offers safety and security services, such as risk monitoring and transaction insurance.

Let's look at some of Alipay’s protection measures²:

Whether you register an official Alipay account or Alipay’s 90-day “tour pass” mini program³, you are requested to provide your ID details and contact information. A passport or a driver’s license is usually a necessary document used for Alipay sign-up. So it's important to know how Alipay stores these documents and user information in order to ensure security.

How does Alipay store and protect personal information⁴?

Similar to Alipay, WeChat Pay stores users’ personal information for the period of time specified by law, regulation or supervision. WeChat Pay has also taken a number of measures to ensure the security of users' funds and information. Physical protection, security technology, management system and other measures are taken to reduce the risk of loss, misuse, unauthorized access, disclosure and alteration of personal information⁵.

Which payment gateway is safer, Alipay or WeChat? Actually, both Alipay and WeChat payments are very secure. Whether it is Alipay or WeChat Pay, as long as you protect your account information and password correctly and do not disclose your password and identity information to others, your money and personal information are protected.

Alipay is a great way to send and receive money within China. Nevertheless, Wise's service is very useful if you wish to transfer money outside of China -- as Alipay does not allow use for this purpose.

You don’t need to go to a physical bank to send money overseas anymore. Foreigners working in China can now transfer their legitimate CNY earnings to their overseas bank account thanks to Wise! You are able to transfer as much as 100,000 CNY per transaction. But overall, the transfer limit you can send out of China is determined by your yearly income in China as well as the amount of income tax you’ve paid there.

Other than transferring money abroad, uses can benefit from having a Wise account:

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

One of the world's largest and most reliable international transfer tools is ready for you. Since it was founded in 2011, Wise has been offering a quick, safe and low-cost cross-border solution for more than 16 million people worldwide.

Expats in China can use Wise to send money home, be it USA, UK, the Philippines or Japan. When it comes to sending money out of China, Wise stands out for using the mid-market rate, instead of increasing exchange rates to boost revenue. That is, the more you make international transfers, the more you save!

You'll also have access to Wise’s currency converting tool that makes it easier and cheaper convert currencies. Download Wise App in English and sign up today. Wise is going to make your life in China as easy and convenient as possible.

*This service is provided in partnership with a licensed third party payment provider in China.

Source:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to use GCash in mainland China - Alipay+ QR payment steps, GCash Card acceptance and ATM withdrawal limits, plus fee considerations.

You can use Mastercard or Visa as forms of payment in China, but there are some limitations and pitfalls you should know about.

Planning to use your AlipayHK in mainland China? You're not alone in wondering how seamless it truly is. This article is your quick guide to everything you...

WeChat Pay HK works in China, but it has some limitations and fees.

Does Venmo work in China? Can you use Venmo in China? This article will answer every question you might come up with about using Venmo in China.

Does Monzo work in China? This article will answer every question you might come up with about using Monzo in China.