WeChat Pay vs Alipay: Which is better for expats in China?

If you’re moving to China, you’ve probably been thinking about what payment options you’re going to use. Two of the most popular payment apps in China are WeChat Pay and Alipay -- but which is better for expats in China?

Both WeChat Pay and Alipay make the electronic payment and online shopping process seamless, but the payment scenario and service range are big differentiators. WeChat Pay may be better if the majority of your income is earned and spent in China, and you are looking for an online payment system that integrates into China’s most popular social media platform. But if global convenience for financial services is a priority for you, consider Alipay.

There are very few options available with WeChat and Alipay for sending money out of China. So most expats in China will also open an account with Wise -- to receive and send international payments. Add to this, a Wise multi-currency account meets expats’ requirements to hold and convert different currencies.

What is WeChat Pay?

WeChat Pay is a leading third-party payment platform in China under Tencent Group. Since its official launch in August 2013, WeChat Pay has been committed to providing users and enterprises with safe, convenient and professional online payment services¹.

With the core concept of "WeChat Pay, more than payment", it has created a variety of convenient services and application scenarios for individual users. In 2014, WeChat Red Packet began to be used on a national scale, and WeChat Pay began to open up to merchants.

WeChat Pay provides professional collection methods and fund settlement solutions for all kinds of enterprises as well as small and micro merchants. Many enterprises, commodities, shops and users have been connected through WeChat.

Can I use WeChat Pay in China as a foreigner?

Yes, you can. When opening WeChat Pay with a foreign passport, you need to open an account with a bank in China. Then complete real-name authentication by connecting your bank card to your WeChat wallet².

What is Alipay?

Since its official launch in 2004, Alipay has grown to become one of the most popular online payment processing platforms worldwide. Currently, 80 million merchants and over 1 billion users benefit from Alipay's quick and easy payment service³.

Through technological innovation, Alipay has developed a number of payment solutions such as Barcode Payment, Face Payment and QR Code Payment, which serve the digital payment needs in different scenarios such as physical business, online shopping, daily bills, and transport.

Individuals can use Alipay for utility bills, dealing with traffic violations, registering at hospitals and so on.

Can I use Alipay in China as a foreigner?

Yes, you can. A Foreigner can also download the English Alipay app, register and link a Chinese or international bank card to Alipay to make payments. Currently, Alipay supports bank cards issued by major international bank card organizations, such as Visa, Mastercard, JCB, Diners Club, Discover, etc.

WeChat Pay v.s. Alipay: What’s the difference?

WeChat Pay vs. Alipay is a topic of great interest to many. Ant Group has stated that the two products are not directly comparable in terms of service, revenue model, operating performance, financial data, etc.

In fact, you will easily discover the two are positioned differently, as well as that the services are different. With 1.2 billion users already, WeChat is positioned as a social platform. The payment feature is mainly to optimize the user experience, such as sending red packets during Chinese New Year and daily life transactions and transfers. Alipay, on the other hand, bases all of its operations on the ideas of "payment" and “financial management”.

To better understand the differences between WeChat Pay and Alipay, let's take a closer look at the details.

WeChat Pay v.s. Alipay market data at a glance

| WeChat Pay | Alipay | |

|---|---|---|

| Share of China’s mobile payment market | 42%⁴ | 54%⁴ |

| Settlement currencies | 16 including HKD, USD, GBP, JPY, CAD, AUD, EUR, NZD, KRW, THB, SGD, RUB, DKK, SEK, CHF and NOK⁵ | 14 including USD, EUR, JPY, GBP, CAD, AUD, SGD, CHF, SEK, DKK, NOK, NZD, THB, HKD⁶ |

| Supported devices | Devices compatible with WeChat | All smart phones, tablets, and PCs |

Pattern of payments

Payments from WeChat Pay are made through WeChat Wallet. You need to link your bank card to WeChat Wallet first before you can make a payment. Alipay payment, on the other hand, is made through the Alipay balance or Yu’E Bao, which also requires you to link your bank card to Alipay beforehand.

In addition, the QR code used for payment differs between the two, with WeChat Pay using the WeChat QR code and Alipay Pay using the Alipay QR code.

General service fees

| Service | WeChat Pay | Alipay |

|---|---|---|

| Install the app and sign up | Free | Free |

| Top up balance | Free | Free |

| Withdraw from balance | A personal ID card is entitled to a free cash withdrawal limit of RMB1000 for life. If exceeding the limit, a service fee of 0.1% of the cash withdrawal amount will be charged, with a minimum of RMB0.1 per transaction⁷. | A basic free quota of RMB20,000 is available for multiple real-name accounts under the same ID (including transfers to bank cards and withdrawals from account balances). If the quota is exceeded, the excess amount will be charged at 0.1% of the service fee, with a minimum of RMB0.1 per transaction. For non-real-name accounts, a 0.1% service fee will be charged for withdrawals to a bank card. |

| Payment to merchant | Free | Free |

| Transfer money | Free if transferring to another WeChat account⁹ | Free if transferring to Alipay WeChat account⁸ |

| Red packet | Free | Free |

Top-up, transfer and withdrawal limits

| Service | WeChat Pay | Alipay |

|---|---|---|

| Top up balance | The maximum amount that a single savings card can top up the balance of an account is RMB 50,000 per transaction per day. But the limit of each bank card is different, please refer to the payment page prompts shall prevail⁹. | If using a savings card or credit card: RMB1,000 per transaction, no daily limit. If topping up with cash: RMB5,000 per transaction, no daily limit¹⁰.

|

| Transfer | Transfer for payment limit: RMB200,000/day Limit for transferring money to balance: RMB200,000/day, RMB 10 million /year¹¹ | RMB50,000 per transaction RMB200,000/day RMB200,000/month¹² |

| Withdraw from balance | Maximum of RMB50,000 per transaction¹³ | For 2 hours to the account, maximum of RMB50,000 per transaction, maximum of RMB150,000/day For next day settlement, maximum of RMB50,000 per transaction, no daily limit¹⁴ |

Can WeChat Pay and Alipay top each other up?

The two are unable to transfer money or top up one another directly. That is, it is not possible to move funds from your WeChat Pay Wallet to your Alipay account balance or vice versa.

However, if you link WeChat Pay and Alipay with the same bank account, you can withdraw from one and top up to the other.

How to sign up for WeChat Pay and Alipay?

On your Apple or Android device, download the WeChat app or Alipay app, and follow the onscreen prompts to set up.

Sign up WeChat Pay step guide

- Open WeChat, click “Me” > “Services”.

- Click “Add a Bank Card".

- Set a 6-digit password.

- Follow the onscreen prompts to fill in the card number, ID card information and other related information and verify the reserved mobile phone number¹⁵.

Sign up Alipay step guide

- Open Alipay, click “Sign up” .

- Enter your mobile phone number.

- Agree “Service Agreement and Privacy Protection”.

- Enter the code received by your phone to verify.

- Click “Pay/Collect”, and “Add” a bank card or another payment method.

- Enter bank card No. to add.

- Verify the mobile phone number registered with the bank¹⁶.

How to top up WeChat Pay or Alipay with a foreign bank card?

It is good to know that both WeChat Pay¹⁷ and Alipay¹⁸ now support foreign bank accounts, including VISA, JCB and MasterCard. You can choose to add a foreign bank account, and top up WeChat Pay Wallet and Alipay account balance directly. However, if you don’t have an accepted foreign bank card, you may need to open a Chinese bank account, which, inevitably, involves more effort for an expat.

How to use WeChat Pay or Alipay to make international transfers?

Sending money out of China via WeChat Pay or Alipay is possible, but only if it is made between WeChat Pay accounts or Alipay accounts.

Nevertheless, you can still use WeChat Pay or Alipay to send money to China from abroad or to receive money from abroad.

Make international money transfer via WeChat Pay

- Log in to WeChat app, search for and open Global Transfer (微汇款) official account, and follow it.

- Click “我要汇款 (Send money)” or “我要收款(Collect money)”.

- If sending money to China from abroad, enter the remitting country, and choose a third-party international remittance service to make the transaction.

- If collecting money from abroad, you need to create a “collect payment card” by verifying your mobile number, and share the card with the remitter.

Make international money transfer via Alipay

- Login to your Alipay app.

- Search for "remit", and find “跨境汇款 (cross-border remittance)”.

- Click"**闪速收款 **(Alipay Quick Collect)", and choose"我是汇款人 (I am the payer)" or (I am the payee).

- If sending money to China from abroad, select the remitting country, currency, and enter the remittance amount.

- If collecting money from abroad, choose “Alipay balance account” or “bank card”, or both, to be the collection method.

Please note:

- Even with the WeChat Pay or Alipay English version, the instructions for the international transfer feature are all in Chinese.

- Only Chinese users -- including those from Hong Kong, Macau, and Taiwan – who have successfully completed real-name authentication are eligible for the WeChat Pay and Alipay international transfer feature¹⁹.

- WeChat Overseas Remittance is only available to users who have linked a bank card in Mainland China to their WeChat Pay account.

WeChat Pay or Alipay? Which one is better for expats?

For expats in China, Wechat may be a better option for everyday use or if you engage in social interactions on Wechat on a daily basis. But if you look for more financial management, you may want to go with Alipay.

But, why even have to choose between WeChat Pay and Alipay if you can use both?

Here we list some payment services with mobile phone that are available on WeChat Pay and Alipay:

| Mobile payment | WeChat Pay | Alipay |

|---|---|---|

| In-store purchase | Yes | Yes |

| Online purchase | Yes | Yes |

| Takeout | Yes (via mini program) | Yes |

| Movie tickets | No | Yes |

| Taobao/TMall | No | Yes |

| Jingdong | Yes | No |

| Taxi (e.g. DiDi) | Yes | Yes |

| Mobile top up | Yes | Yes |

| Hospital registration | Yes | Yes |

| Rail/flight tickets | Yes | Yes |

| Sharing bikes | Yes | Yes |

| Metro | No | Yes |

| Utility Bills | Yes | Yes |

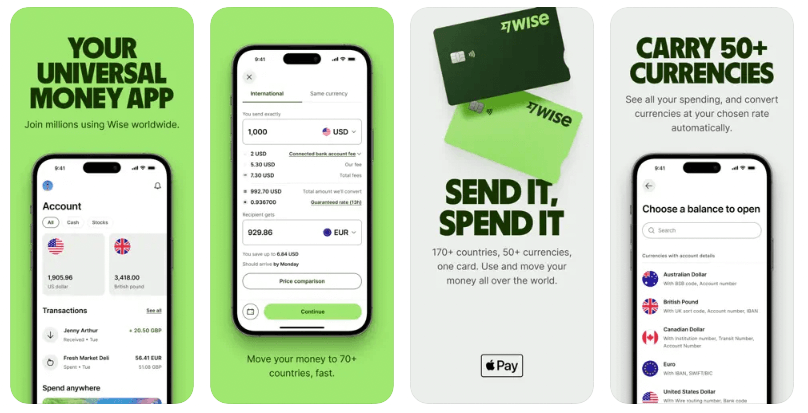

Learn about Wise international money transfer: over 160 countries, and hold +40 currencies. You can use a Wise visa card in China too!

The payment gateways of WeChat Pay and Alipay seem a must for expats in China -- a cashless society now, and if you add Wise to your ‘go-to’ financial apps you’ll be able to make international transfers, and to conveniently top up WeChat Pay and Alipay.

More than 16 million people worldwide, especially the expats, are enjoying the financial transaction services provided by Wise. If you’re starting your life in China and need to convert Chinese Yuan -- you have the versatile Wise multi-currency account -- to convert more than 40 different currencies into the Chinese Yuan. And use your Wise debit card to make purchases in China, and 150 other countries!

To top it off, you may use Wise to send Chinese RMB directly out of China to 160+ countries and expect a lower exchange rate than traditional banks, as Wise adopts the fair mid-market rate.

*This service is provided in partnership with a licensed third-party payment provider in China.

Source:

- Tencent Help Center: About WeChat Pay

- Tencent Help Center: Can I open WeChat Pay with a foreign passport / Home Return Permit / Taiwan Resident Permit?

- Ant Group: digital payment

- Enterprise Apps Today: Alipay Statistics 2023 – Market Share and Marketing Trends

- WeChat Pay: Cross-border payment

- Global Alipay: Alipay, China’s leading third-party online payment solution

- Tencent Help Center: Note on WeChat Balance Withdrawal Application for Service Fee Invoicing

- Alipay Help Center: Fees for transferring money to a bank card

- Tencent Help Center: What is the limit of WeChat balance top-up

- Alipay Help Center: Limit on the amount of money you can top up Alipay

- Tencent Help Center: What is the limit of WeChat transfer

- Alipay Help Center: Limit for transfers to bank cards

- Tencent Help Center: What is the maximum limit of WeChat balance withdrawal

- Alipay Help Center: Summary table of restrictions and limits on the number of withdrawals

- Tencent Help Center: How to sign up WeChat Pay

- Alipay: Sign up

- Tencent Help Center: Which bank cards does WeChat support

- Alipay: School_International bank card payments

- Alipay Render: Global Remittance Tutorials

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.