Are Interac e-Transfers the same as wire transfers in Canada? : A closer look

Read on to understand the differences between e-Transfers and wire transfers. You will also come across Wise as an international alternative

Ria money transfer allows you to send and receive money internationally. As one of the largest money transfer services in the world, Ria can be used to send and receive money online or through their outlets.

In this post, we will discuss their services in Canada, including transfer times and fees. We will also introduce you to Wise as an alternative option for international money transfers.

| Table of Contents |

|---|

Using Ria is simple.

Ria Money Transfer allows various payment methods. These include debit, credit cards, bank transfers, and cash. You can track transfers through the Ria Money Transfer app or using their Track a Transfer service¹.

The daily sending limit with Ria money transfer is 3000 CAD².

Ria transfers can take between 15 minutes and three business days to be completed, depending on various factors, such as

If you pay by debit or credit card, your money should arrive in 15 minutes to 6 hours.

A bank account transfer is cheaper but can take up to 4 business days³. Also, it's important to keep in mind some currencies can only be transferred during business hours and if you try to send money on the weekends or public holidays there might be a delay.

While Ria says that their fees and exchange rates are varying, the fees charged per transfer depend on the following:

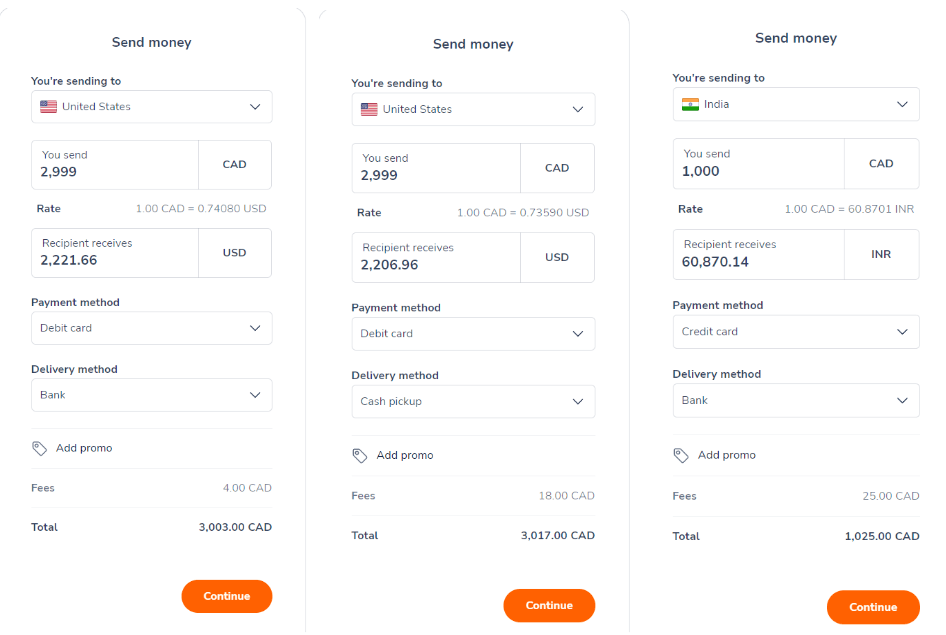

These fees are usually disclosed while making the transfer itself. For example:

We can see from the transfers initiated above that we might be charged different amounts depending on the factors listed above:

| Destination Country | You send | Delivery Method | Fees charged | You Pay |

|---|---|---|---|---|

| US | 2,999 CAD | Bank Transfer | 4 CAD | 3,003 CAD |

| US | 2,999 CAD | Cash Pickup | 18 CAD | 3,017 CAD |

| India | 1000 CAD | Bank Transfer | 25 CAD | 1,025 CAD |

It is important to note that Ria charges a markup on currency conversions³

For the same date on which these transfers were simulated: 3 July 2023, at 09:46 EDT the mid market exchange rate for CAD was recorded as 0.756744 USD, while for Ria's online exchange rate for bank transfers (the cheapest method), it can be seen to be 0.74080 USD.

This difference turns out to be a markup of 2.1% over the mid market rate.

Ria, being a globally established money transfer service, has a large network, along with other benefits. However, there are certain disadvantages to using their service:

| Pros | Cons |

|---|---|

| Fast transfers, taking less than 15 minutes - unless it’s a bank transfer | Daily limit $2999 CAD³ Monthly limit $7999 CAD³ |

| Multiple delivery options: bank, agent location or home/work delivery | Markup on currency exchange³ |

| More than 507,000 locations in 165+ countries | Online transfers possible only using the local currency³ |

Wise is a great choice when looking for an international money transfer provider. With nominal fees, a vast network of delivery options and the ability to get rate alerts in real time, the customers have a reliable, secure, and cost-effective solution for sending money abroad.

Wise offers Canadian consumers several benefits, including:

Ultimately, Wise is a cost-effective alternative to Ria Money Transfer when it comes to making international transfers. It is easy and affordable to send money abroad with Wise. So why not give it a try today? Here’s how much a 1000 CAD transfer to the US would cost you, with Wise.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

To cancel a money transfer with Ria, users must contact customer service. Cancellations are subject to a fee and must be done before the transfer has been processed.

Customers can contact Ria Money Transfer’s customer support team by

Ria and Western Union are different companies. While both companies offer offline and online money transfer services, they have different fees and possibly different exchange rates.

While Ria complies with local regulations in Canada, there are still ways in which customers can get scammed. If you would like to report a complaint, you can reach out to their fraud department on fraudprevention@riafinancial.com.

Sources:

Sources last checked on: 12 July 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read on to understand the differences between e-Transfers and wire transfers. You will also come across Wise as an international alternative

Read on to understand which alternatives such as Wise could replace Chime in Canada for your financial needs

Read on to understand whether you can make wire transfers with PayPal. You will also be introduced to Wise as an alternative

Read on to discover if you can wire money online with BMO. You could easily do so with a Wise to over 160 countries

As one of the big five banks in Canada, RBC offers wire transfers for sending money domestically and internationally. Whether you're making a large business...

Read on to understand how much you can sent from Canada to India, while understanding how Wise can make your money transfers easy and effective