ATMs in the Republic of Georgia: Credit cards and fees

Between the mountains and the scenic Black Sea, there’s plenty to see in Georgia. It’s no wonder tourists are starting to flock to the eastern European...

With mountains to the north, the Black Sea to the west, and deserts to the south, Georgia is finally starting to experience a reputation as a desired travel and living destination. It’s a crossroad of cultures and often shrouded in mystery, which makes it just that much more alluring to foreigners.

Though, for centuries now, Georgians have been world-renowned for their warm hospitality and homemade wine they offer to friends and strangers alike, technically, it’s still a young nation by modern standards. However, as of late Georgia has experienced quite a large economic transformation; it’s now a country continually high on the ease of doing business index. While it has less international banking centers, it’s still a place where you can confidently convert currency. Whether you're moving to this scenic paradise, or just visiting for a bit, this guide will give you a comprehensive overview of money and banks in Georgia.

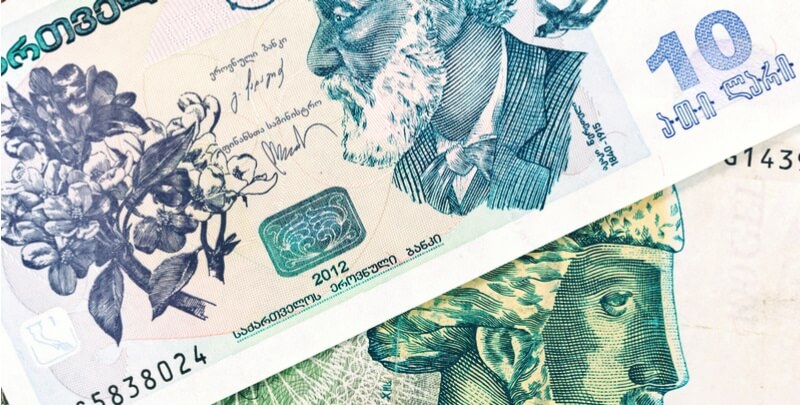

Georgia has been around for quite some time and has gone through more than one currency. However, during Soviet occupation, Georgia used the Russian ruble. But since 1993, Georgia has been using its own currency - today called the Georgian lari.

| Characteristics of the Georgian Lari (GEL) | |

|---|---|

| Names and Nicknames | Hoard |

| Symbols & abbreviations | ₾, ლ, ლარი, or GEL |

| 1 GEL | 1 Georgian lari (₾1) is divided into 100 tetri |

| GEL coins | Coins are available in denominations of 1, 2, 5, 10, 20, and 50 tetri and 1 and 2 lari |

| GEL banknotes | GEL banknotes are available for ₾1, ₾2, ₾5, ₾10, ₾20, ₾50, ₾100, and ₾200. |

While the Georgian lari is the standard currency in Georgia, some shops will accept USD and EUR, but the exchange rates are steep.

Exchanging money in Georgia is straightforward and follows many of the same rules you’d expect anywhere else in the world.

The Georgian lari was established in 1995 following the collapse of the Soviet Union and the creation of an independent republic. The most common currency conversion in Georgia is from lari to US dollars with an exchange of ₾2.46 to $1. Common currencies after the dollar are euros and rubles.

Finding an honest exchange service can be hard, though the following choices are typically your best bet for getting a good deal:

The first two options typically offer lower exchange rate markups and no upfront fees. Exchange offices can be a little sketchy, so be sure to check the rates at several before committing to one. Also, it’s not advisable to exchange your money at the airport, even though it may seem like a trustworthy place. Fees are typically high, and exchange rates are considerably higher than other options available to you.

Regardless of where you choose to exchange your money, be sure to look at more than just the fees or commission you’re charged. While the service may advertise no fees, their profit is nearly always made by marking up the exchange rate, which can be difficult to catch.

To find out what your money's worth, do a Google search for GEL and your own home currency. Compare that amount to what the bank or exchange service is offering you, and unfortunately, you'll see that they usually take more than you initially believed. An effective way to avoid losing out is by using an online currency converter before agreeing to the exchange; then you'll be in the know before you complete the transaction.

Should you exchange money in Georgia or your home country? For most people, it’s more convenient just to use your card at a Georgian ATM to get cash rather than going to a currency exchange. Be sure to choose ATMs that are attached to banks to ensure the best conversion rates. Stand-alone ATMs or those in stores and shops often have inflated exchange rates.

Georgian ATMs often charge little to no fees for visitors. However, getting GEL at your home bank or an exchange service can cost you high percentages, especially if you don't live in a large city.

Damaged banknotes aren’t usually an issue when you use an ATM, but if you go to a bank teller, exchange service, or your hotel to get cash, you'll want to be sure your dollars are in good condition.

Many merchants won’t accept severely damaged notes, and may even reject somewhat spoiled bills. Some less-reputable exchange services may also try to give you damaged bills to recoup their own losses. Be sure to inspect all bills before completing the transaction and reject any bills that you think may be rejected elsewhere. After all, you need to have money that works when you're in Georgia!

The best exchange rate comes from withdrawing GEL from a Georgian bank account - something that’s possible if you have a friend or relative who has a Georgian bank account.

Simply send your friend or relative money with Wise to ensure you get the real mid-market rate – the same exchange rate you found on Google - and a small, fair transfer fee that’s spelled out upfront. Then all you need to do is have your friend or relative withdraw the money from their account.

On the other hand, with a Wise Borderless account, you can keep and manage money in multiple global currencies, including Georgian lari. What’s even more exciting is that by winter of 2017, Borderless account holders will be able to obtain consumer debit cards to use as they travel.

While you can get them, they’re an antiquated form of currency. They're rarely accepted in shops and restaurants and cashing them often leads to exorbitant fees. Due to their lack of functionality and less-than-favorable rates, you’re better off without them.

Most major credit and debit card providers are accepted across Georgia, though Amex and Discover are significantly less common. However, some banks and credit unions won’t allow you to use your cards in Georgia. Also, many small businesses, restaurants, and street merchants only take cash due to credit card processing fees.

Whenever you’re offered a choice of currencies when using your card, either when you pay for goods and services or withdraw at an ATM, always choose the local currency rather than your pre-calculated home currency. You’ll be avoiding Dynamic Currency Conversion (DCC), which essentially allows the local bank to decide whatever exchange rate they want and keep the extra.

Thankfully, it’s easy to choose to be charged in the local currency, despite having to do a little more math on your end. Choosing to be charged in GEL rather than your home currency means you’re trusting your bank, who are committed to keeping you as their customer and give you a much fairer exchange rate.

While heightened fraud protocols are a beautiful thing, they can be a pain while traveling. To ensure you don’t wind up with your card being suspended for suspicious activity, be sure to let your bank know where and when you'll be traveling. Often it takes anywhere from a few hours to a few days to reverse card holds.

There are 16 different commercial banks in Georgia, with countless branches and ATMs for clients to withdraw cash. ATMs are abundant, but if you’re looking for one nearby, you can use the following tools:

Remember, ATMs often offer the best exchange rates when you complete your transaction in GEL, not in your home currency. Otherwise, the benefit is lost.

In Georgia, there’s one central bank and 16 commercial banks. It’s unlikely your home bank will have a branch in Georgia, though you should be able to conduct financial business without difficulty.

As you’re unlikely to see your own bank, it’s good to be familiar with these popular Georgian retail banks:

TBC stands for Tbilisi Banking Centre. It’s one of the largest banks in Georgia with over 1.5 million customers.

The Bank of Georgia is the biggest bank in Georgia with 266 locations. It also has a helpful 24-hour call center for its clients.

Liberty Bank offers a wide array of services to its clients in personal, business, and wealth management accounts. They also show conversion rates on the front page of their website.

With a well-developed branch network, responsive service team, and an impressive array of services, Basis Bank is one of the premier banks in Georgia.

Banking in Georgia is straightforward and simple, but as always, the best way to protect yourself and your money is to be smart about converting cash. Be sure to research exchange rates, look for hidden fees, and inspect your bank notes so you can enjoy your visit or your move to Georgia.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Between the mountains and the scenic Black Sea, there’s plenty to see in Georgia. It’s no wonder tourists are starting to flock to the eastern European...