Commbank large amount transfers. How do they work

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Whether you’re paying friends or family in other countries — sending money across the globe shouldn’t be a complicated process.

Macquarie Bank Limited, part of the assets and investment giant, Macquarie Group, provides everyday banking services which include international money transfers.

This, however, is done through their partnership with currency exchange provider OFX.¹ This guide will break down how to send international bank transfers with Macquarie Bank and a great hassle-free alternative called Wise. Let’s jump right in.

| 💰 Wise provides you the real exchange rate and low transparent transfer fees shown upfront. |

|---|

Learn more about

Wise money transfers

| Providers | OFX | Wise |

|---|---|---|

| Cost to transfer if sent online or using the App | AUD 15 flat when sending under AUD 15,0002 | AUD 5.143 (See pricing here) |

| Potential Correspondent/intermediary and/or recipient fees charged | Yes, when SWIFT network is used for international transfers2 | No, Wise receives your AUD locally and pays out the GBP locally to the recipient in the UK |

OFX states that a AU$15 fee applies to a single beneficiary/transfer and if multiple transfers are made, a separate fee applies for each one.

It’s worth noting that if the money transfer is routed through multiple banks for any reason, these intermediary banks may also charge a fee2.

It’s clear to see OFX is not convenient for small amount transfers. With Wise, you get cheaper fees, avoid the SWIFT network and other correspondent bank fees.

(https://wise.com/au/account/)

(https://wise.com/au/account/)

To get started, you must first set up an account with OFX. This can be done either by selecting the ‘international transfers’ section of your Macquarie online banking page, or directly on OFX’s website¹.

All you need to do is sign-up for an account with OFX. You’ll be requested to provide your details and verify your Identity.

You can send an international transfer by sending a filled telegraphic form that you can find here.

In this case, you can only send an AUD transfer abroad to an AUD denominated account. A no currency conversion transfer.

| Provider | Macquarie Bank/OFX6 | Wise |

|---|---|---|

| Exchange rate | Indicative rate of 0.5286 based on OFX’s external calculator. | 0.539743 |

| Recipient receives, not factoring in the intermediary bank fees. | Recipient receives £528.60 for 1000 AUD. | Recipient receives £537.44 for 1000 AUD⁷ |

* Indicative rate checked on 22 November 2021

So, in this case your recipient in the UK would receive £528.60 for a transfer of 1000 AUD. But if they transferred with Wise, they’d receive £537.44.

Plus, they’d only have been charged a basic transfer fee of 5.14 AUD with Wise, instead of Macquarie Bank and OFX’s fee of 15 AUD.

OFX claims their International money transfers typically complete within 1 – 2 business days once they’ve been sent¹¹.

Macquarie Bank requires you to download a Macquarie Authenticator app to send more than 5000 AUD per day.

With the app, your daily transfer limit is 100,000 AUD9. There is a $250 minimum transaction with OFX10.

You need some information to make an international transfer with Macquarie Bank first¹¹. These are:

Remember, your BSB number is a 6-digit code that represents your bank, state, and branch location.

| Read more: Receive international transfer with Macquarie Bank |

|---|

Macquarie Bank can be contacted using the details below.

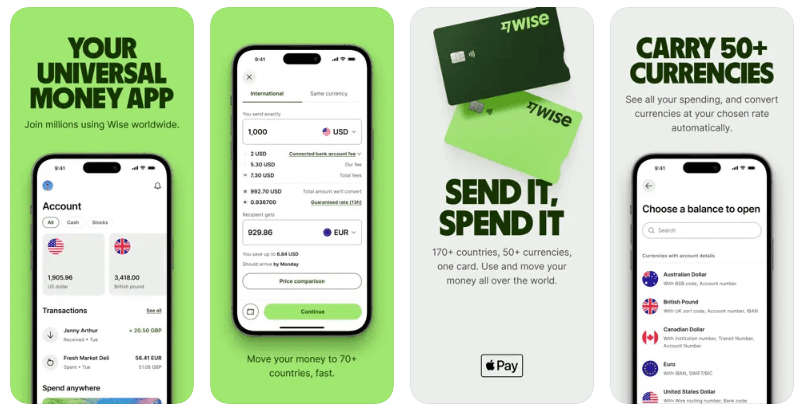

Wise is a great alternative when you’re thinking about sending money overseas. At Wise, you’ll pay low fees shown upfront and get the mid-market rate for your transfers.

Plus, you don’t need to bother with filling in forms and waiting around for third parties to send your transfer. Wise pays out from a bank in the recipient country for most of our transfers. Meaning you get your transfers quickly and know exactly how much the recipient will receive.

Open your Wise account in minutes 🚀

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with ANZ, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with Westpac, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Check out our overview of the international transfer limits you get with the top Australia banks.

Learn about Rabobank Australia international transfers. How they work, the fees, exchange rates and timeframes

These days, there's a whole range of ways to receive money. From cash exchange, bank transfers, to online remittance services, getting money from someone is a...