Commbank large amount transfers. How do they work

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Transferring money from one account to another isn’t too difficult to arrange - although you’ll want to make sure you’ve picked the right service for your needs before you get started.

The huge number of transfers made between bank accounts in Australia are overseen by the Australian Payments Network, which helps to regulate the industry and make sure your money is kept safe. The main things you’ll need to consider when choosing a transfer service are the convenience, cost and speed - all of which can vary a lot between different services.

| 🚀 Over 10 million people send money to local bank accounts overseas the fast, simple and low cost way with Wise. |

|---|

Open your free Wise account now

If you’re trying to figure out which method of transferring money will work best for you, this handy guide has you covered.

Here’s all you need to know if you’re planning on making a bank transfer within Australia, or to an account held overseas.If you want to send money to someone using a bank transfer, you’ll need to give your own bank some key details to make sure the money goes to the right place.

For all domestic transactions, you’ll need the recipient’s full name as shown on their bank account, their BSB number, and account number. Some banks might require additional information, depending on the transaction type - and for international payments you’ll usually have to provide a SWIFT code, too.

BSB stands for Bank, State, Branch. The BSB number is a 6 digit long bank locator which shows exactly where your recipient’s account is held. Usually the first 2 digits show which bank the account is held with, the third digit represents the state, and the final 3 digits is the code showing the exact branch the account is held by.

As well as the BSB number, you’ll have to give your bank the recipient’s numeric account number. This is usually 6 to 8 numbers long, but the exact format varies between banks.

To make a transfer to another Australian bank account, you’ll need to either log into your own online banking, and process the payment that way, call your bank’s telephone banking service, or visit your local branch. Each bank has a slightly different system for processing transfers, so it’s a good idea to check your options with your own bank before you get started.

Transfers can take a day or two to arrive, depending on where you’re sending them. Commonwealth Bank, for example, say they can process transfers to another account held in your own name almost instantly, but a payment to someone else, with an account which isn’t held by them can take a couple of working days.

Some banks have also started to offer customers bank transfers using the New Payments Platform (NPP), which launched early in 2018. This new system allows transfers to take place using a mobile phone number or email address as a reference, instead of a BSB and account number. It’s typically quicker than making a standard payment, but is considered to be less safe by some customers.

The costs of making transfers depend on the terms and conditions of your specific bank account. That means you’ll have to check out the small print to be sure of exactly what you’ll be charged.

Some accounts, for example, offer a certain number of transfers for free, but then start to add a fee beyond that. The costs may also vary depending on whether you’re arranging a transfer online, on the phone, or in person in a branch. Typically, online banking options are much cheaper than visiting your branch in person.

Here’s an outline of the type of fees you’ll find, from the big 4 Australian banks.

| Service | Commonwealth Bank fee | National Australia Bank fee | Australia and New Zealand Bank fee | Westpac fee |

|---|---|---|---|---|

| Domestic payment | Free via online banking for most account types | Free via online and telephone banking for most accounts | Free via online banking - subject to account limits | Free via online banking |

| International payment | $22 | $10-$35 depending on transfer type | Up to $32 depending on the transfer type and destination | $20 |

| Cancel an international payment | $25 | $20 | Not listed | $35 |

One alternative to using your bank to send money to friends and family is to use PayPal. Sending money in Australian dollars to family and friends in Australia with PayPal is free if you’re paying for the transfer with PayPal balance, or from your linked bank account. However, if any part of the payment is funded with a credit, debit or prepaid card, you’ll be charged 2.6% and a fixed fee. The charges increase if you’re paying in a foreign currency, including an additional charge of up to $4.99, and an exchange rate markup of 3.5-4%.

Western Union is another option, especially if your recipient wants to collect the money in person rather than having it delivered into their bank account. You can place your Western Union transfer online or in person at an agent location near to you, and then your recipient can get it in minutes from an agent location that’s convenient for them. However, the fees for this service are typically quite steep - a $100 transfer within Australia will cost between $5 and $10 in fees depending on how you want to fund the payment. International payments cost more, and can come with extra fees which you might not see immediately as they’re wrapped up in a poor exchange rate.

(https://wise.com/au/account/)

(https://wise.com/au/account/)

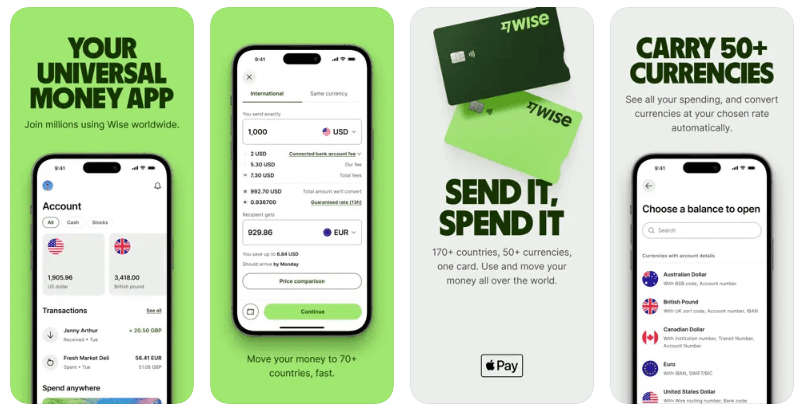

It’s worth also checking out payment specialists like Wise, when you’re researching the best way to make your transfer. Although Transferwise has traditionally mainly been used for international payments, with the recent addition of the multi-currency borderless account, you can now use Wise for domestic transfers as well. A borderless account is a flexible way to hold your money, in Australian dollars, as well as over 40 other currencies, and make and receive payments easily at home and overseas.

Open your free Wise account now

Making payments and sending money to friends and family in Australia or beyond shouldn’t be difficult to arrange. As well as using your regular bank’s online or telephone banking services, or calling into your local branch, you can choose an alternative service for simple and fast transfers. Make sure you understand the fees applied for the transfer you want to make, so there are no nasty surprises, and you don’t pay more than you have to for your transfer.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with ANZ, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with Westpac, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Check out our overview of the international transfer limits you get with the top Australia banks.

Learn about Rabobank Australia international transfers. How they work, the fees, exchange rates and timeframes

These days, there's a whole range of ways to receive money. From cash exchange, bank transfers, to online remittance services, getting money from someone is a...