Commbank large amount transfers. How do they work

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Heritage Bank is one of the oldest financial institutions in Australia, and it's customer-owned too. If you’re a customer and want to send money to friends, family or companies overseas, you’ll need to know how to make an international transfer.

In this guide, we’ll cover everything you need to know about making international transfers with Heritage Bank. This includes info on fees, exchange rates, transfer limits and more.

| 💰 Wise provides you the real exchange rate and low transparent transfer fees shown upfront. |

|---|

Learn more about

Wise money transfers

Heritage Bank charges its own fees for overseas payments, but uses Western Union Business Solutions to facilitate payments. Here are the key charges you need to know about, compared with Wise.

Heritage Bank vs Wise transfer fees for a sample of 1000 AUD to GBP

| Fees | Heritage Bank/Western Union¹ | Wise² |

|---|---|---|

| Cost to transfer AUD to a country with a different currency | 50 AUD | N/A |

| Cost to transfer foreign currency | 30 AUD | 5.14 AUD |

| Intermediary/correspondent bank fees | Additional fees may be charged by correspondent banks | None |

You can see from the table above how convenient sending money overseas with Wise instead is. You also get the mid-market rate with no markup.

There are two ways you can make an international payment with Heritage Bank. For most people, the best option is to make a telegraphic transfer (TT), which involves filling out a Western Union Telegraphic Transfers Order form.

However, you can also send money overseas using a Draft, which is a cheque that can be sent by mail. We’ll look at both of these options next.

Note that, it isn’t possible to make an international payment via online or mobile banking with Heritage Bank³.

To send a Telegraphic Transfer with Heritage Bank, simply follow these steps⁴:

Another option is to send a Draft. This is like a cheque made out in a foreign currency, which is mailed to the recipient — who will then have to deposit it at their bank.

Compared to a telegraphic transfer, a Draft can be much slower and less secure. You’ll also be limited to just 24 currencies, compared to the 130 available with a telegraphic transfer¹.

However, it can be fractionally cheaper at around 12.50 AUD¹, although the cost can vary. Drafts are also useful when you don’t know the recipient’s bank details, are sending a small amount or want to send a payment with a birthday card or letter.

To send a Draft with Heritage Bank, you’ll need to pop into your local branch and an assistant will arrange it for you⁵.

As Heritage Bank uses Western Union for international payments, this is the exchange rate to pay attention to.

The exchange rate offered by Western Union is unlikely to be the mid-market rate, which is the one you’ll find on Google. Instead, it is likely to have a margin added on top.

To give you an idea of how this can affect your transfer, let’s look at a quick example.

| Rates | Heritage Bank/ Western Union⁶ | Wise⁷ |

|---|---|---|

| Exchange rate* | Indicative rate: 1 AUD = 0.5304 GBP | rate: 1 AUD = 0.537 GBP |

| How much the recipient receives for this sample transfer, not factoring in intermediary bank fees. | 530.43 GBP | 534.54 GBP |

*Rate as provided on 1st December 2021

Regardless of the upfront fee, it is often the exchange rate that can make your transfer more expensive.

So if you want to get the most for your money, look for providers like Wise that offer the real, mid-market exchange rate.

There are no upper limits with Heritage Bank international transfers⁵, so you can send as much as you like. This is the case whether you send via telegraphic transfer or Draft.

To complete the Telegraphic Transfers Order Form, you’ll need the following details for your recipient¹:

You may also need to provide a reference, indicating what the payment is for.

If you’ll be receiving an inward telegraphic transfer from overseas into your Heritage Bank account, here’s what details you’ll need to provide⁸:

To receive other types of payments, you may need to provide your bank’s BIC/SWIFT code in addition to the details above.

Note that these payments will arrive through Western Union Business Solutions to your bank account. Keep in mind the exchange rate it will be converted at will be Western Unions’ and those are mentioned in the table above.

Remember that even if no fees are charged by your bank to receive money from overseas, extra costs are still a possibility.

If your money is sent via the SWIFT or another payment network, intermediary banks may be involved along the way. And each of these correspondent banks may apply their own charges.

It generally takes around 3–4 working days¹¹ to send a payment overseas with Heritage Bank. However, it can take as long as 10 working days¹ for certain minor or exotic currencies.

Have a question about international transfers, or need help setting one up? Here’s how to contact Heritage Bank⁹:

Heritage Bank offers a secure, reliable way to send money overseas using its partner Western Union. However, there is a cheaper, faster solution available — one that is just as secure.

(https://wise.com/au/account/)

(https://wise.com/au/account/)

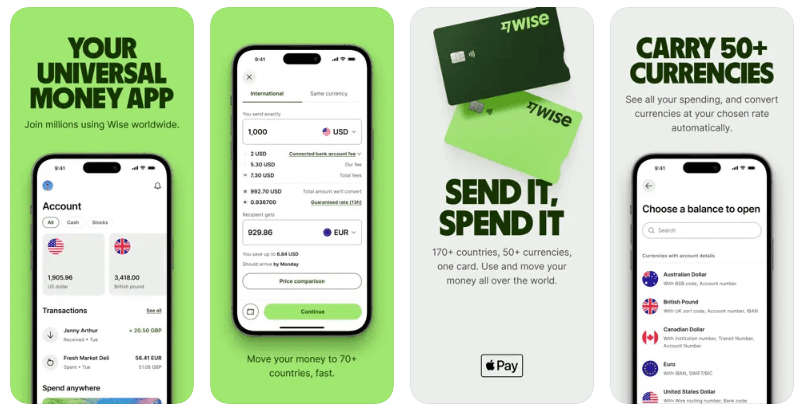

Send money internationally with Wise and you’ll only pay one upfront transfer fee. There are no correspondent fees to worry about, and you’ll always get the real exchange rate.

Plus, there’s the added bonus of being able to set up your transfer online. You don’t need to fill out forms and wait for them to be processed.

With Wise, you can set up and send a transfer in just a few clicks and know exactly how much your recipient will receive into their accounts.

Open your Wise account in minutes 🚀

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with ANZ, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with Westpac, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Check out our overview of the international transfer limits you get with the top Australia banks.

Learn about Rabobank Australia international transfers. How they work, the fees, exchange rates and timeframes

These days, there's a whole range of ways to receive money. From cash exchange, bank transfers, to online remittance services, getting money from someone is a...