Commbank large amount transfers. How do they work

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Great Southern Bank is one of the largest customer owned banks in Australia. Formerly known as Credit Union Australia or CUA, it offers many banking services including overseas telegraphic transfers.

This guide will run you through how to send or receive money abroad with Great Southern Bank, including the fees, rates and procedures. We’ll also see how Great Southern Bank measures up against Wise.

| 💰 Wise provides you the real exchange rate and low transparent transfer fees shown upfront. |

|---|

Learn more about

Wise money transfers

There’re a couple of different fees for sending money overseas with Great Southern Bank. Here’s a comparison of how it might look if you were sending 1000 AUD to someone in the United Kingdom.

Keep in mind that fees change so it's a good idea to double check what you’re being charged before you finalise the transaction.

| Fees | Great Southern Bank³ | Wise |

|---|---|---|

| Cost to transfer foreign currency overseas if staff assisted at branch | $20.00 AUD | N/A |

| Cost to transfer foreign currency if sent online or using the App | $0 — Intermediary bank fees may apply. | $5.14 AUD (see pricing here) |

| Cost to transfer AUD to an overseas account | $50.00 AUD | N/A |

While online money transfers with this bank may look fee-less, you have to take into consideration the exchange rate you will be provided and any other fee other institutions may charge to process your transfer.³

Quoting Great Southern Bank’s fee schedule:³

Additional fees may be deducted by other financial institutions involved in the transfer. GSB does not have control over these fees.

In their fee schedule, Great Southern Bank states that you might be charged additional fees by other institutions who are involved in the transaction³. This could include the recipient's bank and Western Union Business Solutions, who are Great Southern Bank’s partner for foreign exchange transations¹.

There are two main ways to complete an overseas telegraphic transfer (TT) with Great Southern Bank. You can go through your Online Banking Portal or visit a branch in person.

If you’re comfortable using internet banking services you’ll likely find that the Great Southern Bank online money transfer process is the most convenient option.

If you want to do a Great Southern Bank overseas money transfer in person, you can do it at your local branch.

Western Union Business Solutions provide the exchange rates used for customers of Great Southern Bank.

| Rates | Western Union Business Solutions (Indicative Rate)⁵ | Wise |

|---|---|---|

| Exchange rate offered on the date you wrote the article. Source, superscript and screenshot please. | 1 AUD = 0.53565 GBP | 1 AUD = 0.53587 GBP |

| How much the recipient receives for this sample transfer | 535.65 GBP when sent online, not factoring other bank fees. | 532.98 GBP — No additional intermediary bank fees to bear |

* Rate as provided on the 26th of November, 2021

The rates Western Union Business Solutions shows online are only indicative so you won’t know your actual rate until you’ve set up a transaction with Great Southern Bank⁵. This is because Western Union Business Solutions adjust the rate for different companies based on transaction sizes and processing costs.

With Wise, you always get the mid-market rate.

When you make an international transfer with Great Southern Bank you’ll need to provide a few pieces of information about the recipient.

Great Southern Bank also offers an Inward Transfer service using Western Union Business Solutions. To complete the process you’ll need to carefully follow these steps⁴:

Generally your funds will arrive in the recipients account within 5 business days.¹ If you use the Inward Transfers process to receive money, you’ll usually receive it within 2 business days.⁴

If you need to contact Great Southern Bank for additional support you can:

After reading this guide you might be thinking that some of the processes at Great Southern Bank, including its reliance on Western Union Business Solutions, seem overly complicated.

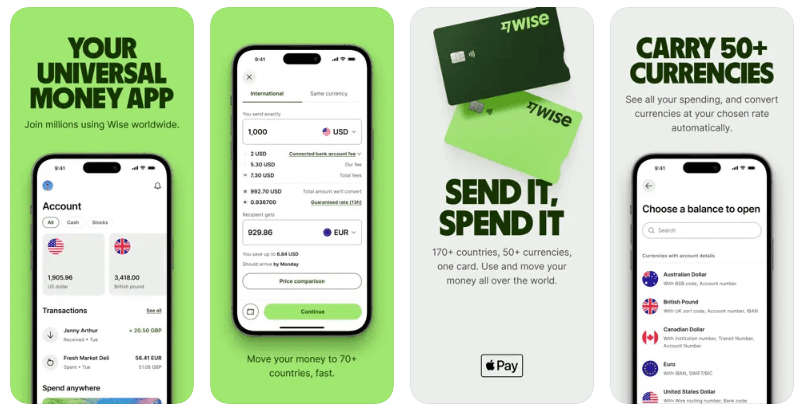

In comparison, Wise strives to make the process of sending money overseas simpler, faster and more transparent.

(https://wise.com/au/account/)

(https://wise.com/au/account/)

With Wise you can exchange AUD for over 50 different currencies which can be sent to accounts around the world . There’s no lengthy forms and you’ll know the fees and the exchange rates upfront, before you make the transaction.

For the majority of Wise’s supported transfers, payout is made from an account in your recipient bank’s country — helping to avoid intermediary bank fees and speeding up your transfers.

So why not try out the pricing calculator today to see how Wise can make international money transfers easier for you.

Open your Wise account in minutes 🚀

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with ANZ, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with Westpac, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Check out our overview of the international transfer limits you get with the top Australia banks.

Learn about Rabobank Australia international transfers. How they work, the fees, exchange rates and timeframes

These days, there's a whole range of ways to receive money. From cash exchange, bank transfers, to online remittance services, getting money from someone is a...