Complete Guide to ING International ATM Fees: Withdrawal Fee, Exchange Rates and Rebates

Planning to use your UBank card to make ATM withdrawals internationally? Read on to understand the true cost of overseas transactions with UBank.

For people who travel regularly, work or study abroad, it can pay to have a specific payment card to use when overseas, which comes with favourable terms and conditions - and can help you save on transaction fees. Many people choose to get a prepaid travel card before they head off, which can be loaded in advance with currency, and used for international payments or ATM withdrawals. This is popular especially with customers under the age of 35, and can prove a safe and convenient option.

At the moment, Citibank Australia does not offer a prepaid travel card for foreign currency transactions. Instead, you can apply for a Citibank Plus account, which offers fee free international purchases and a range of perks which suit those who travel a lot. There are some advantages, and disadvantages to choosing a Citibank Plus account for your foreign travel, instead of using a prepaid foreign currency card. This handy guide will help you understand your options, so you can choose the right approach for your needs.

We will cover:

| 🚀 Over 10 million people send money to local bank accounts overseas the fast, simple and low cost way with Wise. |

|---|

Open your free Wise account now

Although Citibank Australia does not offer customers a specific prepaid travel card, they do recommend the Citibank Plus account for customers looking to minimise overseas transaction fees.

With a Citibank Plus account you’ll get the following benefits:

If you’re considering getting a Citibank Plus account to use when you travel, you’ll want to know about the overall costs of using the account, including the exchange rate applied to international purchases and withdrawals.

Even though the Citibank Plus account offers international purchases and ATM withdrawals with no fee, the exchange rate used will make a big difference to the true cost of your overseas spending. Exchange rates move up and down all the time, in line with changes in the global currency markets, so it’s a smart idea to keep an eye on the rate offered so you know what you’re really paying for things while you travel. You’ll be able to see the exchange rate applied, on the Citibank Australia website, or by calling into your local branch.

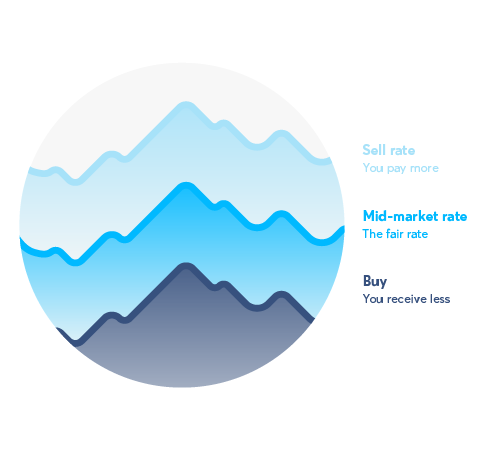

Once you’ve found the exchange rate being offered by Citibank, try comparing it to the mid-market exchange rate. The mid-market rate is the one you’ll find on google, or by using an online currency converter. It’s a useful benchmark, because it is the rate that banks use when buying and selling currency among themselves. However, it’s not always the rate they pass on to their customers.

Many banks and currency exchange providers add a markup or margin to the mid-market exchange rate, which they then keep for themselves as profit. This can mean that you pay more than you expect for your purchases while overseas.

One provider which always offers the mid-market exchange rate is currency exchange specialist Wise. With Wise you can send money anywhere in the world using the mid-market rate, and with just a small transparent fee to pay. You can also get yourself a multi-currency account, which makes managing your money while you travel even easier.

With the Wise multi-currency account you can hold your money in any of 40+ different currencies, bank like a local using your own bank details for Australia, New Zealand, the UK, US and Euro area, and get a linked MasterCard debit card for easy overseas spending. This smart new account is a perfect solution for people living an international lifestyle. Like a prepaid travel card, you can top up your account in advance from your Australian bank, and convert your money to the currency you need when abroad, using the real mid-market exchange rate. It’s free to spend any currency you hold in your account using your debit card, and you can withdraw up to the equivalent of $250 a month from ATMs fee free, too.

And because Wise is AUSTRAC registered, and regulated by the Australian Securities and Investments Commission, you’ll know your money is safe in your borderless account, whether it’s in dollars, yen, pesos or any other world currency.

Before you choose the right account and card for your travels, you’ll need to look at the small print - and especially the fees and charges. Here are the main fees you need to know about, when you’re considering the Citibank Plus account:

| Service | Citibank Fee |

|---|---|

| Account opening, and maintenance fee | Free of charge |

| International ATM withdrawals and card payments | Citi will not charge a fee. However, you may be liable for third party charges, which will not be refunded - more on these below |

| Making an international payment | $25 |

| Receiving an international payment | No Citibank charge |

| Foreign currency drafts | $15 to request a foreign currency draft$30 to cancel a foreign currency draft request |

| Dishonour fee - insufficient funds to cover a payment | $9 |

| Account closure | If you hold a balance under $5 it will not be returned - higher balances will be returned following account closure |

| Other fees | There are other fees for special services including:$15 for a statement copy$10 to stop a cheque$15 for an emergency cheque |

When using the Citibank Plus account, it’s helpful to know that although Citi do not add charges for international transactions, there could still be a fee to pay depending on the specific purchase or withdrawal you’re making.

Citibank’s terms and conditions say the following:

Citibank Australia does not charge Citibank Plus everyday account holders a fee when they withdraw funds from an international ATM or use their Citibank Debit Card to make in-store purchases overseas. Customers may be charged by the third party provider, which Citibank Australia does not control.

You may be charged an additional fee by an ATM operator, for example, or you could end up paying more than you expect due to dynamic currency conversion - DCC.

DCC is where you’re asked if you would rather pay in your home currency for an international purchase instead of the local currency wherever you are. Although this sounds like a simple way to keep track of your money, it can actually mean you pay more, because the exchange rate and fees are applied by the merchant, not Citibank. This usually means that paying in dollars costs much more than paying in the local currency, and because these extra charges are not levied by Citi, you’re still responsible for paying them, even with the favourable terms applied by your Citibank Plus account.

To avoid these charges, always choose to pay in the local currency - and whatever card you choose to use when travelling, watch the ATM display carefully to make sure you’re aware of any additional fee, which usually shows up on screen before you confirm the withdrawal.

Prepaid travel cards are growing in popularity, because they’re usually as convenient as using a debit card abroad, but considered by some people to be safer.That’s because a prepaid travel card is not linked back to your main bank account, so even if a thief were to get hold of your prepaid card and secure PIN, they can never access the bulk of your funds which are safe in your main bank account.

However, prepaid travel cards typically come with some fees and charges which may mean they’re not the most economical way to pay for your travels. If you’re considering getting one, do check out the fees charged for common services such as ATM withdrawals, which can mount up quickly - especially over a long trip abroad.

Whether or not a Citibank Plus account is right for you depends on your personal preferences and the type of transactions you’ll need it for. Doing some research into all the options is the best way to get a good deal.

Open your free Wise account now

Don’t forget to look at modern alternatives like the multi-currency account from Wise too. The Wise multi-currency account can be operated in many different currencies,and like the Citibank Plus account offer fee free international purchases. Because you can top up your multi-currency account with only the funds you want to spend while you travel, they also offer the same security and convenience as a travel card, making them a great choice for many travellers looking to balance cost and simplicity.

If you’ve decided that the Citibank Plus Account is right for you, here’s what you need to do to apply.

Citibank Plus accounts are offered to Australian residents, aged over 18. You’ll need a valid email address, mobile number and form of ID. Accounts can only be opened on a personal basis - so you can’t use one for your business, or get a joint account.

It’s easy to apply online for your Citibank Plus account. You’ll just need to provide the following:

If you don’t have the right ID documents to apply online, you can have your identity checked by visiting an Australia Post branch instead. Check out the full range of documents accepted, online. Similarly, if you don’t have a valid TFN or exemption you can still get an account, but Citibank will be required to charge you tax at the highest tax rate.

Once you’ve submitted your application, you should receive a welcome pack which includes your card and all the details you need to get up and running, in 5-7 days. You’ll also be able to track the progress of your application online, to see how it’s doing.

With your account set up, you can use your card to make contactless payments, manage your money using online banking, and send and receive payments wherever you need to.

If you need to talk to a member of the team about your account options, you have a few different options:

When it comes to planning your travel money, you have plenty of options to think about. You could open a dedicated bank account such as the Citibank Plus account, which will offer some perks while you’re overseas. Or you might decide a separate prepaid travel card is the better choice for you. For many travellers, though, the Wise multi-currency account offers the perfect balance of the convenience of a traditional account, and the security of a prepaid card - as well as market beating exchange rates and low, transparent fees, which can save you money.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Planning to use your UBank card to make ATM withdrawals internationally? Read on to understand the true cost of overseas transactions with UBank.

Wondering if Travel Money Oz is the right solution for you? Our guide outlines everything you need to know about their currency exchange and travel money cards.

If you're trying to decide between Travelex and Travel Money Oz for your international money needs, read on for our side-by-side comparison of the features.

Side-by-side Comparison of Westpac Travel Card vs Wise Travel to help Australian users decided which is a better travel card for spending abroad.

Looking for a card for international transactions while traveling overseas? Read on for our guide to the options available with Macquarie Bank.

Looking for a card for international transactions while traveling overseas? Read on for our guide to the options available with ME Bank.