Buying property in Australia as non-resident. What you need to know

Whether you’re considering moving to Australia and hope to buy a home or are interested in investing in the Australian property market while remaining...

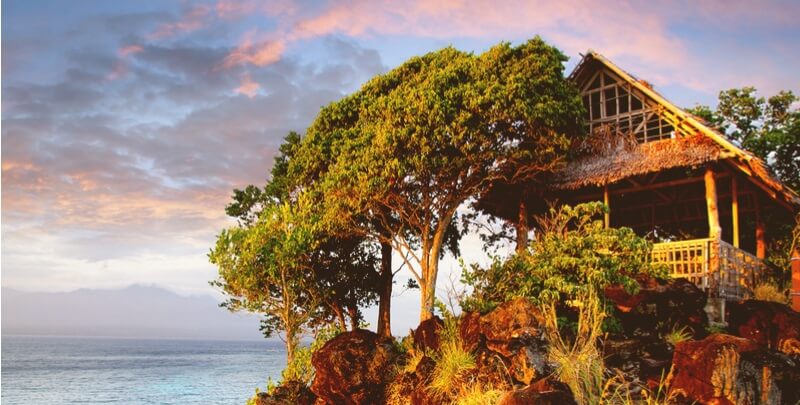

Equally as well known for its delicious cuisine and bustling cities – as its stunning islands and white sand beaches – the Philippines is a popular destination for Australia tourists and expats alike.

Also offering a reasonable cost of living in comparison with Australia, it is easy to see why so many Aussies choose to relocate there. If you’re thinking of making the move to the Philippines, whether it be to retire, start a business or simply for a change, then you may also want to know what your options are for buying property there.

Read to discover whether this is allowed as an Australian and the processes involved. You may find yourself settled into life on this vibrant island nation sooner than you think.

| 💰 Wise provides you the mid-market exchange rate and transparent transfer fees shown upfront. |

|---|

Learn more about

Wise money transfers

| Note: This article is purely for general information purposes and is not to be taken as financial advice. We recommend that you obtain independent financial advice before making any form of decision. |

|---|

Yes, however, there are some restrictions on this as Philippine real estate law does not permit foreign nationals to own property outright. What this means is that while you can purchase a flat or condominium as an Australian, you will not be able to buy or own land.¹

Further to this, you may only buy a flat or condo in a building if the current foreign ownership sits under 40% overall. This means you may be limited on where you can buy and will need to do your research carefully before buying – but we’ll talk more about this as we go on.

Some countries have what is referred to as Reciprocity or a Reciprocity Agreement for buying property. Intended to make these exchanges mutually beneficial, these agreements typically outline any protections and conditions for citizens of both nations when choosing to buy property in the opposing country.

In the case of Australia and the Philippines, no formal reciprocity agreement exists in terms of property. The Philippines currently levies stronger restrictions on foreign ownership than Australia for non-resident buyers..

The Philippines experienced a record property boom between 2010 and 2018. However, several factors such as slowing domestic economy and eventually the COVID-19 pandemic saw the market sharply decline in the years following this.²

While is is slowly recovering and is now considered stable with encouraging growth projected, careful consideration is recommended before investing.²

Whether you choose to live in a busy city metropolis or popular beachside regions of Cebu and Boracay, pricing per square metre can vary significantly.

As foreigners are restricted to buying condos, which are largely equivalent to an apartment in Australia in terms of dwelling type, we have focused on pricing for these.

| City/Region | Average Price per square metre |

|---|---|

| Manila³ | PHP₱155,000 per sqm |

| Cebu³ | PHP₱160,000 per sqm |

| Boracay³ | PHP₱100,000 per sqm |

| Davao⁴ | PHP₱133,000 per sqm |

| El Nido⁴ | PHP₱158,000 per sqm |

As seen on 19 July 2024

It is important to remember that these averages are by no means a firm indicator of what you can expect to pay. Just like anywhere in the world, exactly what you’ll pay per square metre will not only be down to location, but what amenities the property offers and how popular the region is.

Just like Australia, property brokers and real estate agents must be licensed to sell property in the Philippines. Handled by the Professional Regulation Commission (PRC) agents must also sit an exam demonstrating their expertise to secure this license.⁵

It is recommended to find a trusted agent through your local network or by researching online. To check their credentials, you can visit the PRC website and search them by name as needed.

Typically the preferred way to browse sale listings and prices throughout the Philippines dedicated real estate websites make it easier to find your ideal property.

Popular sites for searching out property listings throughout Germany include:

As if often the case throughout Asia, properties for sale may also be advertised through social media such as via Facebook marketplace. If you find a listing in this way, just be sure that you are dealing with a proper agent or property broker to avoid any risk of being scammed.

With both densely populated cities with residents in the millions to quiet coastal villages and everything in between, the Philippines offers a diverse range of properties and lifestyles depending on where you buy.

We recommend considering the following to determine which property will be best suited to your needs:

You’ll find both local and global banks in the Philippines offering a wide variety of mortgage products. Yet while it can be possible to get a mortgage as an Australian, not all of these banks or lenders will be willing to lend. For those that do, strict criteria and lending limits may also apply.⁶

While you can approach these banks directly to check their current offerings for housing loans as a non-resident, working with a licensed mortgage broker is often the simpler solution.

Completely across which banks and lenders offer financing to Australian expats for purchasing a home, they’re also best placed to advise on which loans are most competitive and how to apply.

There are several documents you’ll need to arrange when buying a property in the Philippines. While some of these are required for all purchasers, as an Australian living in the Philippines, you’ll specifically need to make sure you have⁷:

As noted previously, Australians, alongside other foreigners are legally restricted from buying certain types of properties or land in the Philippines.⁸

Aside from this and so long as you can provide the necessary documentation outlined above, the process can begin.

Just as you would expect in Australia, there are some taxes and fees you will need to cover as part of your property purchase in the Philippines. These include⁸:

Of course, if you have opted to engage a broker to assist you in your property search, you’ll need to factor in their fees too.

Purchasing property in the Philippines follows a similar process to that of buying a home in Australia. Outlined below is the basic steps involved for buying a condo as an Australian citizen.³

As an Australian buying property in the Philippines you may be targeted by fraudsters seeking to take advantage of your foreign status . To avoid falling victim to any property scams we recommend that you:

Buying a property in the Philippines is not a guarantee or pathway to achieving residency or citizenship. To live and work there long-term, you will still be required to go through the normal government immigration processes to secure an appropriate visa or residency status.

Send money with Wise and you get the mid-market exchange rate, which means no surprise mark-up on your currency conversions. Fees are clear, shown upfront and secure.

Wise is a specialist in sending large amounts overseas, securely. The added bonus is that with a sliding fee scale, the more you send, the more you save. The exchange rate is always based on the mid-market rate.

Safety is super important at Wise, and in Australia, it is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services Licence (AFSL number 513764).

It’s super easy to arrange a payment with Wise. Once your account is approved, you can set one up in minutes, without the need to visit a physical branch in person.

Join over 16 million customers currently enjoying Wise. It’ll only take a few minutes to register and see what’s inside.

Register your Wise account

in minutes

Please see Terms of Use and product availability for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

This article is purely for general information purposes and is not to be taken as financial advice. We recommend that you obtain independent financial advice before making any form of decision.

Sources:

Sources checked on: 19 July 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Whether you’re considering moving to Australia and hope to buy a home or are interested in investing in the Australian property market while remaining...

Australia and Italy have shared a close connection for many years, with over 100 million Australians showing Italian descent in the 2021 census.¹ It’s...

Check out our guide on buying property in New Zealand as a foreigner. Learn about the property market, the process, average prices, fees, local tips and more

Whether you’re moving to Pakistan or already there, you might well be tempted to look into buying property in the country. If you do so, you’ll find that...

Malaysia is home to some beautiful places to live, in vibrant Kuala Lumpur and further afield as well. It could be the perfect place to set up your new home....

Buying a property in Singapore is a major financial commitment. On top of the loan payments, you’ll need to set aside some money for paying the annual...