How to help the people of Ukraine from Australia

In Australia and want to support the people affected by the war in Ukraine? Here are some charities and organisations that you can donate to.

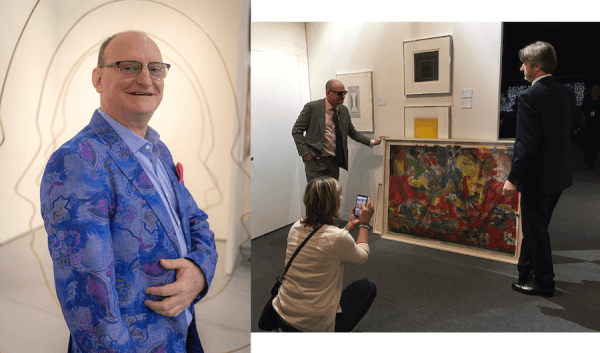

Living abroad comes with its own challenges but in that, its rewards and opportunities — whether they are professional, personal, or financial. We spoke to three British customers who are successfully building lives abroad and simplifying their international finances by using Wise.

I left London about 10 years ago. Moving from Europe to Asia was a big leap for me. It was quite scary because I had just formed some networks of collectors and people who had supported my work in London.

When you're working in a foreign country, one of the first things you realize is that you need a team around you. From a local sourcing person, a project manager to contractors and suppliers. To get that team of professionals, you have to pay people. It was quite a challenge to use my bank and open accounts in various countries. That’s when I looked into Wise.

Thanks to Wise, I’m able to get payments over to my suppliers in a timely manner, and there’s no need to stress about being from a different country, bad exchange rates or hidden fees.

I remember when I did my first project in the US. I made the artwork, but then I needed installers to help set it up. They were all local people and needed to get paid. I ended up using a bank account from Singapore and was charged a lot.

It’s so important for businesses because I set my own prices and rates and I need to know how much of that will get lost in bank fees. I calculated all the fees from this project, and over a year, I was spending more than $1000 in fees. It can be frustrating because it's hard-earned money that just gets lost.

Now, I’m spending a lot less with Wise and it’s more transparent. I know exactly what’s in my account and what’s not. This is something that’s definitely worked, especially for a small business like mine, but maybe for everyone else too.

I left the military in 2013 after 17 years. I went to Thailand for 6 months to go diving and was offered a job teaching people how to dive. I spent 4 years working in Thailand then moved to Papua New Guinea to head dive operations at a resort. My next step was to throw all of my energy into growing a business and start my own dive agency.

I spent a couple of years looking for the right payment structure for my company. I've used bank transfers, PayPal, Square, Stripe, Alipay. Then I looked into Wise and since then, everything's moved forward exponentially. There are so many currencies and it’s the easiest platform to use. About 99% of my regular customers are on Wise now and pay me through there. Most of them have taken advantage of the Wise debit card too so they’re not paying a fortune on trips.

I use the Wise card for my business as I travel all the time. I also like that we can set up accounts in different currencies and receive almost instantaneous deposits from all over the world. Within the app, I can convert the money to Australian dollars and it’s done at a minimal fee. Now when it comes to purchasing equipment, I know exactly how much I've got to spend. I use my Wise account because I know my money will be safe and I avoid costly bank fees.

I moved to San Francisco from London when I was younger. It was so different. Everyone had a go-getter attitude, which really inspired me to take my work to the next level. The US gave me an ambitiousness that has driven my career.

However, it was when I went to work in Japan that I started to learn how to develop a business and manage money. The people there were so meticulous — it forced me to focus and learn how to run the company financially.

Using my bank to pay freelancers was very expensive and a rip-off. That’s why I turned to Wise. I actually got a call recently from my bank trying to sell me on their foreign exchange, but I told them I use Wise. They said, “well you can’t beat them on price”. Wise is the only provider where I know I’m getting a fair price, and it’s been so easy to use. I’m an artist, I don’t want to spend a lot of time making payments.

Having a diverse professional background has allowed me to create a diverse network. It enables me to tap into different cultures and also gives me a 24-hour workforce. I work with freelancers from around the world — from Japan to the United States and Europe. We’ve worked with 70 artists in 16 countries and had projects in 26 countries. Having a global payment system we can rely on has been so vital.

| Wise is proud to help people manage their finances all over the world - for less money and with less stress. We're here to make living a borderless life easy. Join our 11 million customers at Wise.com, or through our Android or iOS app. |

|---|

As told by Natalia Romero. Edited by Sandy Choephel. Photography kindly provided by Nicola, Matt and Ben - and edited by Stephanie Stoddard Cortés.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

In Australia and want to support the people affected by the war in Ukraine? Here are some charities and organisations that you can donate to.

After working in Japan and the United States, Creative Director Ben Sheppee returned to London to open a studio and develop his business. His innovative work...

Seven years into her career as an engineer, Gina Stuessy decided she wanted to have more of an impact on the world. So she took the plunge, quit her job, and...

After spending almost a decade working in fashion and the movie industry in Los Angeles, Dominique V. Richardson sought a change. He packed up his bags and...

For Polish orchestral conductor Marta Gardolinska, sitting on a plane is just part of the job. At least, it was until COVID-19 cancelled concerts around the...

Building an art collection is an art in itself, one that Chelsea Art Group founder Don Christiansen has forged into a globe-spanning career. He explains how...