Commbank large amount transfers. How do they work

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Customers of Bank Australia can send international transfers online on the web or app. The transfers are handled by Western Union Business Solutions. This article walks you through everything you need to know about sending money overseas using Bank Australia. Let's jump right in.

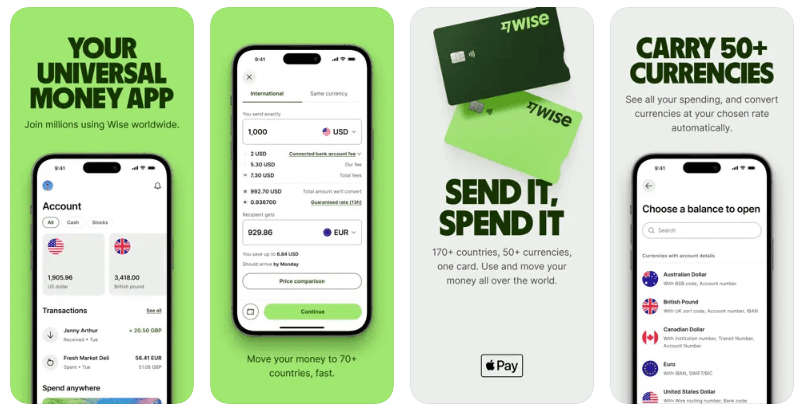

| 💰 Wise provides you the real exchange rate and low transparent transfer fees shown upfront. |

|---|

Learn more about

Wise money transfers

Bank Australia partners with Western Union business solutions for its international transfer service. Here is the breakdown of the transfer fees Bank Australia charges if you send AUD to a friend in the UK in GBP.

Below are the fees incurred if you sent AUD 1000 to a friend in the UK. This considers the transfer was funded using a bank transfer or your Bank Australia account debit as your payment method.

| Fees | Bank Australia² | Wise |

|---|---|---|

| Cost to transfer of staff assisted at branch or contact centre | AUD 30 Flat fee | N/A |

| Cost to transfer if sent online or using the App | AUD 10 Flat fee | AUD 5.14 pricing here |

Western Union makes the currency conversion and sends the international transfer on behalf of Bank Australia. The exchange rate you get will be Western Union’s.

Here’s what Western Union say in the Send Money Online page footnotes³, relating to international transfers:

Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Fees, foreign exchange rates and taxes may vary by brand, channel, and location based on a number of factors. Fees and rates subject to change without notice.

It’s clear to see Western Union uses a marked up rate that makes them money. You should factor the exchange rate in your decision to use a money transfer provider as the rate difference does add up.

A sample calculation done on Western Union’s website on 16 November 2021 showed you’ll get 0.5384 GBP for each 1 AUD you send.³

Let’s compare that to the real exchange rate Wise uses for international transfers.

| Rates* | Bank Australia/Western Union | Wise: |

|---|---|---|

| Exchange rate offered on the date you wrote the article. Source, superscript and screenshot please. | AUD 1 = 0.5384 GBP | AUD 1 = 0.54516 GBP |

| How much the recipient receives for this sample transfer | 538.42 GBP | 545.16 GBP — Your recipient gets 6.74 GBP more and you also pay less in bank fees to send this transfer. |

*Checked on 16th of November 2021

Simply based on the exchange rate in this sample transfer, your recipient will get 6.74 GBP more for this transfer sent with Wise.

Remember, you also pay almost half the price of Bank Australia’s transfer fees to send this payment with Wise.

Let’s get to grips with how to make an international transfer using Bank Australia.

Bank Australia states you must send the payment to a foreign currency¹. So, for example, you cannot send AUD to an account in the UK denominated in AUD.

You can only send an international transfer that involves a conversion of currency.

Bank Australia offers customers multiple ways to send international transfers that are all easy to do. Here they are:

You can send an international transfer by logging into your account online and selecting ‘international transfers’.

Then, all you need to do is:

You can send your transfer at a Bank Australia branch. All you have to do is:

You can initiate your international transfer on the phone as well. You’ll need contact Bank Australia phone support.

Delivery times for international transfer depend on the Western Union transfer time for your recipient’s bank account country and may vary. It could take up to 5 working days for the money to reach your recipient’s account⁴.

Here are the fees charged by Bank Australia for additional services related to your international transfer.²

If you’d like to cancel an international transfer or stop its debiting, then you’ll need to pay a A$25 fee.

Should your transfer not reach the recipient in time, you can request for it to be traced by the bank. The cost is A$25.

There is a daily transfer limit of AU $2000 with Bank Australia. However, you can reach out to them directly if you wish to send more than AU $2000 worth of currency in an international transfer per day.¹

To make an international transfer with Bank Australia, you’ll need the following information¹:

The details you’ll need depends on the country you’re sending a payment to. For example, not all countries use the IBAN system.

All you need to do is follow these steps:⁵

Bank Australia offers a few different ways to get in touch if you need help⁷.

Bank Australia makes sending money overseas easy. But given that it uses Western Union, you should take into account the marked up exchange rate.

Wise is a smart, modern, and trusted alternative to send money overseas. Its low fees and real exchange rate mean your money goes further when making international transfers.

(https://wise.com/au/account/)

(https://wise.com/au/account/)

Open your Wise account in minutes 🚀

Sources:

Sources checked on 17 November 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you wish to send very high amounts with Commbank, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with ANZ, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

If you wish to send very high amounts with Westpac, you may need additional assistance of transfer approvals. Let’s see how large transfers work with this bank

Check out our overview of the international transfer limits you get with the top Australia banks.

Learn about Rabobank Australia international transfers. How they work, the fees, exchange rates and timeframes

These days, there's a whole range of ways to receive money. From cash exchange, bank transfers, to online remittance services, getting money from someone is a...