How to send money from PayPal to Wise

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

Wondering if Wells Fargo® has a money market account? You’re in the right place.

We’ll look at whether or not you can open a Wells Fargo money market account, and some alternatives you might want to consider. Plus, we’ll highlight Wise as a great option for holding, sending, spending and exchanging currencies with low fees and the mid-market rate.

At the time of writing, Wells Fargo does not offer a money market account to new customers.

However, as product offerings do change from time to time, you may still want to double-check the Wells Fargo desktop site to see if there has been any change.

Plus, Wells Fargo does have alternative savings products and certificates of deposit¹ which might interest you. We’ll cover alternatives to the Wells Fargo money market account, later.

There’s no available Wells Fargo money market account minimum balance at the time of writing, as the product isn’t being offered to new customers. However, it helps to know that Wells Fargo’s financial education pages note that money market accounts often have higher minimum deposit requirements compared to savings accounts².

Other Wells Fargo products have their own minimum deposit requirements - a CD for example has a minimum of 2,500 USD as a minimum opening balance.

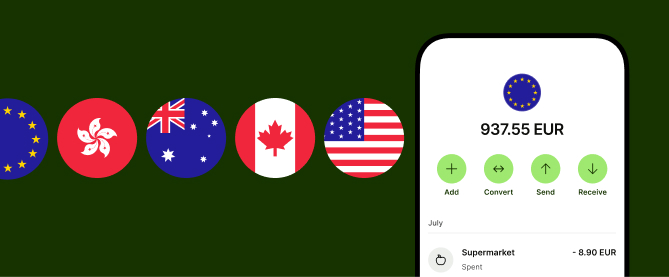

If you’re looking for a flexible way to manage your money across currencies - and send and receive international transfers, meet Wise. Wise is a Money Transmitter specializing in low cost currency conversion, international payments and multi-currency accounts you can operate with just your phone.

You can open a Wise account online or in the Wise app, to hold 40+ currencies, send payments to 70+ countries, and get paid like a local from 30+ countries.

Plus, if you travel frequently or shop online, you can get a Wise Multi-Currency Card to spend in 170+ countries. Whenever you need to convert from one currency to another - to send a payment or spend with your card, for example - you’ll get the mid-market exchange rate and low fees.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

The Wells Fargo money market account interest rate isn’t available, as this product is no longer being promoted to new customers. However, as we’ve mentioned, Wells Fargo does have a selection of other savings products to suit different customer needs. Here are the rates that apply at the time of writing³:

Wells Fargo doesn’t offer a money market account, but other providers like Sallie Mae®⁴ and Discover Bank®⁵ do still have a money market account available for new customers. If you’re specifically looking for a money market account, you might find a product that suits you by shopping around other services.

Another alternative to money market accounts is to open a money market fund, which is a mutual funds investment - and quite different to a money market account despite the name sounding similar. Or, you might consider shopping around for some of the best high yield savings accounts out there. You could also pick a business savings account if you’re looking for a way to save for your company.

Finally, if you’re more concerned with finding a way to save with Wells Fargo, you can consider a Wells Fargo savings account, or a certificate of deposit. Savings accounts have higher interest earning opportunities if linked to a Prime checking or Premier checking account - while CDs offer varied interest based on value and term, including some promotional offers.

There’s currently no option for a Wells Fargo money market account - but you can still open Wells Fargo savings accounts and certificates of deposit if you want to keep your money there. As an alternative, you can also find other money market account options from popular providers - so shopping around will help you compare your options and pick the best one for your particular needs.

And if you’re looking for ways to conveniently manage your money across borders, take a look at Wise for low-cost ways to send, receive, hold and exchange 40+ currencies right from your phone.

Wells Fargo does not have a money market account at the time of writing. However, as product ranges do change from time to time, it’s worth watching the Wells Fargo desktop site for more on availability and the Wells Fargo money market account rate that will apply if the product becomes available again in future.

Money market accounts can offer a good balance for some customers, with relatively high earning potential alongside options to access funds when needed. However, they're not right for everyone, so shopping around is essential to make sure you’ve found the right product for your needs.

Typically, money market accounts can offer higher rates compared to regular savings accounts, with some options to access your funds within pre-arranged rules. However, the rates applied by different banks and credit unions can vary significantly, so do some research to find the one that fits your needs.

Interest rates on money market accounts, savings products and CDs change frequently and vary a lot between different banks and providers. Compare a few options to find the best for you, based on convenience and return.

All sources checked on 24 July 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

For many of us who are first-generation Americans, financial literacy isn’t something we learn from our parents - and we’re definitely not taught about money...

Everything you need to know about Discover It balance transfer limits.

Save when traveling to Europe by reading our guide on avoiding ATM fees.

Sendwave vs Wise: Comparing features, benefits, and more. Explore this article for insights on international money transfers.

Should I exchange money before traveling to Europe? Gain insights in this article for making informed decisions about currency exchange before your trip.