Hispanic Heritage Month: Shaping the future of remittances together

Remittances tell a powerful story of sacrifice and hope. These transfers of money, sent by people living and working in the U.S. to their families in their home

“Open banking” is moving forward in the United States. Well, actually, it’s been happening through industry-driven partnerships for years, but the government will soon produce its first set of regulations.

In October of 2020, the Consumer Financial Protection Bureau (CFPB) announced the start of a rulemaking process to implement section 1033 of the Dodd-Frank Act, which provides for “consumer rights to access financial records.” Stakeholder comments were due last week.

Open banking is the practice by which financial institutions can connect directly via APIs, often through third parties, at the direction of consumers. Open banking is commonly utilized when consumers add money to payment apps, use personal financial dashboards, or aggregate investments with a robo-investor, among other use cases and applications that help people manage their money more efficiently and effectively.

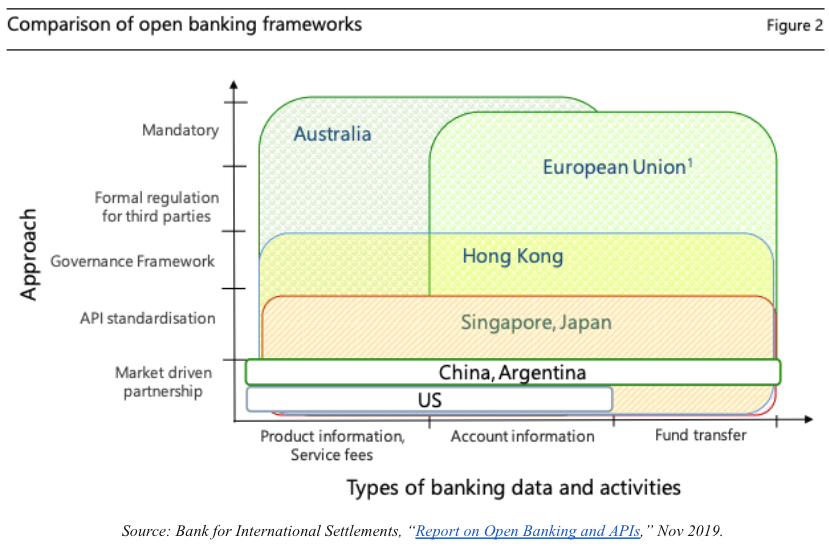

Until now, open banking in the US has been almost entirely industry driven. That stands in contrast to the UK's more prescriptive approach with enforceable unified standards and registration/accreditation requirements for participants. The UK implemented Open Banking in 2018 to induce more innovation and competition into financial services.

As the US moves towards implementing its first ever regulations, Wise offered comments from its perspective as one of the UK’s largest open banking payments initiators, at one point originating as much as 70% of transactions.

Our recommendations to the CFPB include:

The benefits of authorized data access, and open finance more broadly, are clear. Consumers benefit from increased innovation and competition. This should be a continued priority for US policymakers.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Remittances tell a powerful story of sacrifice and hope. These transfers of money, sent by people living and working in the U.S. to their families in their home

So, will “fee-free” and “no fee” advertising disappear tomorrow?

There should be nothing to hide Sending money abroad is a big deal for many Brazilians living international lives. You might be supporting your family,...

“Junk fees” were certainly a buzz word of 2023, as the Biden Administration announced a crackdown across industries to protect American consumers. The White...

In a year, US military service members spent more than $455 million on foreign exchange fees. Of that, $301 million was lost in hidden fees.

Wise was founded by immigrants, built by immigrants, and is used by immigrants.