Paypal Business vs Wise Business (2025 Guide)

Discover the key differences between PayPal Business and Wise Business. Compare features, fees, and benefits to find the best solution for your business needs.

A surprising 99% of businesses across the U.S. are small businesses¹. And if you’re an entrepreneur or business owner, you know how important it is to have a reliable financial product that can help you manage your finances.

Netspend is known for their prepaid debit cards and other financial products. But, they no longer offer a small business account. Luckily, there are still plenty of accounts for small business owners to choose from.

We’ll introduce you to a few of the best alternatives, including the Wise Business account that helps you get paid and save on currency transfers.

Did you know that the Wise Business account is free to open for US businesses?

No minimum balance requirement or monthly fees!

| Table of Contents |

|---|

Netspend no longer offers a small business account for entrepreneurs and businesses.

They currently only offer a personal debit account option called the Netspend All-Access Account. It features all the usual suspects – cash back, alerts, mobile banking, and more.

It seems like a solid personal account, but not something that’s suitable for a small business. On the other hand, they do have employer payment solutions for businesses that need to pay their employees.

Their collection of modern payment solutions includes²:

There also used to be a Netspend Business Card, which was designed for small businesses to make purchases, receive funds and take charge of their money. This card is no longer available either, but there is the Netspend branded debit card and the prepaid card program.

There’s also the personal prepaid debit card, which has all you’d expect a debit card to have. Except, if you’re doing business abroad, there are a few things to consider. When it comes to foreign transaction fees, there’s a 3.5% fee on every transaction. If you’re withdrawing internationally at an ATM, there’s a hefty fee of $4.95 per withdrawal and other potential fees. As well, there aren’t any reload locations outside the U.S.³

Did you know that the Wise Business account has a business debit card?

Get the Wise Business debit today >>

Don't forget that card is only for single-member LLCs and sole proprietors!

While Netspend no longer offers a small business account, there are still plenty of options out there, along with prepaid debit cards for small businesses. Let’s explore a few of them here:

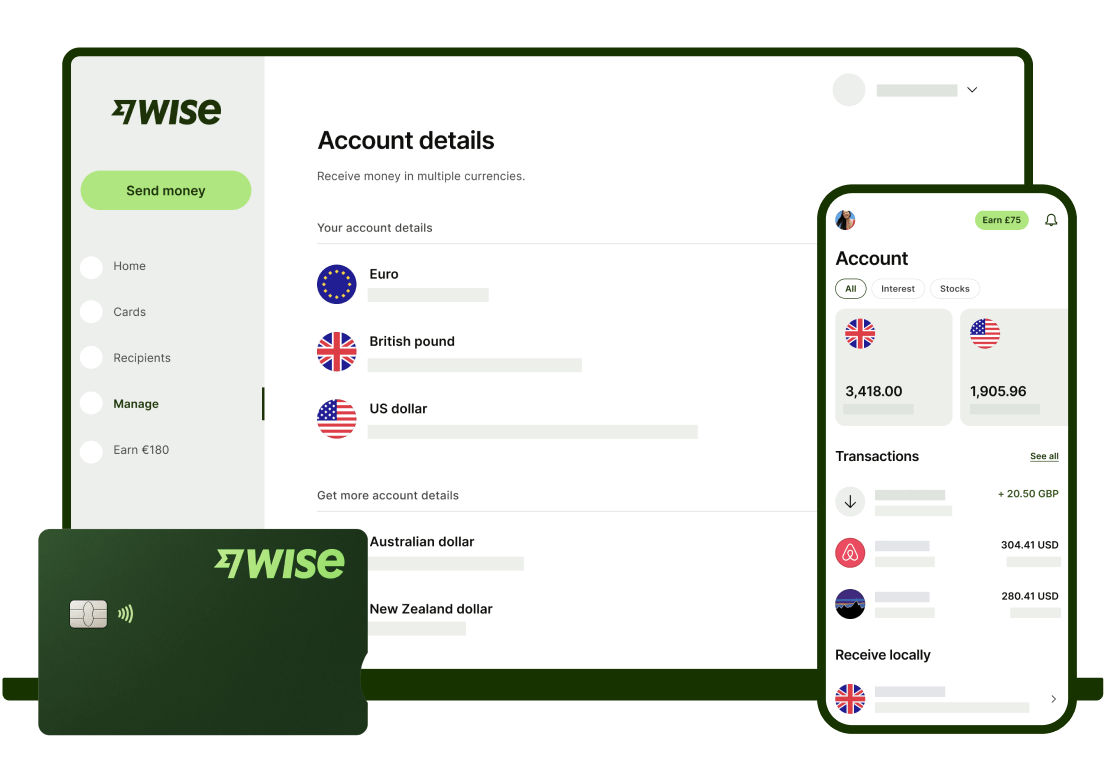

The Wise Business Account is designed to help small business owners get paid and save on currency transfers. The best way to describe it? Hassle-free. It’s free to set up and use, with no hidden fees or minimum balances.

Paying vendors, employees, and invoices internationally and locally is made easy. All you have to do is link your Wise account to your payment processor. And if you’re worried about exchange rates, the built-in currency conversion feature will help you save on international transfers.

You can also transfer money in multiple currencies at competitive rates - ideal if your customers are overseas or you have international suppliers. Withdrawals from ATMs are free, and you can also manage your finances via the Wise app.

The Wise Business debit card is a great alternative for entrepreneurs and small business owners. It has no monthly fees, and you’re not required to maintain a minimum balance. You and your team can use the card at millions of locations worldwide and withdraw money from ATMs with no extra charges.

You also get access to a range of features, such as budgeting tools and spending reports. What’s more, you can set up automatic payments and direct deposits to deal with your finances more efficiently.

When it comes to international transactions, you can rest easy with the mid-market exchange rate. Start paying bills or expenses in foreign currencies with no monthly fees in 55+ currencies and 200+ countries.

The Chase Business Account is a suitable choice for entrepreneurs and small business owners⁴. You get access to an extensive network of ATMs, as well as features such as the ability to transfer money from one account to another, set up recurring payments, and pay bills online or by phone.

There are three available checking accounts: the Total Business Checking, Performance Business Checking, and Platinum Business Checking, perfect for scaling your business. They come with traditional banking features such as cash deposits, wire transfers, as well as Chase Payments Solutions. Their payment solutions will let you accept payments online or offline, anytime you need.

Chase business debit cards are perfect for small business owners who need to make purchases and oversee their capital⁵. There are no monthly fees or minimum balances, and you can use the card anywhere Visa is accepted.

You get access to a range of features, such as budgeting tools, spending reports, and automatic payments. Plus, there are additional benefits, including discounts on select services from participating merchants.

Bank of America offers two business accounts that suit the needs of small business owners. It includes a free online banking platform and allows you to make deposits from multiple sources like checks and mobile wallets. Adding on to that, you can easily move money between accounts, use their mobile app for convenient access on the go, and get help with account setup if needed.⁶

There’s the essential Business Advantage Fundamentals Banking account and the more robust Business Advantage Relationship Banking account. You can take advantage of tools like Cash Flow Monitor, Zelle for Business, QuickBooks integration, and more.

It’s a great choice if you’re looking for a full scope of services and tools and access to small business specialists.

If you’re looking for a prepaid debit card, Bank of America has you covered. Their prepaid cards offer up to $1000 daily limits on ATM withdrawals and are accepted anywhere Mastercard or Visa is accepted. You can also set up direct deposit and use the card to make payments online or over the phone.⁷

Purchases are even itemized in monthly and online statements for easier tracking. This means keeping a closer eye on your finances, something any small business owner should be doing.

Read more about Bank of America >>

Wise is an innovative money transfer solution that offers competitive rates and fast payments. Their products include the Wise Business account, which helps entrepreneurs save on currency exchange when making or receiving payments from abroad.

The Wise Business account lets you hold multiple currencies in one place, so you can make international payments with ease. It also comes with a debit card for easy access to your money, as well as features like automatic conversion of funds between currencies and real-time rate tracking. Plus, the mid-market rate ensures that you get the best exchange rate available.

Wise is the perfect alternative for local and international businesses alike.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the key differences between PayPal Business and Wise Business. Compare features, fees, and benefits to find the best solution for your business needs.

Compare US Bank and Chase business checking accounts. Understand fees, features, and benefits to choose the best business checking account for your needs.

Discover the best business bank accounts for real estate investors in 2024. Compare features, fees, and benefits to find the perfect account for business.

Explore our complete overview of Relay vs. Wise Business. Understand their features, benefits, and which option best suits your business requirements.

Discover the key differences between Payoneer and Paxum. Compare features, fees, and usability to find the best payment solution for your needs.

Discover the key differences between Zelle Business and Wise Business. Compare features, fees, and benefits to find the best payment solution for your needs.