Selling inherited foreign property from the US: Complete guide

Read on for a step-by-step guide to selling inherited property abroad, including fees, taxes, and timelines.

Want to send money overseas? If you want to make a transfer to friends or family in Africa, a convenient online solution is NALA.

The money transfer app lets you send from the US to countries like Kenya, Côte d’Ivoire, Nigeria and more.

But how does it work, and how much does it cost? Find out everything you need to know below, in our full NALA money review.

We’ll also show you an alternative - Wise. You can send money worldwide with Wise, for low fees and great exchange rates.

NALA is an international money transfer app, offering its services to both personal customers and businesses.

Once you have the app, you can send money from the UK, US or EU to countries across Africa - all using just your phone.

The app is designed to help people make fast, secure payments to friends and family in Africa, as well as buying goods and paying bills directly.

NALA has offices in Nairobi, Kenya, as well as in the USA (Brooklyn, New York), the UK (London) and the Netherlands (Amsterdam).

With NALA, you can send money from the following countries:¹

You can send to any of these African countries:¹

NALA doesn’t have upfront transfer fees, although a fee of $0.99 may apply if you’re sending to a bank account.²

But when considering the cost of a transfer with NALA, you also need to factor in exchange rates.

NALA adds a margin to the mid-market exchange rate when converting currency. This is a kind of fee, but it’s built into the rate.³

As NALA doesn’t charge fees on many of its transfers (except bank to bank transfers), you might be wondering how it makes enough money to keep offering its services.

The answer lies in the exchange rate. NALA uses the mid-market exchange rate as the baseline for all of its transfers, but it then adds its own small percentage markup on top.

This helps NALA to cover its costs. Although from your perspective, it is a kind of transfer fee in itself. It means that less of your money reaches its destination.

If you want better exchange rates with no margin on top, use Wise to send money internationally. It’s a great alternative to NALA, and could even work out cheaper for some destinations.

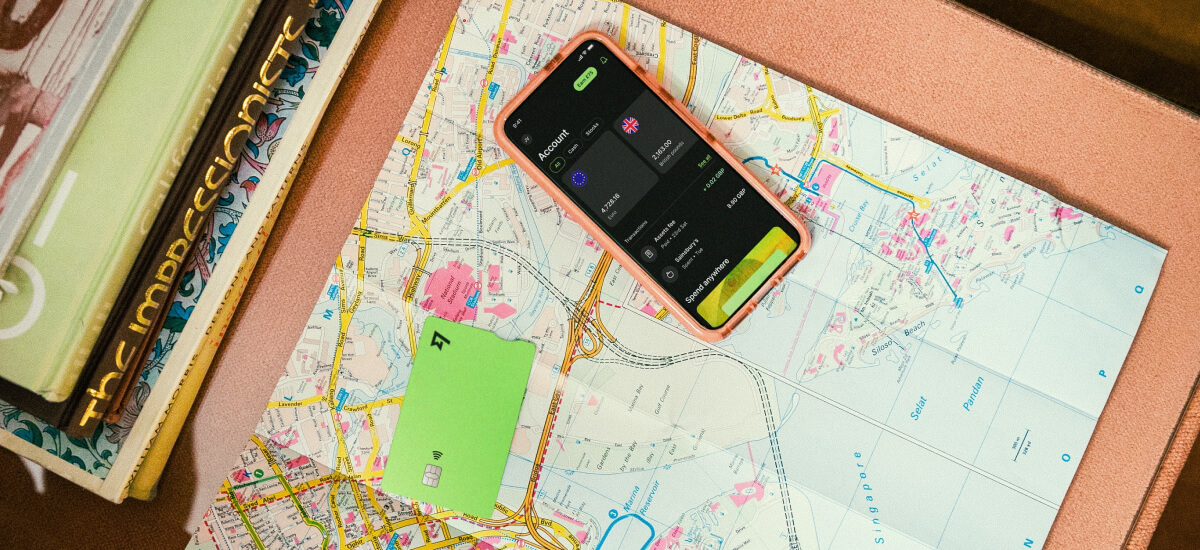

Wise is a money services business (MSB), offering a multi-currency account, international money transfer services and a debit card.

Open a Wise account online and you’ll get all these fantastic benefits:

It’s quick, easy and free to open a Wise account online. And there’s even a handy Wise app so you can manage everything from your phone.

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

To give you an idea of how much it costs to use NALA for a real-life transfer, let’s do a quick price comparison with Wise.

Let’s imagine you want to send $1,000 USD to a family member in Uganda. Here’s how much it’ll cost with both NALA and Wise:

| Transfer fee | Exchange rate | Recipient receives | |

|---|---|---|---|

| NALA⁴ | $0 (fee may apply to bank transfers) | 3464.37 | 3,464,363 UGX |

| Wise⁵ | $9.55 | Mid-market rate | 3,585,300 UGX |

(08/08/2023 – Pay in method is ACH.)

So as you can see from this example, it’s the exchange rate that makes all the difference. NALA may charge no fee, but your money may go further with Wise because of its margin-free exchange rate.

To use NALA, you’ll first need to download the app from the Google Play or App Store.

Then, follow these steps to set up your first transfer:

If you’ve received money through NALA, you’ll need to know how to withdraw it. Here’s what you need to do to withdraw funds from your NALA wallet to your connected and verified bank account:⁶

Transfers should happen instantly.

NALA has a number of security measures in place to protect you, your money and your data.

It uses what it describes as ‘bank-grade security’, including fraud detection, encryption and Strong Customer Authentication for new users.⁷

So, there you have it - a complete NALA money transfer review, covering everything you need to know.

It’s an easy-to-use, competitively priced option for sending money from the US to Africa.

Just remember that it may not be the cheapest option out there for every transfer. It’s always worth checking whether you could save money with another provider such as Wise.

There are lots of ways to send money across to Africa, including using your bank - although this could be an expensive option. A digital solution such as Wise or NALA could be easier, faster and cheaper.

Comparing NALA to an alternative like Small World? Take a look here at our Small World review, to find out how long transfers take.

NALA is a popular choice, as it’s easy to use, fast and competitively priced. Alternatively, why not give Wise a try? You may end up saving money - sign up for an account today!

Sources used for this article:

Sources checked on 08-Aug-2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read on for a step-by-step guide to selling inherited property abroad, including fees, taxes, and timelines.

Thinking of moving to Spain or Portugal? Find out what tax programs they have for expats to decide which might be better for you.

Need to report the sale of an inherited property abroad? Read on to learn how to avoid capital gains tax and other tips.

Interested in selling a classic car overseas? Find out what American classic car models are popular abroad and tips for listing and shipping your car.

Find out the key points of international estate planning, including US taxes, wills and trusts, country laws, and reporting requirements.

Importing a car to the US? Learn about the 25-year import law and how to verify your vehicle for import to the US.