Maximizing Your Small Business Profits During the Holiday Season

The holiday season is often hailed as the most wonderful time of the year, but for small businesses or e-commerce stores, it can also be the busiest and most...

Facebook Marketplace is an excellent sales channel for eCommerce businesses. It’s used by more than one billion people each month.¹

One advertisement on the Facebook Marketplace can reach a whopping 562 million people.¹ This gives your products global exposure.

Let’s look at how to accept payments on Facebook for your eCommerce business. We’ll also check out how you can accept payouts with your PayPal account.

Receive international payments

with Wise Business

| In this article: |

|---|

The Facebook Marketplace is a great place to give your products exposure.

But to sell products, you’ll need to add a payment method. So let’s look at how to accept payments on Facebook marketplace.

When a customer makes a payment, the money goes directly into your connected payment method. This could be a debit card, bank or PayPal account. Facebook also supports local payment methods and currencies.²

You can add a payment method to your Facebook Business Manager to receive payments:

Keep in mind, you’ll need to be an admin or finance editor to make changes to payment methods.³

You can add your PayPal account to Facebook Pay.

When a customer makes a payment, the money will go directly into your PayPal account as long as the item is shippable.

| To add PayPal to your Facebook Pay account, you’ll need to: |

|---|

|

Now that you’ve added PayPal to Facebook Pay, you can set it up as the account to receive payments through. Keep in mind that you can only do this with items that can be shipped. PayPal is also only available if you have an ad account with automatic payments.⁴

To get paid with PayPal through Facebook Pay, you’ll need to:

Open your Facebook Marketplace

Click “Create new listing”

Add the necessary details to create a product listing. You’ll need to add the price, description, condition and a photo of your product. When you select the category, remember that you can only select those that say “shipping available”. Otherwise, you won’t be able to receive payouts through PayPal

Select “Next”

Select “Shipping” or “Set up shipping”

Fill out the information needed for setting up shipping. You’ll need to enter some details so Facebook’s payment processors can verify your account. Part of this process is connecting a bank account. This is so Facebook can send you payments, such as chargebacks

Specify your shipping preferences. Local pickup is not available if you want to be paid through Facebook Pay. You can select “Shipping only” from the Delivery Menu to disable local pickup as an option. You can list your shipping carrier, rates, weight and other information too

Add your product listing to groups or leave it in the Marketplace

Select “Publish”

Enter the tracking number of your shipment to mark your product as shipped. You can do this by buying a prepaid shipping label in the Facebook Marketplace. Or you can go to “Shipping orders”, enter the tracking number and save it

Keep an eye on your PayPal account. Payouts are initiated 15 days after marking an item as shipped or 5 days after the item has been delivered. It can then take an extra 5 days until the payment reaches your PayPal account⁵

When you accept a payment through PayPal via Facebook Pay, Facebook will pay the transaction fee. But if a currency conversion is needed, you’ll have to pay a conversion fee.⁶

If you sell internationally, Wise Business could save you money in the process. It’s easy to set up and easy to use.

With a Wise Business account, you get access to local account details. From IBANs to Routing Numbers, you can get paid with ease, free of cross border fees.

And if you do need to make a currency conversion, you’ll get access to the real mid-market exchange rate. This saves you from hidden fees and markups.

| 🔍 Key features |

|---|

Wise Business is not a bank, but a Money Services Business provider and a smart alternative to banks. It’s quick and easy to set up an account and get started.

With a Wise Business account, you can hold over 40 currencies in one place. You’ll also have access to local account details for up to 10 different currencies, enabling you to receive international payments like a local. This makes it easier for customers to pay in their local currency, and also saves you from having to pay cross border fees.

Overall, Wise Business is cheap to use. And where there are fees, you’ll know about them beforehand.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

| 👏 Great for | |

|---|---|

| Wise Business is great for businesses looking for a cost-effective and easy to use business account that supports many currencies and gives you access to local account details. | |

|

Sources:

All sources checked June 22, 2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

The holiday season is often hailed as the most wonderful time of the year, but for small businesses or e-commerce stores, it can also be the busiest and most...

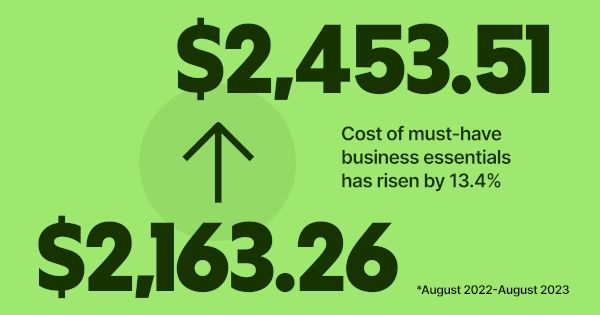

At Wise Business, we're focused on building a multi-currency account helping businesses grow internationally while tackling the rising costs of doing business

Getting paid is a key moment for your business - it means that your product fit and marketing strategy has hit the mark and customers are happy to exchange...

Explore how to get investors for small business to raise the capital you need to succeed. 1. Friends and Family 2. Small Business Loans and more

Handling finances manually is slow, repetitive, and full of errors. From chasing invoices to approving expenses, finance teams spend too much time on admin...

As the holiday season approaches, managing cash flow effectively becomes critical for business owners. The final months of the year can be make-or-break, with...