Renting in New Zealand as an American: Everything you need to know

Thinking about moving to New Zealand? Find out what you need to know about renting in New Zealand in this guide.

If you’re a location independent professional or digital nomad, figuring out how best to get adequate health cover can be a challenge.

Typical private medical coverage doesn’t necessarily work while you’re outside of your home country — while travel cover might not be designed for longer trips or anything other than emergency care.

Getting the best digital nomad health insurance for your needs is crucial though, to make sure you’re covered no matter what happens.

This guide runs through some things to think about when considering nomad insurance. And to help you save and manage money when you’re working remotely overseas, we’ll also introduce the Wise Account. Let’s dive right in.

Yes. It’s just as important to have health cover when you’re working remotely overseas as it is when you’re at home or taking a short trip.

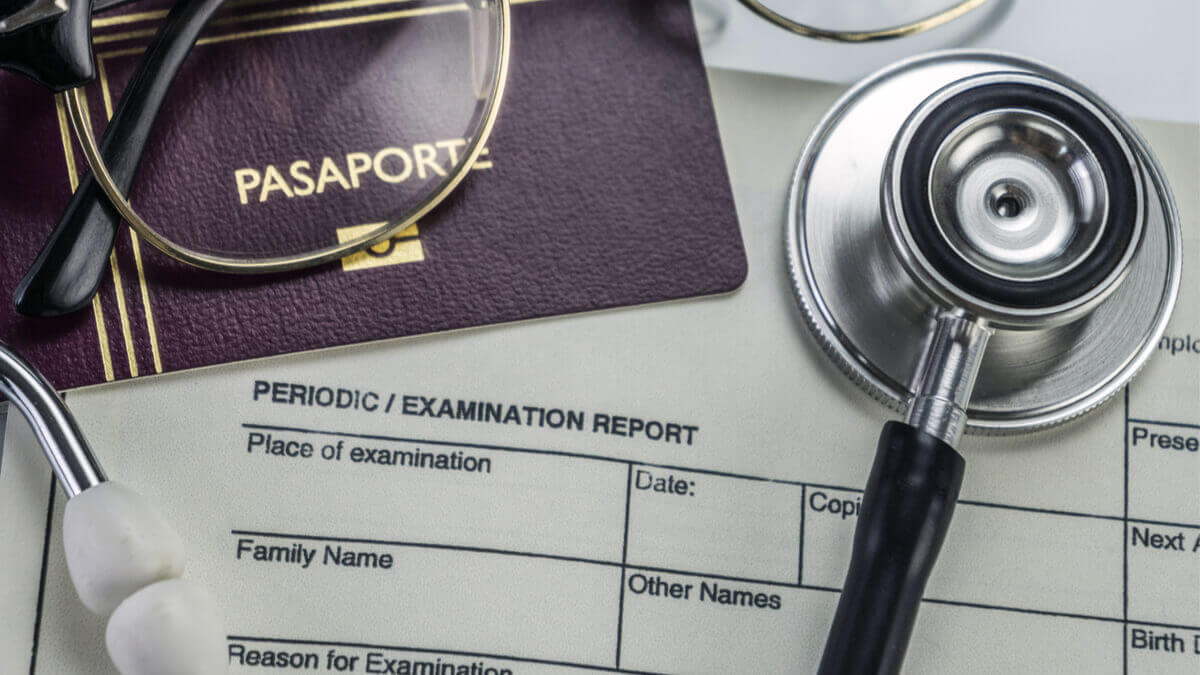

Depending on how you’ve arranged your travel you might even find that adequate medical cover is a mandatory requirement to get a visa — and even if it isn’t, it’s just good planning to make sure you’re covered no matter what happens.

Regular travel insurance is usually designed to cover only the basics of emergency care and repatriation, for short trips overseas.

In most cases you’ll find that the coverage includes comprehensive support for critical situations, but relatively high deductibles are in place to make sure it’s only used when it’s really necessary.

As a digital nomad, you’ll likely be abroad for longer, which means traditional travel insurance might not cut it. It’s also common to find that you can only get a travel insurance policy prior to leaving your home country, which might not work if you’re not sure of your longer term plans just yet.

Digital nomad health insurance plans may have more comprehensive cover compared to regular travel insurance, be designed for trips to multiple locations, and last for far longer.

Picking the right digital nomad health insurance plan can be a bit of a challenge.

The options out there are very varied, so the right one for you will depend on what you’re expecting to do while you travel, your personal risk profile and any preexisting conditions you might have.

Here are a few questions to consider when you’re picking the best nomad insurance for your needs:

|

|---|

The range of digital nomad health insurance plans out there is pretty diverse. Some offer more basic care with affordable prices, while others look more like comprehensive private medical insurance you can draw on globally.

Full feature plans may cover adventure activities, preventative care, and even maternity cover, while the most basic plans are more based around emergency support offered for longer term trips.

As we’ve mentioned, the range of nomad health insurance plans out there is pretty broad — and so are the prices you’ll pay. The quote you get will mainly depend on:

- Your age

- Where you’re traveling to

- How comprehensive the cover is

- Deductibles and maximum cover provided

- Any pre-existing conditions you have

Many providers have different tiers of cover which have their own deductibles and maximum limits for different types of scenarios. It’s also common to have plans which are intended for travel outside of the US only, and other plans which can include time spent in the US — handy if you’re expecting to return home from time to time.

To give a bit of an idea, let’s look at the quotes available for a few different customer types, from Safety Wing.

We’ll review Safety Wing as a digital nomad insurance provider in more detail later, but cover is offered on a monthly subscription basis for up to a year at a time, with costs based on age and destination¹:

Prices rise quite a bit based on age, to take into account higher risks. Here’s another example for an older traveler:

It’s important to compare a few providers before you pick out the right health insurance plan for your needs, as quotes are highly personal and based on your own situation. We’ll look at some providers to include in your research in just a moment.

When you live and work overseas, you also need a smart way to manage your money in a range of currencies. Meet the Wise Account.

Open your Wise Account online or in the Wise app, to hold 40+ currencies, and exchange between them with the mid-market exchange rate and low, transparent fees.

If you’re getting paid internationally too, you’ll have local bank details for up to 9 currencies so you can bill clients and receive income like a local. There’s also a linked international debit card on offer for spending and withdrawals from 150+ countries around the world.

See how Wise can help you save when you’re living a nomadic lifestyle, with simple, cheap and easy ways to manage your money across borders.

Get started with Wise

in minutes

| Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information. |

|---|

Let’s look at a quick overview of some top digital nomad insurance plans. We’ll pull out some key features, and then explore each in a little more detail afterwards.

| Provider | Safety Wing | World Nomads | Atlas Travel Insurance | Insured Nomads | Integra Global |

|---|---|---|---|---|---|

| Eligibility | Before or after travel starts | Before or after travel starts | Range of plans for different travel types | Global or regional plans available | Range of plans for different customer needs |

| Maximum medical coverage | 250,000 USD | Depends on country of residence | 1 million USD emergency medical | Depends on plan | Core, comprehensive and premium plans with different cover offered |

| Deductible | 250 USD | Depends on plan | 0 - 5,000 USD depending on plan | Depends on plan | Depends on plan |

| Exclusions | High risk activities, pre-existing conditions, cancer | Depends on plan — adventure activities are often covered | Depends on plan — acute onset of pre-existing conditions may be covered | Depends on plan, but full feature plans have extensive cover options | Depends on plan, but provider aims to offer cover to individuals even with unique needs |

| Travel insurance | Available | Available | Available | Available in a separate policy | Not specified |

| Notable points | Up to 100,000 USD emergency medical evacuation coverage | 150+ adventure activities covered Covid cover not available on all plans | Plans can be highly tailored to individual needs | Regional and global plans available — true private medical cover offered, not just for emergency situations | Smaller provider with custom made plans across a range of price points |

Safety Wing nomad insurance covers both medical and travel insurance issues. Medical insurance coverage includes emergency care, Covid cover, ambulance costs, urgent dental work, and even physical therapy.

Travel insurance includes emergency medical evacuation, trip interruption, lost luggage, injury and death. The plan is effectively a subscription service, so there’s no need to decide in advance how long you need coverage for. One child under 10 is included for free for each adult signed up.

The cover you can get with World Nomads depends on your country of residence — but the good news is that 150+ adventure activities are usually covered, which is an unusual feature.

Typical coverage includes emergency medical and dental, trip cancellation, lost luggage, and multi-lingual support when you need it. Generate a quote online based on your plans so you can see if World Nomads works for your travel plans.

Atlas Travel Insurance plans can be custom built depending on your age, residence, personal needs, pre-existing conditions, and the type of trip you’re taking.

One notable feature is that the acute onset of some pre-existing conditions is covered with Atlas, which can be useful. The range of maximum cover, deductibles and so on does vary quite widely depending on the plan you pick, but you can generate a quote by entering your details online.

Insured Nomads medical coverage offers more than just emergency care, and depending on the plan you pick may include preventative care, mental health support, substance abuse treatment, maternity and more.

Plans are either regional or worldwide, with customized options depending on your needs. Regional plans won’t cover you for time spent in the US — if you’re making trips home you’ll probably need to take the full feature global cover. In most cases, cover lasts up to 1 year.

You’ll be able to choose from a Core, Comprehensive and Premium plan with Integra Global, with cover for individuals and family available depending on your plan preference. All plans have emergency support, life cover and 24/7 help available.

All the plans are built around offering great value for money with services you need put together into easy to understand packages. Integra is a smaller provider which prides itself on being flexible and providing cover for individuals with unique needs.

There’s no perfect digital nomad health insurance plan — different providers and plan types will suit different individuals.

You’ll need to do a bit of research to find your best match based on your trip and your personal requirements and preferences — here are some thoughts on great providers for specific needs, to help you get started.

| Category | Winner |

|---|---|

| Best digital nomad health insurance for adventure travel | 🏆 World nomads: 150+ adventure activities covered |

| Best digital nomad health insurance for trips home | 🏆 Safety Wing: After 90 days abroad, keep medical cover for 15 days for short trips back to the US |

| Best digital nomad health insurance for pre existing conditions | 🏆 Atlas Travel Insurance: Cover is provided for acute onset of pre-existing conditions, subject to eligibility requirements |

| Best digital nomad health insurance for individuals with unique need | 🏆 Integra Health: Integra plans are custom made to offer cover for people with unique personal needs |

| Best digital nomad health insurance for full feature cover | 🏆 Insured Nomads: Depending on the plan you select, you may find preventative care, alternative care, maternity and more is covered |

The right nomad health insurance for you will depend a lot on your situation, and what cover requirements you have.

However, there are plenty of different providers out there so with a bit of research you’re sure to find the perfect match for your needs.

Use this guide to kickstart your quest — and don’t forget to check out the Wise Account as a smart way to manage your money as a digital nomad.

Sources:

Sources checked on 10.11.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking about moving to New Zealand? Find out what you need to know about renting in New Zealand in this guide.

Thinking about moving to Thailand? Find out what you need to know about renting in Thailand in this guide.

Thinking about moving to Costa Rica? Find out what you need to know about renting in Costa Rica in this guide.

Thinking about buying a vacation home? Read on for the top 10 best places to buy a vacation home around the world and their relative costs.

Thinking about moving to Canada? Find out what you need to know about renting in Canada in this guide.

Find out the true cost of owning a private island, how to buy one, and the top destinations for island ownership around the world.