How to Buy Commercial Property in Singapore: A guide for US businesses

In this US guide to buying commercial property in Singapore, navigate the process, costs, and unlock foreign investment opportunities with expert insights.

In the world of international trade, the Incoterms® rules are well established norms by which you can do business. They clearly state who is responsible for each part of the delivery process – whether the buyer or the seller handles the various stages.

CIF is one of those terms. Here’s an introduction to what it means.

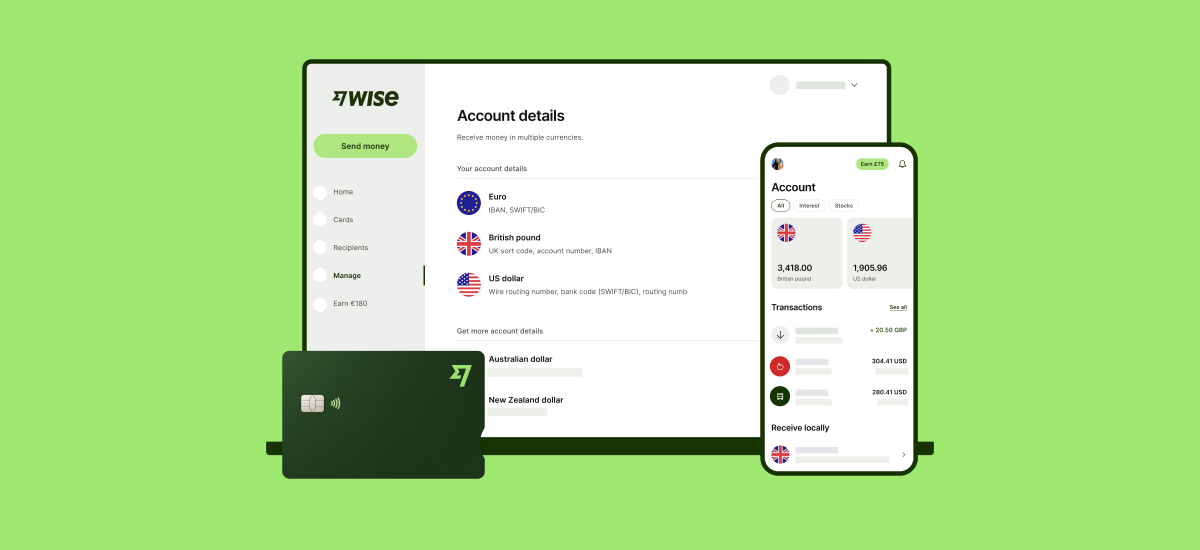

International transfer costs can really cut into the profit margins of a business.

That's why 7 million users are already using Wise, the new and clever way to send and manage money internationally.

Wise lets you send money for a low transparent fee using the mid-market rate, through their own network of local bank accounts. Money never crosses borders, fees stay low and you save cash.

See if you could save with Wise

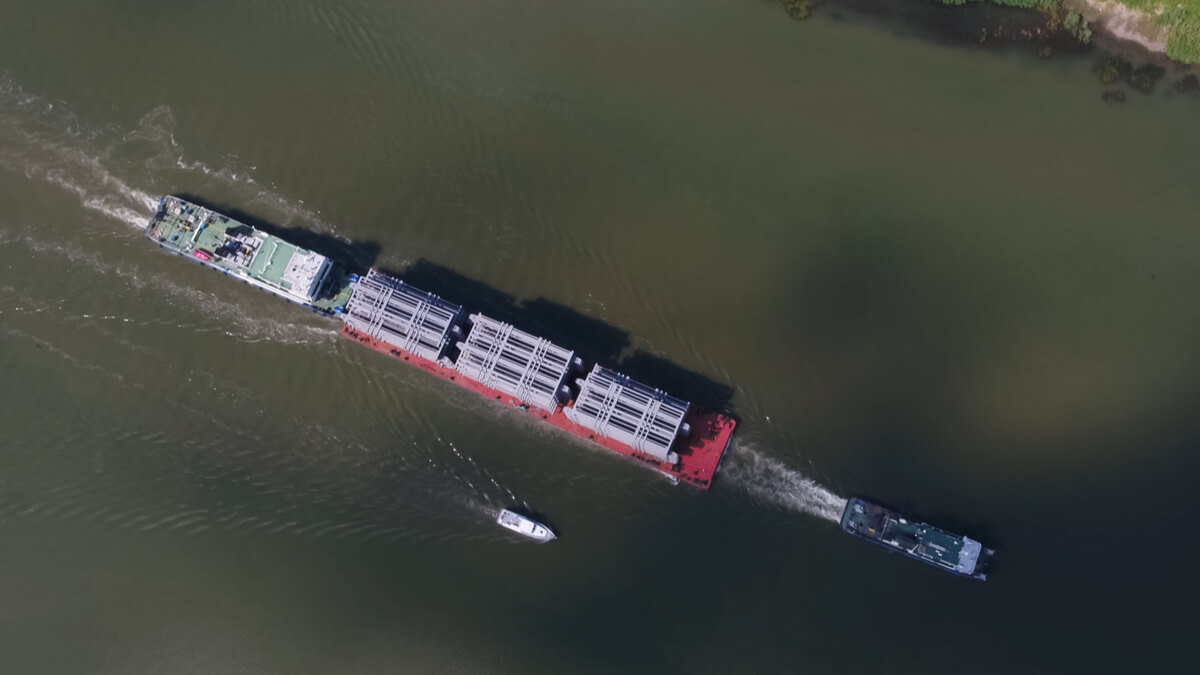

There are 11 Incoterms® rules in total, and CIF – standing for cost, insurance and freight – is one of four that relate only to waterbound transportation.

That means either sea freight or transportation via inland waterways. CIF shouldn’t be used for air or land transportation, or for containerized goods.

So, who does what under the CIF rule?¹ ³ ² ⁴

The seller is responsible for:

The buyer is responsible for the process once the goods have arrived at the destination port, including handling customs there.

However, risk transfers at an earlier point. The buyer is responsible for risk from the moment the goods are loaded onto the vessel – so the risk during the main carriage is the buyer’s.

There are a few things to bear in mind if you’re considering using CIF:

The Incoterms® rules are usually updated by the ICC every 10 years, and a new set was published in 2020. The previous set was in 2010. Incoterms® 2015, Incoterms® 2016, and so on, don’t exist.⁵

So long as you specify which set of rules you’re using, there’s no obligation for you to use the latest set of rules in a contract. Just make sure all parties know what you’re talking about.

Were there any key changes in 2020? As far as CIF goes, not really – but there’s one thing to bear in mind.

CIF and CIP (“carriage and insurance paid to”) are the only two rules that specify that the seller is responsible for insurance. In the Incoterms® rules 2020 update, the minimum level of insurance under CIP was increased. However, the same change didn’t occur for CIF – the minimum insurance level for CIF remains relatively low.⁶

Be careful when using CIF, as the rules aren’t totally intuitive. While the seller pays costs up to the end of the main carriage, the buyer assumes risk at an earlier stage.

Plus, the seller does have to arrange insurance, but you might well need to discuss in detail exactly how much coverage is required.

CIF is one of the four terms that can only be used for waterbound shipments, but don’t forget about the seven terms that can be used for any type of shipment. It could be worth checking out CIP instead, which now requires the seller to take out a higher level of insurance.

1.Shipping Solutions - Incoterms 2020 CIF: Spotlight on Cost, Insurance and Freight

2.Freightos - CIF Incoterms: Cost Insurance & Freight Shipping

3.Incoterms Explained - Cost Insurance & Freight

4.Investopedia - Cost, Insurance, and Freight (CIF) Definition

5.International Chamber of Commerce (ICC) Incoterms® 2020

6.ICC - What are the key changes in Incoterms® 2020?

All sources checked 14 May 2020

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

In this US guide to buying commercial property in Singapore, navigate the process, costs, and unlock foreign investment opportunities with expert insights.

Learn the essentials of how to invest in commercial property in the UK as a US investor.

Discover how to invest in commercial property with our comprehensive guide.

Learn how to hire independent contractors in Canada. Understand legal rules, tax responsibilities, and how to avoid misclassification with this guide.

Learn how to hire independent contractors in Brazil. Understand tax rules, compliance, contracts, and how to avoid misclassification risks.

Learn how to hire and pay independent contractors in Mexico. This article also includes an FAQ and best practices about working with contractors in Mexico.