How to send money from PayPal to Wise

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

Money market accounts can be a convenient option for people who want to boost their savings without needing to fully lock away their funds for a long term. However, it’s important to understand the risks of any financial product - so if you’re considering opening one you’re probably wondering: can you lose your money in a money market account?

This guide walks through the important considerations - plus, we’ll highlight Wise as a handy way to save money on fees when you’re managing your money across currencies.

A money market account is a way to save, which offers relatively low risk and high liquidity. That means you’ll often be able to get a better interest rate compared to a regular checking account, but you’ll also be able to access your money as and when you need it.

While some money market accounts have caps on the number of certain transaction types, these accounts are typically still more flexible than a fixed deposit account, while carrying lower risks compared to buying stocks and shares.

This makes them a good all round option for people who have excess funds they want to use to earn interest, but who aren’t ready to lock their money in for a very long period of time.

It’s helpful to know that money market accounts are not the same as money market funds.

Money market funds are a type of mutual fund offered by investment companies, which invest in assets like government, corporate and bank securities. Money market funds are pretty liquid, in that you can buy and sell your assets - but they aren’t FDIC protected. If you’re considering a money market fund, read up on the risks involved, so you’re fully aware.

Here are a few pros and cons to think about before you get your own money market account.

Pros:

Cons:

| 💡 Want to know more about money market accounts? Learn more about money market accounts and how they work here. |

|---|

If you hold a money market account with a bank, it’s protected by FDIC deposit insurance², and money market accounts at credit unions are covered by NCUA’s share insurance fund³. This means that in both cases, your deposit is protected up to 250,000 USD per depositor if the provider were to fail.

However, while this means the chances of losing your principal investment are low, it doesn’t necessarily follow that it’s impossible to lose money in a money market account. More on that next.

You can rest easy if your worry is whether you can lose your principal in a money market savings account if the provider goes bust. However, as with most financial products, this doesn’t mean that money market accounts are entirely without risk.

There are still a few ways you might ultimately find a money market account doesn’t work well for you - and in the worst case scenario, this may mean you lose money overall.

The key thing to look at is the costs of maintaining your money market account, and any penalties that may be applied to your account. You’ll then need to set these fees and charges against the interest earning potential - which may also vary based on the amount you have in your account. Here are some scenarios to watch out for:

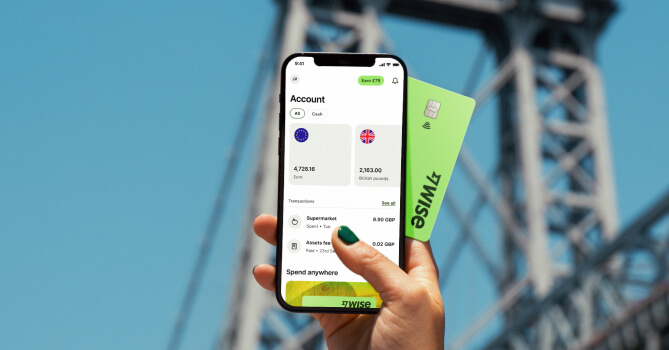

Looking for ways to hold, exchange, send and spend foreign currencies? Meet Wise. Wise is a Money Transmitter specializing in low-cost currency conversion, international payments and multi-currency accounts you can operate with just your phone.

Wise accounts can hold 40+ currencies, with local bank details to get paid conveniently in 9 currencies right to your Wise account. Once you hold a balance you can switch between currencies with the mid-market rate, or send payments to others in USD or a selection of foreign currencies - all with low, transparent fees.

If you hold money in foreign currencies and need to send it to your US bank to add to your US money market fund, see if a low cost international transfer from Wise can help. You’ll get the mid-market rate, transparent pricing, and deposits can be quick, too.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

To make sure you don’t lose money in your money market account, you’ll need to make sure you’ve read through, and comply with, the account terms and conditions. Look for account products which have high interest with low or no monthly fees, and stick within the maximum withdrawal number if one applies, to avoid penalty charges.

Money market accounts aren’t right for everyone. If you need to make frequent withdrawals, check if any penalty fees apply, as these can eat away at the interest your account earns. You might also have to make a high minimum deposit to open the account in the first place, or to actually earn interest on your balance. Shop around, and compare a few money market accounts based on their interest, features and fees, before you commit.

Money held in money market accounts with banks and credit unions is protected by deposit insurance through FDIC, or via the NCUA’s share insurance fund. However, be aware that maintenance fees or penalty charges can be deducted from the interest your account earns, or even from the principal, so you’ll need to make sure you follow the account’s terms and conditions carefully to minimize the potential costs.

Whether a money market account is right for you depends on your personal preferences and needs. If you intend to make withdrawals from your account, be sure to check how many are allowed under the account’s terms and conditions, to avoid extra fees.

Generally, money market accounts don’t have minimum deposit terms, which means you can hold funds as long as you like.

Money market accounts are considered to be pretty safe as they benefit from deposit insurance. This means you won’t lose your money if the bank or credit union fails. However, it is still possible to lose money with a money market account if you don’t earn enough interest to cover the costs of maintenance fees and any penalties applied for making withdrawals over the allowed maximum amounts.

Double check your account terms and conditions, so there are no surprises. And if you’re moving money from a foreign currency to your USD money market account, take a look at Wise for low-cost currency conversion with the mid-market rate.

All sources checked on 24 July 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

For many of us who are first-generation Americans, financial literacy isn’t something we learn from our parents - and we’re definitely not taught about money...

Everything you need to know about Discover It balance transfer limits.

Save when traveling to Europe by reading our guide on avoiding ATM fees.

Sendwave vs Wise: Comparing features, benefits, and more. Explore this article for insights on international money transfers.

Should I exchange money before traveling to Europe? Gain insights in this article for making informed decisions about currency exchange before your trip.