Brex and Wise are Solving Growing Pain Points for Employers: Global Employee Reimbursements

The “Going Global” Challenge In today’s post-pandemic world where employees can work from anywhere and companies are more frequently hiring beyond their...

Banking is one of the world’s oldest businesses. It's been with us in one form or another since the merchants of Ancient Babylon started offering grain loans to farmers who needed to transport goods between towns. It wasn’t until 14th century Italy that banking as we recognise it today developed: In fact the oldest bank still trading today (the Monte dei Paschi di Siena) was founded in 1472.

The speed that modern technology has developed has meant that the traditionally slow-moving financial institutions have had to invest billions to remain relevant to customers and competitive in the marketplace. So, which aspects of technology have caused the biggest disruptions - and which have changed the way banking works in the 21st century?

If you are over 30, you've probably spent hours in interminable bank queues over lunchtimes or on a Saturday mornings, to withdraw money or pay in a cheque. Banks have leaped on the opportunities offered by online - and now mobile - banking. It's possible to do everything online, from simple transactions to complicated issues such as applying for a mortgage.

A new study by YouGov reveals that one in three retail banking customers feel their bank’s mobile app isn’t as good as their online banking provision however. This, coupled with the fact that more people are relying on their phones to access their banking, is sure to be a focus for high street banks in the coming years. Some banks are now only available virtually - banks like Smile in the UK and Simple in the US don’t have any physical branches at all (although they're partnered with existing institutions which ensures the funds are completely safe).

Although Mobil first issued contactless cards for customers to use at their petrol stations in the US as early as 1997, the very first contactless cards associated with banks were given out by Barclaycard in 2008. Now there are well over 32 million in circulation in the UK. By 2011, mobile technology had merged with contactless, and the first wave of apps that allowed their owners to pay by tapping the phone against the terminal were born.

Google Wallet is now one of the most popular in the world, allowing users to store debit, credit, loyalty gift and store cards on their phones. A few years ago London buses opened their doors to contactless technology - you can now pay your fare with a quick tap of your card as you step onto the bus.

In the first half of 2015, 400 data breaches took place in the US, according to the US-based Identity Theft Resource Center, with 117,576,693 personal records put at risk. 10% of these breaches were in the banking sector - and that is an 85% jump from the same period in the previous year. Keeping financial information safe is one of the biggest areas of investment for banks, and it is also a responsibility for customers.

Easy passwords, public computers and “phishing” scams are some of the most common ways we are separated from our money. Take a look at Which?’s guide to banking online safely - and their rundown of the safest UK banks.

2015’s World Retail Banking Report spelled out some bad news for high street banks: Positive customer experiences had fallen for the second year in a row. Younger, Generation-Y, bank customers are less likely than their parents to show loyalty to one particular bank. Customers are generally less willing to take their bank’s word for which secondary products such as mortgages and investments they should take, preferring to do research themselves. Online banking and mobile banking mean that generic customer services are no longer needed. Customers expect a more tailored and personalised experience when they - on rare occasions - need to contact their bank by phone or by chat, or even in person at a branch.

The IT research company Gartner suggests that gamification will become increasingly important for customer service in the coming years. Customers will need to be more engaged digitally through the use of the sort of mechanics usually only seen in video games, combined with virtual reality technology such as gesture recognition and head-mounted displays.

One of the biggest changes to happen to the banking sector is the opening up of competition to some of the processes that were only ever available in-bank before. Take Transferwise, which can save you on the fee your bank would charge you for an international money transfer, as an example. It will be interesting to see how banking evolves in the future, and which institutions will be flexible and nimble enough to keep up with the demands of today’s society. What those demands will be and what banking will look like in five or ten years time is an exciting proposition.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

The “Going Global” Challenge In today’s post-pandemic world where employees can work from anywhere and companies are more frequently hiring beyond their...

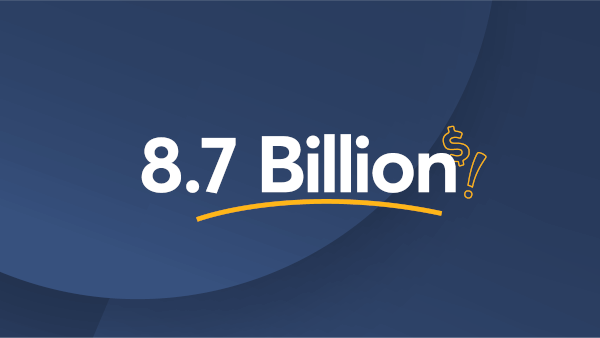

Hidden exchange rate markups estimated to cost Americans $8.7 billion in 2019 Consumers and businesses lose billions every year when they send and spend money...

Our mission has become irreversible, the company financially independent, and adoption continues to accelerate. Thank you - Wise customers - for...

To the Wise community When my co-founder and I launched Wise 7 years ago, we set out to irreversibly fix how money doesn’t work across...

Money is information. Using, storing and moving money should be as cheap and instant as exchanging information. As cheap as sending an email. And certainly it...

The grassroots story of how Hubstaff customers helped them make the switch to Wise API for mass payouts. And why they're happy they found the solution.