What you need to know when buying gold in Dubai

Find out where to shop and how to save money when buying gold from Dubai.

Written by Carrie Smith, an expert freelance finance writer or small business writer, who's written for everyone from The Huffington Post to Glamour. Proudly self-described as the #girlboss behind the Careful Cents brand, a community of solopreneurs and freelancers who are committed to building life-centered businesses.

As a recent arrival in the United States, there are a few considerations that need to be made in order to make your transition successful.

For example, where are the best places to live, and how can you manage your finances in a new country? What are your initial steps right after moving?

This post explores five financial tips you should know if you’ve just moved to the U.S.

The United States works with a specific set of rules when it comes to building and establishing a history of credit.

Your credit score, also known as a FICO score, is a number that financial institutions use to determine the likelihood you’ll pay back a new loan. This allows companies to determine your eligibility for how much money you’ll be approved for, along with the other terms such as the interest rate, loan timeline and fees.

You won’t have a history of credit right away so you’ll have to start building credit from scratch. There are many methods for doing this, but the best way is to simply manage your money properly by never paying bills late and not overextending yourself with credit.

Financial companies in the United States make it very easy to apply for new credit cards, each with their own line of credit. While this can be a helpful way of building credit, it’s also an easy stumbling block for getting into a lot of debt.

Aim to be financially responsible and you’ll have a decent credit score in no time.

When moving to the United States, one of the first things you must do is choose the best financial institution to house your money.

As you begin getting a work visa you’ll start receiving money from your new job. Within the U.S. there are many different kinds of financial companies and services available. Here’s a list of the various financial institutions and accounts they offer.

Commercial banks: These institutions often have a wide variety of offerings as well multiple branches across the country. This makes it very convenient for customers who want access to their funds at all times. Commercial banks offer products such as checking accounts, savings accounts, loans for vehicles or mortgages, personal loans and even credit cards.

Credit unions and local banks: A credit union or local bank may have limited locations in comparison to commercial banks but they generally offer better customer service. In addition, accounts and loans offered by credit unions usually come with better interest rates and lower fees.

Investment companies and brokerages: Investment banks and brokerages can help house multiple types of currencies as well as get you set up with an investment portfolio. While these institutions offer checking and savings accounts, as well as some loans and credit cards, they also allow you to access to investment or legal advice. It’s important to note, however, that investment brokerages often come with much higher fees to compensate for the expertise at your disposal.

Online-only banks: Some up-and-coming financial institutions include online-only banks. Since there are no physical locations to maintain, online-only banks are able to keep their overhead costs low and can therefore pass these savings onto their customers. They offer especially helpful services for international residents who may be looking for flexible money options.

The United States tax code is extremely complicated and has specific implications for people who've moved here.

Because of this, it’s important to consult with a tax professional or financial advisor as soon you as you move to the U.S.

A tax professional is similar to your doctor; the more honest information you share with them the better they will be able to help you and set you up for the future. The details you divulge to them are completely confidential so you can feel confident in honestly sharing your financial situation.

One action to take is to take time to research whether or not there’s a tax treaty between the U.S. and your homeland.

“These tax treaties can help you reduce taxes while in the U.S.,” says Rachel Michaelov, of Empire Tax Professionals.

The exact details of how your finances will be impacted after moving can be defined by a finance professional.

The best way to find a qualified tax professional in your area is to search the Internal Revenue Service’s directory. This will give you a list of the Accredited Business Accountant/Advisor and Accredited Tax Preparers in your area and who specialize in immigrant tax situations.

The cost of living various widely from different states and different areas of the country. In a 2016 cost of living survey performed by Mercer, the most expensive cities in the U.S. included New York, San Francisco and Los Angeles.

The coastal areas will often be more expensive than the southern or midwestern states. Likewise, cities that host international airports, such as Dallas, Denver or Seattle, will have a higher cost of living than in more rural areas.

You may want to avoid these highly-populated areas in favor of more cost-effective cities such as Portland, which was listed as one of Mercer’s least expensive cities.

Cost of living includes all of your expenses related to everyday living. When researching the best cities to live in, to take into account housing, food, childcare, transportation, taxes and healthcare costs. Each state has it’s own laws and taxes regulations, so it’s important to review all of the pros and cons -- preferably with a finance professional who understands the local laws.

Sending money back and forth abroad often comes with high fees. One way to circumvent this is by using Wise.

Danny, who works at Wise, moved earlier this year from London to New York with his wife, to work in Wise's US office. He knows that a move abroad can be financially challenging, but well worthwhile:

“Work brought us here. The move has been tough, and we’ve had to watch every cent, but we love our new life.”

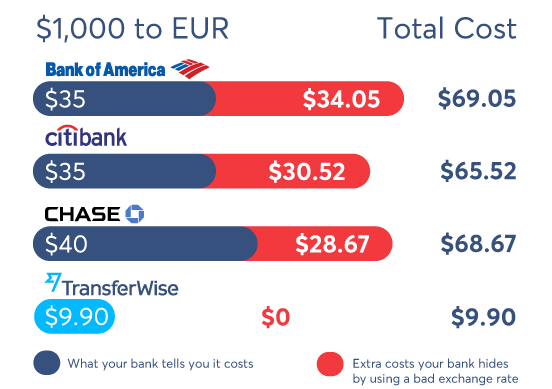

Here's how Wise compares to some of the biggest banks in the U.S. for sending dollars to euros:

See how that's calculated here.

Find out how it compares for pounds and Canadian or Australian dollars by following the links.

It's fast to set up, the transfer is typically complete in a fraction of the time it takes with a bank, and you can also make $300 for every 3 friends you invite. Sign up for your free account or try the calculator below to see how much you could save.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find out where to shop and how to save money when buying gold from Dubai.

Wondering if you can send money from PayPal to Wise? In this article, we'll cover the possibilities.

For many of us who are first-generation Americans, financial literacy isn’t something we learn from our parents - and we’re definitely not taught about money...

Everything you need to know about Discover It balance transfer limits.

Save when traveling to Europe by reading our guide on avoiding ATM fees.

Sendwave vs Wise: Comparing features, benefits, and more. Explore this article for insights on international money transfers.