Comparison of the best online brokerage accounts in Singapore

Looking for the best online brokerage in Singapore? Compare platforms like IBKR, Saxo and Moomoo on fees, features and more to find the right account.

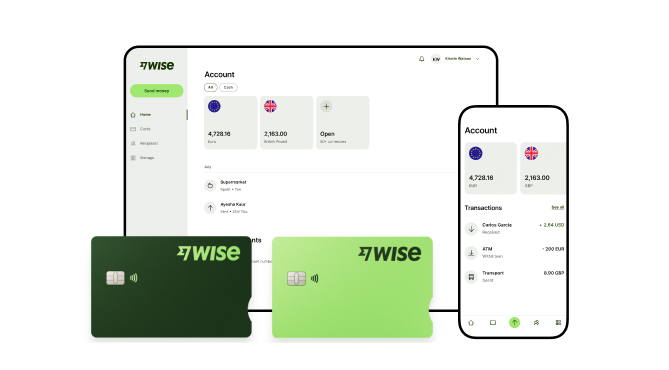

If you need to send or receive international payments - or if you’re looking for simple ways to hold and convert foreign currencies for yourself or your business - you may have heard of Wise. Wise is a financial technology company specialising in currency conversion which uses the mid-market exchange rate, with account options for personal and business customers.

But how does Wise work? This guide walks through how to use Wise in Singapore, including Wise money transfers, the Wise account, the Wise card and Wise Business. We’ll also cover the charges, and how to use the Wise app to send payments and manage your money. Jump to the sections which interest you the most:

Wise Singapore is licensed by the Monetary Authority of Singapore (MAS) as a Major Payment Institution under the Payment Services Act. To receive and maintain this licence, Wise must follow strict rules and legislation to keep customer funds and accounts safe.

As a global business, Wise is also overseen by a broad range of other regulatory bodies around the world. In fact, Wise is currently trusted by over 13 million individual and business customers around the world, and has an Excellent rating on Trustpilot¹, which has aggregated customer feedback from over 180,000 reviews.

Learn more about how Wise keeps its customers and their money safe in this full guide.

You can send a Wise international transfer to bank accounts in any of 80+ supported countries. Wise uses its own payment network to process cross border payments, which can be cheaper and more efficient than sending your transfer through the SWIFT network with a bank.

When you set up a Wise payment online or in the Wise app you’ll be able to either specify the amount you want to send - or the amount you need the recipient to get in their local currency. This can be handy when you have to send a specific amount to pay a bill for example.

Most of all, Wise stands out on price. Wise money transfers use the mid-market exchange rate, with no markup or hidden fees. You’ll just pay a low, variable charge based on where you’re sending money to and how you prefer to pay, which is clearly detailed for transparency.⁶ There are no intermediary fees to pay - and your money could arrive pretty fast too. 50% of Wise payments are instant - arriving within 20 seconds - and 90% arrive in 24 hours.⁵

Here’s a quick overview of how to send money with Wise²:

Register a Wise account - you can sign up to Wise online or in the Wise app

Enter the transfer amount and currency - you can either add the amount you want to send or the amount the recipient needs to get

Confirm if you’re making a personal or business transfer

Enter your details and verify your identity - you’ll need to add your name and address for example.

Add your recipient’s bank details - exactly what’s needed may vary depending on where you’re sending to, but you’ll be guided through the process by onscreen prompts. Don’t have your recipient’s banking information? You can also send to an email address - more on that later.

Choose your preferred payment method, check everything over and confirm

In Singapore, Wise payments can be funded using³:

Bank transfer (including linked bank account)

Debit card

PayNow

Wise account

You’ll see a full summary of the costs involved in making your transfer, plus the estimated delivery time, before you confirm your payment. You can even compare the costs of your specific transfer with Wise against some other popular providers, on the Wise website.

If you don’t have the bank details for the person you’re sending money to, Wise can still help. Simply enter the recipient’s email address and Wise will do the rest. If the person you’re sending to is already on Wise, the system will retrieve their account information to process the payment. And if not, Wise will generate an email to the recipient asking for the details required to get the money to them safely. Easy.

The amount you pay for your Wise transfer can vary based on 3 things:

The amount of money you’re sending

The way you want to pay

The exchange rate

Wise always uses the mid-market exchange rate - the one you’ll find on Google - with all other costs split out and clearly shown. The cost of your Wise transfer can include a percentage fee based on the currency, from 0.43%, and a fixed fee which varies according to the way you want to pay. Use the pricing calculator below to model your example transfer:

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

Wise transfer limits vary based on the currency you’re sending. Check the limits for specific currencies from our help centre.

If you’re expecting someone to send you a transfer in SGD, your sender will normally be able to send up to 200,000 SGD to PayNow details, or up to 2 million SGD as a bank deposit.

If you’re sending a SGD payment yourself, you can send up to 16,000 SGD at a time if you’re using a bank card, or up to 1 million SGD from your bank.

Note that can't send or spend more than 30,000 SGD or foreign currency equivalent from money held in your Wise account in a fixed 12 month window. The window starts on April 1st and ends on March 31st of the following year.

*Limits accurate as of 03/01/2024

You can also choose to register for a Wise account to manage your money across currencies, with just your laptop or smart device. Here are some of the key features you get with the Wise account:

Hold and exchange 40+ currencies with the mid-market exchange rate

Get local bank details for up to 8+ currencies to get paid fee free

Send money to 140+ countries for low, transparent fees from 0.33%

Spend with a linked Wise card in 150+ countries (more on the Wise card later)

Manage your account online or in the Wise app for convenience

No maintenance charges or minimum balance requirement

Personal customers in Singapore can open a Wise account for free, and get a Wise card for a low fee of 8.50 SGD. Once your Wise account is up and running you can add SGD and up to 8+ other currencies, with account details you can use to get paid by local transfer from 40+ countries.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information

One of the key features of having a Wise account is the ability to hold 40+ currencies in your account. This makes it convenient if you are looking to travel or create international transfers to your recipients. You can convert money between any of these currencies in your account, with the real exchange rate.

To add a currency, just click on Open in your Wise app or the website and choose which currency you’d like to hold. You can add a currency to your main account or open a Jar to set money aside.

The main difference is that money in a jar is kept separately from your main account. Think of it as a savings jar - Jars lets you set aside your money to save up for holiday, bills, or anything you like. You can’t accidentally spend money in a Jar with your debit card, and you can’t send it or use it to pay Direct Debits.

For customers based in Singapore, you can take it a step further and maximise the money you hold by choosing to invest it in Interest or Stocks. This lets you grow your money with us through low risk interest-earning funds or index tracking funds depending on the currency you have selected. More on that later.

The most convenient way to top up your Wise account is probably using the Wise app. Here are the basic steps if you want to add SGD) to your Wise account:

Tap your SGD currency

Tap the + Add button

Enter the amount you want to add in SGD, and confirm the currency you want to pay with

Tap Continue

Choose your preferred payment method - bank transfer, PayNow, Apple Pay or card for example

Check everything over and confirm

If you need to receive money to your Wise account you can do so with your local account details for up to 9 currencies.

Log into the Wise app

Tap the currency you want to receive money in

Select Get account details

You’ll be shown your local account details which you can share with the person sending you money

The first time you add a currency you may need to take a couple of extra steps, including uploading some verification documents and adding a small amount of money to activate your account. Any money you add to your account can then be used to fund a payment, or spent with your Wise card.

Wise is regulated by Singapore authorities and must comply with local and international regulation to keep customers and their accounts safe.

If your Wise account is held in Singapore, you’ll be able to hold up to a maximum of 20,000 SGD or the currency equivalent⁴ - a requirement under the Singapore Payment Services Act. Learn more about holding limits here

However, if you have money kept in Jars that are held in Interest or Stocks, your money is not subjected to these limits.

You can choose to hold your SGD and/or USD as either Interest or Stocks, allowing you to hold as much as you want while getting returns from the money market fund, depending on the currency you have selected.

Wise Business accounts are also not subject to these limits.

Once you have a Wise account you can also pay a 8.50 SGD fee to get a linked Wise debit card.

Your Wise card works with your Wise account, with no fee to spend any currency you hold in your account, and low conversion costs from 0.43% when you don’t have the currency you need. That can be far cheaper than the foreign transaction fee commonly applied by banks when you spend using your card overseas. In fact, bank foreign transaction fees are often around 3% - pushing up costs when you travel or spend online with retailers based abroad.

Wise cards can be used for spending in 150+ countries. You can’t make local ATM withdrawals with your card here in Singapore - but you’ll be able to make 2 withdrawals up to the equivalent of 350 SGD a month fee free when you travel, with low fees after that.⁶

| Check out our review of Wise card benefits in Singapore 👀 |

|---|

Manage your Wise card in the Wise app, with options to freeze and unfreeze your card for security, and get a virtual card. Plus instant transaction notifications and balance updates.

That can make the Wise card a perfect partner when you’re away from home - safer than carrying cash, and cheaper than relying on your bank for currency conversion and card payments.

You can easily order your Wise card in the Wise app:

Log into the Wise app

Tap the Cards tab

Confirm your personal details and complete any required verification step

Pay the one time 8.50 SGD fee

Your card will be delivered in the post - and you can get your Wise virtual card details instantly in the Wise app for online and mobile spending. Wise card details can also be added to services like Apple Pay to tap in and out of public transport, pay in stores and buy things online with ease.

When you get your Wise card you’ll need to activate it for contactless spending. All you need to do is activate the card using the 6-digit code printed on the carrier.

If the carrier is lost, misplaced, or didn't come with the code, the card can still be activated if you make a regular card purchase and enter your PIN in the terminal, or use your card in an ATM for a balance enquiry. Check out our help page for more details on card activation.

If you’re a freelancer working with clients overseas, an entrepreneur with international customers, or a business owner paying suppliers, staff or contractors in a foreign currency, you could benefit from Wise Business.

Open a Wise Business account online with a low one time fee of S$ 99 to get all the available features. Business customers get all the perks that a personal customer does - including holding and exchanging 40+ currencies with the mid-market rate, and getting paid like a local from 30+ countries - plus some extra business friendly bonuses to help you save even more time and money.

Wise Business has extra benefits which can support business owners - and cut costs at the same time.

You’ll be able to make batch payments to up to 1,000 people at once - perfect for running international payroll for example, order Wise debit and expense cards for you and your team, and reconcile your Wise account with cloud based accounting software. Plus, you can always add your admin staff or accountants to Wise with Wise Business’ multi-user access features, to give your team the tools they need to do their jobs efficiently.

Get a full rundown of Wise Business vs Wise accounts for personal use here.

Opening a Wise Business account can be done online or in the Wise app, with no need to stand in line at a bank branch to get started. The exact process you follow may vary slightly depending on the type of business you own, but you’ll be guided through the steps in the Wise app - and you can always save and return to your application later if you need to.

In general all you’ll need to do is enter some information about yourself and your business, and complete a verification step - needed to keep your account safe. In most cases that’ll mean providing the following:

Proof of your identity - like a passport or driving licence

Proof of address - like a bank statement or utility bill in your name.

Business documentation which can vary based on entity type

The names, date of birth, and country of residence for any directors and shareholders who own 25% or more of the business

Learn more about how to open a Wise Business account here.

When you hold money in Wise, your funds are held as Cash, by default. This simply means that your funds will be kept in your account as per our safeguarding policy.

But if you are looking to grow your SGD, Wise Assets might be for you.

Wise Assets lets you decide how you keep your money in Wise. You can choose to hold your money as Cash, Interest or Stocks.

If you choose to hold your money as Interest - you'll start earning a 3.82% variable rate on your SGD without the need to lock your money away (includes 0.50% annual fee).*

If you choose to hold your money as Stocks - we’ll invest all of the money you hold in that currency in the index tracking fund we’ve chosen (available only for USD).

However, switching to Interest or Stocks doesn’t change what you can do with your money. It allows you to grow your money in the stock market, while maintaining instant access to it.

*Interest rate as of 03/01/2024. Return not guaranteed, past performance is not an indicator of future results, capital at risk.

Wise personal and business accounts based in Singapore are eligible for Wise Assets.

For business accounts, we can’t onboard every type of business just yet - if you don’t see the option to switch a Jar to Interest or Stocks, we can’t onboard your business. We’ll let you know when that changes.

You can change how your money is held at any point of time, whenever you like.

To change how we hold your money:

Go to the currency you want to change

Select the Cash, Stocks or Interest icon (right under the currency nformation section)

Click on Switch how the currency is held on the next screen

Once you make the switch, it can take up to 2 working days for the change to be reflected. It can also take an extra working day if you’ve still got transactions in progress, or if we’re still processing a change.

Wise is a safe and trusted provider offering currency account services, international payments and currency conversion with the Google rate in Singapore. You can use Wise for yourself or your business, to send payments, spend with a linked Wise card, receive money like a local in up to 9 currencies, and exchange currencies in just a few taps.

Use this full Wise Singapore guide to get you started, and see if Wise can help you save time and money the next time you travel or transact internationally.

Sources:

The speed of transaction claim depends on funds availability, approval by Wise’s proprietary verification system and systems availability of our partners’ banking system, and may not be available for all transactions.

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

In some cases it can take up to 2 business days to complete the sell order, learn more here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for the best online brokerage in Singapore? Compare platforms like IBKR, Saxo and Moomoo on fees, features and more to find the right account.

Looking to start trading? Check out our guide which compares top platforms like Moomoo, Tiger Brokers, and more to help you start investing

Learn how to invest in the S&P 500 in Singapore. Discover S&P 500 ETFs to buy, compare top brokers, and get tips on minimizing fees and tax considerations.

Considering the Maybank Family & Friends card? Read our 2025 review on its cashback, benefits, and fees. Find out if it's the right fit for your spending.

Compare the OCBC 90°N, VOYAGE and Premier Visa Infinite cards to find Singapore’s best OCBC miles credit card for your spending habits and travel goals.

Looking for the best credit card with free travel insurance in Singapore? Compare top cards like UOB and AMEX to get complimentary coverage and save on trips.