Best International Money Transfer Apps in the Philippines

Compare the best international money transfer apps in the Philippines. See fees, exchange rates, speed and payout options to find the right app for you.

If you need to receive a payment quickly in PHP and want it to be deposited to your GCash1 account, you may be considering asking the sender to make a Xoom2 to GCash remittance. If the person sending you money lives in one of the countries served by Xoom, this could mean your money arrives very quickly to GCash, ready for spending.

But what are the requirements to receive money from Xoom to GCash3? This guide walks through all you need to know - and also touches on Wise as a low cost way to send payments to PHP, including to GCash, from all over the world with the mid-market exchange rate and low fees4.

Let’s walk through how to receive money from Xoom to GCash - including eligibility for sender and recipient, and the process to claim a Xoom payment once it arrives in GCash.

Xoom is not globally available. You can send payments with Xoom from the US, Canada, the UK and the EEA⁵. If your sender is based somewhere else they’ll need to choose a different way to send money to GCash. We’ve got a bit of information about one good option coming up later - Wise.

It’s important to check you meet the requirements to get paid through Xoom to GCash. The eligibility rules include6:

You can’t receive payments from Xoom to GCash at all unless you have a fully verified GCash account. The good news is that the process to get verified is pretty easy - if you’re a Filipino citizen, over 18 and with a local SIM, you’ll usually just need to upload an image of a government ID and then take a selfie. Different processes apply for foreigners, Filipino citizens living abroad, and other categories of customer - full details are available on the GCash website8.

Once your sender has arranged the Xoom to GCash payment it should be available to you in just a few minutes. All you’ll need to do is to claim the money once you’re notified it’s available. Bear in mind you need to claim the payment within a fixed time scale - usually 90 days - or the money will be returned to the sender¹⁰.

Here are the basic steps to claim your Xoom to GCash payment - you’ll be guided through the process by on screen prompts for convenience:

Xoom payments to GCash usually arrive in minutes. You’ll get a notification that your money is available and can then claim it3.

If you struggle, there are some handy troubleshooting tips on the GCash help pages online - or you can reach out to GCash customer service directly for support getting your money.

There’s no GCash fee to receive an incoming remittance from Xoom. However, bear in mind that your sender will have paid a fee on the transfer, which may be in the form of an exchange rate markup.

Xoom may not charge an upfront transfer fee to send payments to GCash - the fees will vary depending on where in the world the sender is. However, Xoom uses an exchange rate markup, which is a fee added to the exchange rate used to convert the sender’s currency to PHP. This fee isn’t always easy to spot and can mean you get less in the end than you expected.

Compare the Xoom exchange rate from the sender’s home currency to PHP, against the mid-market exchange rate to see the markup that’s been added. You may find alternative providers offer better rates, so having your sender shop around is a smart plan - both for them and for you!

If your sender isn’t in one of the countries served by Xoom - or if you just want an alternative for comparison, check out Wise.

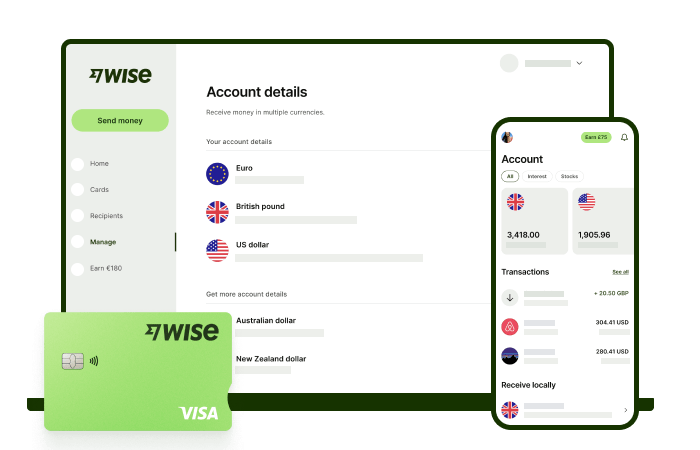

Wise international money transfers can be set up online or within the Wise app with low fees from 0.57% and the mid-market rate, to over 140+ countries. There’s no markup added to the exchange rate that’s used to convert your currency, which makes it easier to see exactly what you're paying for a transfer, and what the recipient will get in the end. Just transfer the amount indicated in PHP and let Wise do the rest.

To make sending foreign currency even easier, create a free Wise account, and you'll be able to manage and convert your money in PHP and 40+ other currencies. You'll get the same great rates, and be able to track your transfers all from one place. You can also get 8+ local account details to be able to receive money in PHP, USD, GBP, and more.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare the best international money transfer apps in the Philippines. See fees, exchange rates, speed and payout options to find the right app for you.

Wondering how to pay for your Atome bill using GCash? Learn more about how to make payments for your Atome card and more.

Need to send money from Paypal to GoTyme? Our 2025 guide covers the step-by-step online transfer process, fees, and processing times.

Learn how to transfer money from GCash to Wise with our detailed guide. We cover fees, processing times, verification steps, and account requirements.

Sending money from Japan to the Philippines? Learn how to transfer from SBI Remit to GCash with our guide, covering fees, exchange rates, and transfer times.

Learn how to transfer money from the eCebuana app to GCash. We cover the step-by-step process, transfer fees, and how long it takes.