How to pay Atome using GCash : Step-by-step guide for Filipinos

Wondering how to pay for your Atome bill using GCash? Learn more about how to make payments for your Atome card and more.

Payoneer1 is a global provider of business accounts and services, with a focus on online sellers and anyone working digitally. Payoneer can be a handy tool for businesses and freelancers to get paid online - but if you’d prefer to have your money in your GCash2 wallet for easier day to day spending, you may be wondering: Can Payoneer send money to GCash? This guide covers all you need to know.

| Table of contents |

|---|

If you have a Payoneer account and want to move your balance to GCash, you may be able to do so by linking your eligible GCash account to Payoneer. You can then use the Cash in process to withdraw your money from Payoneer to GCash, to be deposited into your GCash wallet for easy spending later. Fees apply when you send money from Payoneer to GCash. We’ll look at how this process works in more detail, next.

To transfer money from Payoneer to GCash in the Philippines, you’ll need to take a few steps first. Here are some eligibility requirements to consider:

Payoneer to GCash transfer limits are likely to apply, which can vary based on your account usage, verification, and the currencies involved. You’ll be notified of any relevant limits when you set up your Payoneer to GCash cash in.

If you don’t yet have a fully verified GCash account you’ll need to set this up first. Here are the steps to verify your account if you’re over 18, and have a Philippines mobile number. If you’re under 18, or don’t have a local phone, there are different options available4:

The first step if you want to move money from Payoneer to GCash, is to link your GCash account to your Payoneer account. Here’s what you need to do5:

Once you have linked your GCash and Payoneer accounts, you’re ready to set up a GCash cash in to withdraw money from Payoneer to GCash. Here’s how to arrange your Payoneer to GCash transfer6:

Once you’ve initiated your withdrawal, the Payoneer to GCash processing time is usually only about 5 minutes.

You’ll receive a message via SMS to confirm your payment has been approved. You’ll also be able to access Payoneer to GCash tracking by logging into your Payoneer account and reviewing the withdrawal there.

Payoneer has recently reviewed its cash in charges, and there is now a fee to make a Payoneer to GCash withdrawal or transfer. Read on for all you need to know.

From July 8th 2024 onwards, GCash has started to charge a 1% fee when you make a Payoneer to GCash withdrawal7. If you need currency conversion as part of the process, you may also find that other fees apply which are added into the exchange rate applied. More on that next.

If you need to withdraw from Payoneer to GCash and want to exchange currencies as part of the transaction, there may be an additional fee in the form of an exchange rate markup.

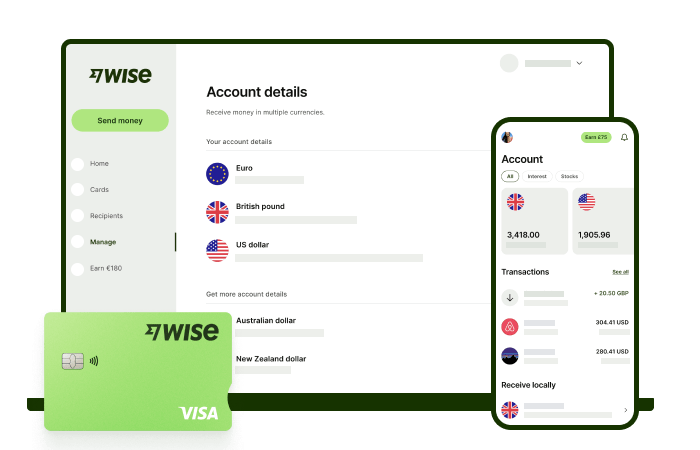

With Wise, you'll get 8+ local account details including PHP, USD, GBP, AUD, and more. This way, you can receive money directly, in a cheap and convenient manner. All you need to get started is to sign up for a free account, and you'll be able to manage your money with just a few taps of your phone.

After getting your money, you can easily convert it to 40+ currencies, with low fees, and the mid-market rate - also known as the rate you see on Google. This includes exchanging to PHP with a one-time conversion fee from 0.57% that's shown upfront, and no markups or additional fees.

Receive, exchange, and move your funds to your local bank account in PHP in a cheap and convenient manner with Wise.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering how to pay for your Atome bill using GCash? Learn more about how to make payments for your Atome card and more.

Need to send money from Paypal to GoTyme? Our 2025 guide covers the step-by-step online transfer process, fees, and processing times.

Learn how to transfer money from GCash to Wise with our detailed guide. We cover fees, processing times, verification steps, and account requirements.

Sending money from Japan to the Philippines? Learn how to transfer from SBI Remit to GCash with our guide, covering fees, exchange rates, and transfer times.

Learn how to transfer money from the eCebuana app to GCash. We cover the step-by-step process, transfer fees, and how long it takes.

Need to send money from RCBC to GCash? Our guide covers the step-by-step online transfer, fees, and processing times.