Top Laptops for Virtual Assistants in the Philippines: 2025 Specs & Budget Guide

Searching for the best laptop for a virtual assistants? Our guide covers top specs, brands, and budget options to boost your WFH productivity.

If you are considering starting to work freelance in the Philippines, you’ll need to quickly get to know about freelance tax in the Philippines, to make sure you comply with the law and don’t end up with a hefty fine.

Freelance tax - also known as self employed tax in the Philippines - is paid to BIR, the Bureau of Internal Revenue. Whether you’re a resident or not you might need to pay freelance tax in the Philippines if that’s where your income is derived from - and if you’re living in the Philippines for self employment purposes, you’ll probably have to pay tax there on your worldwide income.

This guide is a starting point for you to learn more about how Philippine freelance tax might work for you.

| Table of contents |

|---|

This guide is for information only. It does not constitute tax advice. For more information seek advice from a professional, or from the Bureau of Internal Revenue (BIR).

The Bureau of Internal Revenue (BIR)1 views freelancers as self employed people earning an income from a professional activity. You may also be considered a freelance worker if you’re a sole proprietor, working for yourself.

Generally, freelancing is any form of work where you’re earning from one or multiple employers, without an ongoing contract of employment. Freelancing comes with freedoms. You can take on the work you enjoy, schedule your own time, do lots of different types of projects and make a living doing what you love and what you’re good at. However, there are also some downsides - particularly when it comes to tax.

Unlike when you’re employed by a single employer, as a freelancer you’ll be responsible for your own tax filing, and for paying your bill at the end of the year. That can get complex - particularly if you’re location independent and work from more than one place during the course of a tax year.

This guide walks through some of the basics and key facts about freelance tax in the Philippines. It is not a substitute for doing your own research - and it is not tax advice. If you need tax advice to make sure you stay on the right side of the law, engage a professional in the Philippines to help you. It’ll cost you, but it will also mean you don’t need to worry about fulfilling your obligations for paying freelance tax in the Philippines.

In short, yes.

BIR income tax2 rules dictate who has to pay income tax in the Philippines. Among people who need to report and file for tax payments, you’ll find:

As a freelancer in the Philippines, broadly speaking the rules for self employed people will apply to you. If you’re not sure where you fit in these BIR classifications, or what income you need to report and pay tax for in the Philippines, you can reach out for help and guidance from BIR directly.

Before you can pay your freelance tax in the Philippines you’ll need a TIN (Tax Identification Number). If you’ve already got one you may be able to skip this step - but if not, make sure you check out the BIR TIN registration3 requirements as soon as possible. You’ll need your TIN for all tax matters in the Philippines - so if you’re a new arrival there, or if this is your first time paying tax in the Philippines, this is an important step.

You’ll need to prepare:

All BIR forms are available online on the BIR website. There’s also a handy chat function there that you can use if you’re not sure what process you should follow to register for your local TIN.

You may be able to qualify for deductions or exemptions for filing for tax in the Philippines, based on your personal situation. For example, if you’re earning at the minimum wage you may not need to file. However, as Philippine freelance tax exemption rules are complex and pretty strict, this is definitely an area where taking professional advice based on your situation would be a smart idea.

The primary document you need to find for your tax filing as a freelancer in the Philippines is:

You can find this form on the BIR website, or talk it through with a tax professional to get personal advice on your filing.

You’ll also need to complete:

To file your self employed tax in the Philippines, you must complete BIR Form 1701 AIF in triplicate, and attach it to a completed BIR Form 1701. You’ll physically have to hand over 2 form copies, and you keep the third yourself. Make sure you keep this form safe, as you’ll need it when you pay your taxes later.

Depending on your specific situation, as well as Form 1701, you may need several other documents to complete your tax filing. These can include paperwork associated with your BIR Form 1701, such as:

Not all of these documents will apply in any given situation. If you’re unsure what paperwork is needed to complete your freelance income tax (Philippines) filing, take advice from a professional.

The deadline to get your paperwork submitted is usually on or before the 15th day of April of each year. As details can change from time to time, make sure to double check the information to make sure you hit the deadline and to avoid unnecessary hassle.

Depending on your situation you may also have options to file and pay monthly or quarterly. If this solution works better for you, head to the BIR website for more information, or discuss your options with a tax professional.

BIR tax rates at the time of writing, for freelancers earning income from their profession, are as follows.

If the total gross sales/receipts do not exceed VAT threshold of 3,000,000 PHP, you can choose either2:

OR

| Amount of net taxable income | Tax rate |

|---|---|

| Up to 250,000 PHP | 0% |

| 250,000 PHP - 400,000 PHP | 20% of the excess over 250,000 PHP |

| 400,000 PHP - 800,000 PHP | 30,000 PHP +25% of the excess over 400,000 PHP |

| 800,000 PHP - 2,000,000 PHP | 130,000 PHP +30% of the excess over 800,000 PHP |

| 2,000,000 PHP - 8,000,000 PHP | 490,000 PHP + 32% of the excess over 2,000,000 PHP |

| 8,000,000 PHP+ | 2,410,000 PHP + 35% of the excess over 8,000,000 PHP |

This is a graduated tax scheme. To give an example of how it works, if you earn 300,000 PHP, you’ll pay 0% on the first 250,000, and then 20% on the excess 50,000 PHP to make up your annual income in full.

If your total gross sales/receipts exceed the VAT threshold of 3,000,000 PHP, you must pay tax based on the graduated tax scheme.

When it’s time to actually pay your tax in the Philippines you can do so using one of these methods:

If you’ve chosen to pay in person, make sure you have printed copies of all your BIR forms when you go. The person you end up paying will then stamp your copy of the form to show you’ve properly paid, and for your own records.

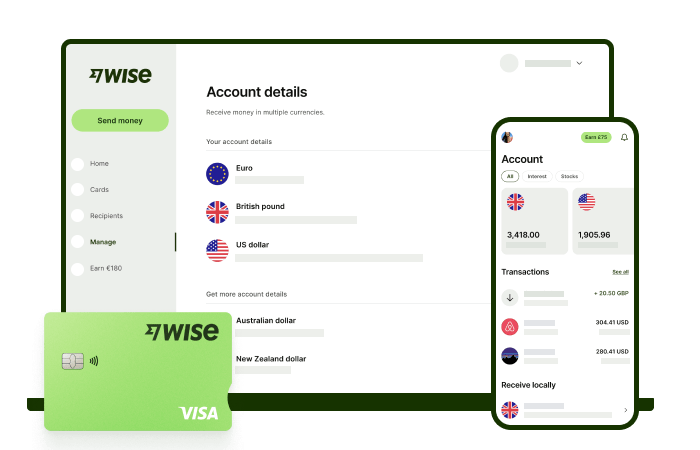

Did you know that over 76%* of Filipinos cite low and transparent fees as an important factor when receiving money from abroad? With Wise, that's exactly what you're getting - all you need to get started is to sign up for a free Wise account, and you'll be able to manage your money with just a few taps of your phone.

You'll have access to 8+ local account details for major currencies including PHP, USD, GBP, AUD, and more, allowing you to receive money directly, in a cheap and convenient manner. After getting your money, you can easily convert it to 40+ currencies, with low fees, and the mid-market rate - also known as the rate you see on Google. This includes exchanging to PHP with a one-time conversion fee from 0.57% that's shown upfront, and no markups or additional fees.

Get paid and move your funds to your local bank account in PHP in a cheap and convenient manner with Wise to stretch every peso.

*Disclaimer: The percentage figure mentioned above is based on an internal survey conducted by Wise in April, 2024

✍️ Sign up for a free account now

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

It also comes with the Wise prepaid card, which lets you spend globally in 150+ countries and shop online at the same mid-market rate. Start bringing your money home in a smart way without extra hidden fees with Wise⁵!

If you’re a self-employed freelancer in the Philippines, it’s crucial you get to know how freelance tax works. Paying your taxes is one of the trickier aspects of freelance life - but properly reporting your income and settling your dues is essential to make sure you don’t run into fines or even criminal prosecution.

Take professional advice to make sure you’ve covered all you need to do for taxes in the Philippines and beyond - and check out Wise to see if you can keep more of your money when working with overseas clients.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Searching for the best laptop for a virtual assistants? Our guide covers top specs, brands, and budget options to boost your WFH productivity.

Ready for a non-voice WFH job? This guide covers roles (with salaries!), essential skills, where to find legitimate postings, and how to get paid.

Explore the types of virtual assistant work. Find your niche, from social media to data entry, and learn how to manage client payments easily.

Your guide to landing direct client virtual assistant jobs from the Philippines. Learn where to find clients, build your portfolio, and get paid easily.

Looking for an HMO for freelancers in the Philippines? Compare the best prepaid health card and plans to see how to avail coverage for your needs.

Find medical coder work from home jobs in the Philippines. Our guide covers the training, certification, and tips you need to land a remote medical coder role.