E-Wallet Apps in the Philippines (2026 Guide)

See how popular e-wallet apps in the Philippines compare for online and in-person payments, remittances, fees and features.

PayPal1 is a popular provider for people wanting to shop online, or to send and receive payments locally and internationally. As PayPal is a global business, many different currencies can be used with your PayPal account - which might mean you receive a payment to PayPal in a foreign currency like USD.

If someone has sent you money you may be wondering how to convert dollars to pesos in PayPal to make it easier to spend here. This guide walks through how to switch between currencies, and how to find the PayPal exchange rate for USD to PHP, so you know what you’ll end up with in your account after conversion.

| Table of contents |

|---|

PayPal in the Philippines has both personal and business account services. If you’re a personal PayPal customer you can use PayPal to shop securely online, including getting buyer protections in case anything goes wrong with the service. The other major use of PayPal in the Philippines is to send and receive money.

Personal PayPal payments are available both locally in PHP and internationally - which might mean you receive foreign currencies to your PayPal account. If someone from abroad is sending you money to PayPal the transfer may well be made in their home currency, and deposited to your PayPal account without conversion. This then leaves you the option to either convert to PHP instantly, or to hold your balance in the foreign currency until you need it.

Because PayPal has a huge user base you might find friends and family members send you money to PayPal - this guide walks through how it works if you receive a foreign currency like USD and need to switch it back to PHP to use here at home.

So - how to convert USD to PHP in PayPal?

First up, you’ll need an active and verified Philippine PayPal account, which you can set up online or in the PayPal app. You’ll only need to give some pretty basic information to get started such as your name and email address2. Once you’ve registered you can receive payments right away. However, to spend and send money with PayPal you’ll ultimately need to get verified which you can do by adding and confirming a bank account, debit or credit card to your account3. This proves your ID and also provides you with a way to pay if you choose to use your PayPal account to shop online.

Once you’re all set up with payPal, you’ll need to have someone send you money. As a sender, PayPal is very easy to use - the person sending you a payment just needs to know your name and the email or phone number you used when you signed up. They can then set up the transfer to you, to be received in USD or any other supported currencies and pay from their balance, bank account or card. Payments are often received instantly with PayPal, although this will depend a bit on the way the sender sets up the transfer.

So - let’s say you’ve now received a payment and need to use PayPal to convert USD to PHP. You’ll first want to check out the PayPal conversion rate for USD to PHP which you can find by tapping the Currency Converter button in your PayPal wallet4. Bear in mind that fees apply for converting currencies with PayPal, which we’ll look at in more detail later.

Once you’re ready to convert USD to PHP in PayPal you can take the following steps5:

Your currency will instantly be converted from USD to PHP. You’ll see your new PHP balance in your account.

PayPal supports 24 currencies for holding and exchange6, including PHP alongside other major currencies like USD, GBP, EUR, AUD and NZD. Other useful currencies include regional options like SGD and THB.

If someone is sending you money from Singapore, for example, they’d be able to send Singapore dollars from their local account to your PayPal, and you can receive the payment in SGD to either spend or convert later.

| 👀 Looking for an account that can receive payments in USD and convert directly to PHP with low, transparent fees? Learn more about how to use Wise in the Philippines |

|---|

Sign up for a free Wise account

If you’re planning to convert USD to PHP in your PayPal account or when you withdraw a balance to your Philippine bank, you’ll need to make sure you’re aware of the PayPal fees7 which will apply.

There’s a currency conversion cost which we’ll look at next - plus there may be a withdrawal fee. If you're withdrawing less than 7,000 PHP the chances are that you’ll be charged 50 PHP - a fee which is waived for higher value withdrawals.

PayPal sets its own exchange rate for currency conversion. This is created by taking a base exchange rate which is based on rates within the wholesale currency markets on the conversion day or the day before, plus an exchange fee8.

The exchange fee is deducted from the amount being converted from USD to PHP at the point the payment is converted, or when you withdraw your balance to your bank account in the Philippines.

There’s no fee to receive an incoming payment to PayPal, in PHP or USD. However, there's a conversion fee if you have USD and need to switch it over to PHP. In the Philippines, the currency conversion fee will usually be 4%.

It’s also worth remembering that if you’re withdrawing funds to your bank, there might be a fee if you are withdrawing an amount under 7,000 PHP.

You can usually convert a balance in PayPal from one currency to another instantly. You’ll simply see the new balance reflected in your PayPal account as soon as you’ve confirmed the conversion request.

Check out Wise for easy, low cost ways to receive dollar payments and convert USD to PHP.

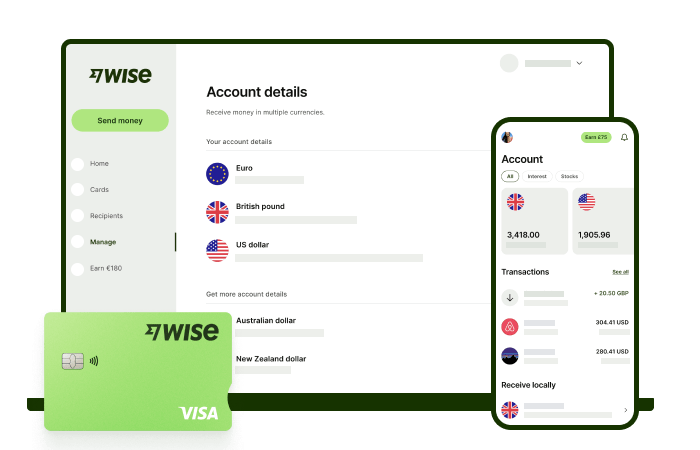

The Wise account is an easy way to hold and exchange 40+ currencies, including PHP, USD, CNY, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.57% and absolutely no markups. Plus, you can order a Wise card for convenient spending at the same great rate, without any foreign transaction fees. At times you need cash, you can also make up to 2 free ATM withdrawals to the value of 12,000 PHP when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in PHP and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Converting USD to PHP doesn't have to be complicated or expensive. Get a Wise account to get the most out of your foreign currency conversions!

| This content incorporates publicly available data points from as part of research and comparative analysis conducted as of 4 November 2024. The information and insights provided are for informational and illustrative purposes only and may not reflect the most current data. Readers are advised to independently verify and cross-check the information before making any decisions or proceeding further. |

|---|

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

See how popular e-wallet apps in the Philippines compare for online and in-person payments, remittances, fees and features.

Learn how to pay SSS contributions online using My.SSS, the mobile app, e-wallets, or online banking. A simple guide for OFWs and voluntary members.

Learn how to pay PhilHealth contributions online using banks, GCash, or Maya. A guide for OFWs, freelancers, and voluntary members.

A detailed review of the BPI Rewards Credit Card, including fees, eligibility, rewards points, and whether it’s suitable for everyday spending.

A detailed review of the Chinabank Freedom Credit Card, covering fees, eligibility, rewards points, and whether it suits everyday spending in the Philippines.

Confused about Maya Bank vs Maya Wallet? Learn the key differences, features, fees, and which Maya account suits your needs in the Philippines.