Receiving International Cheques: How to Deposit, Clearing Time, Costs Involved

Learn how to receive and deposit cheques from overseas in our guide that covers essential tips for processing and cashing checks across borders efficiently.

PayPal1 is a super convenient platform for sending payments to friends and family locally, and for shopping online. But what about international use? How long does it take to receive money on PayPal from another country? And what’s the lowdown on how to receive money on PayPal when someone sends you a foreign currency?

This guide has you covered. We’ll also touch on an alternative - Wise - which can offer quick international payments with mid-market exchange rates and low, transparent fees that can help you save on international transfers2.

| Table of contents |

|---|

There are plenty of ways to receive money to your PayPal account in New Zealand. Which is best for you will probably depend on who’s sending the money and your personal preferences. You’ll need to have a PayPal account to get your money - if you’re not registered yet and someone sends you a payment you’ll be notified so you can register and make a withdrawal from your account.

Generally options to receive money on PayPal in New Zealand include:

It’s helpful to note that there may be differences between how to receive money on PayPal from a friend, and how to receive money if you’re a PayPal business customer. While both personal and business PayPal users have the same withdrawal and currency conversion fees3, PayPal business customers may also pay commercial transaction rates, for example when selling online and using PayPal checkout for taking customer card payments4.

This guide focuses on personal PayPal customers - we’ll touch on business users, but if you’re using PayPal as a merchant it’s worth reading the fee schedule thoroughly before you start transacting.

Let’s walk through the different ways of receiving money with PayPal, step-by-step.

1. Using Email or Phone Number

If you need to receive money on PayPal from a friend, all you need to give them is your email or phone number5. Just make sure they have the details you used when you registered with PayPal, and the sender will be able to find you right from their contacts.

You can also receive money on PayPal from games and apps, by entering the contact details you used when you signed up to PayPal. In both cases, this is easier and more secure than passing out your bank details.

2. Through your PayPal.Me Profile

If the person sending you money doesn’t have PayPal themselves, but you want to receive the transfer to your PayPal account, another smart option is PayPal.Me.

With this you’ll generate a PayPal.Me link - structured as PayPal.Me/Your Name - and add the amount of money you want the person to send to it. For example if you need 25 NZD, your link would be structured PayPal.Me/Your Name/25. You can even request different currencies - just add in another currency code after the amount - PayPal.Me/Your Name/25AUD for example6.

The sender just has to click on the link to pay.

3. By Sending a Payment Request

You can send a payment request to anyone who has an active email address7. All you need to do is log into your PayPal account and navigate to Send and Request. Here you’ll see the option to create a payment request and can follow the prompts to enter the payee’s email, the amount and currency. You can finish it all up with a note or message and send it to the person who needs to send you money. This service is available for PayPal personal and business customers.

To pay a PayPal money request you’ll usually need to have a PayPal account8 - make sure the person you want to send you money has PayPal already, or consider an alternative option.

4. By sending an invoice

You can create a PayPal invoice online or in the PayPal app, which is a good option for businesses and freelancers who need a more professional approach. This takes a few more steps than some of the other options9:

To pay a PayPal invoice you’ll usually need to have a PayPal account - check the person you’re billing is comfortable paying with PayPal before you create your invoice.

PayPal Checkout is a payments gateway that provides card processing, and payments buttons you can integrate on websites and apps10. It’s a useful tool for business customers and people selling online, but it does come with different fees compared to PayPal personal services.

One key question will be how to receive money on PayPal without fees. Nobody wants to have to pay to access their own money. Let’s look at how PayPal New Zealand fees work.

We’ll highlight the key fees to receive money via PayPal for New Zealand users, but do check the full details online to make sure you know what costs may apply in your specific case.

| Service | PayPal NZ fees |

|---|---|

| Receive money from friends and family | No fee as long as no currency conversion is required |

| Receive money as a business | Standard commercial transaction rates: 3.4% + fixed fee for domestic payments 4.4% + fixed fee for international payments |

| Withdraw money to a NZD bank account | No fee as long as no currency conversion is required |

| Withdraw money to a USD bank account | 3% |

| Currency conversion | 3% - 4% depending on the transaction type |

Currency conversion costs apply if you need to exchange from your PayPal balance currency to make your withdrawal. If someone sends you money in NZD from overseas, the chances are that they'll need to pay these costs at their end instead. For a cheaper alternative, read on.

PayPal may not be your best bet to receive money from abroad. Whether it’s the sender paying the fees - or you as the recipient - PayPal tends to crank up the costs when it comes to international transfers.

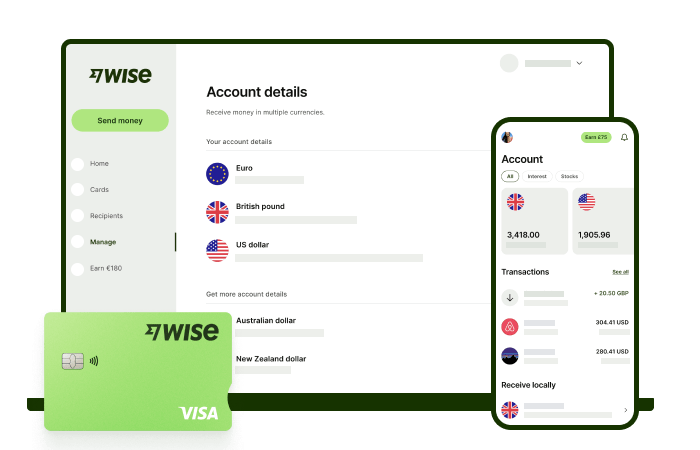

Check out Wise instead. You can open a Wise personal account for free, to get local bank details which will allow senders to send you money with a local payment in 8+ currencies.

There’s usually no fee for you to receive the payment¹³, and as it’s sent as a local transfer, the costs for the sender are generally low or zero, too.

Looking for more? Wise accounts can also be used to hold and exchange 40+ currencies, send international payments to 140+ countries, and spend with an international Wise debit card in 150+ countries. See if you can save with Wise today.

Receiving money from abroad with Wise

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

You can withdraw a balance from PayPal to a NZD bank account or a USD bank account. Bear in mind that there’s a 3% fee to withdraw to USD, and currency conversion costs of 3% - 4% will apply if you need to exchange money to make the withdrawal. Here’s what to do11:

Wondering how to receive money on PayPal without a bank account? You may be able to receive payments to PayPal without a bank account, but you can’t then withdraw your money. You can leave your balance in PayPal and use it to send a payment or shop online instead.

Frequently Asked Questions about receiving money with PayPal in New Zealand.

PayPal payments can be instant, depending on how the sender pays. However, it can take 3 - 5 days to withdraw the money to your bank. If you’re in a hurry ask the sender to initiate the transfer through a service like Wise instead, which can be fast or instant12.

Limits may apply both on the person sending and receiving funds through PayPal. Limits vary based on country, account use, and a range of factors.

If you receive a payment to a New Zealand PayPal account in NZD and then make a standard withdrawal to your linked NZD bank account there should be no fee. However, it can take 3 - 5 days to withdraw the money to your bank. Check out alternatives like Wise to get your money moving faster.

PayPal transfers can be received instantly to your PayPal account, usually if the sender pays with their PayPal balance or with a card. Bear in mind it can take time to then withdraw to your bank account.

Sources:

Sources verified on 22 May 2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to receive and deposit cheques from overseas in our guide that covers essential tips for processing and cashing checks across borders efficiently.

Discover whether to select local or home currency when shopping online from an international website or while traveling abroad with our insights on saving fees.

How does Wise compare against PayPal in New Zealand? Read on from our Wise vs PayPal guide comparing money transfers, international payments, and more.

How does Wise compare against Western Union in New Zealand? Read on from our Wise vs Western Union comparison to see what would work best for you.

Making a choice between Wise vs OFX? We reviewed both the platforms to help decide which is better for international transfers from New Zealand.

Making a choice between MoneyGram vs Western Union? We reviewed both the platforms to help decide which is better for international transfers from New Zealand.