How to open a bank account online in New Zealand: Eligibility, steps, and top providers

Wondering if you can open a bank account online in New Zealand? Discover the options available and how to open a bank account online.

The ANZ Jumpstart Account is a popular option for students in New Zealand to get started with with their first NZD account. This guide will explore the features, benefits, and potential caveats of the ANZ Jumpstart Account, as well as way to save on international transfers using Wise.

| Table of contents |

|---|

The ANZ Jumpstart Account is a transaction account designed specifically for young people under 21 and students. It's tailored to meet the banking needs of those starting their financial independence, whether they're studying, working, or both.

ANZ Bank is one of major banking providers in New Zealand, with widespread ATM network around the country. They offer 24/7 access to your account online or via the ANZ app, plus Access to ANZ's extensive branch network for in-person banking. Here are the key highlights for the ASB Jumpstart Account in particular:

No monthly account fee: The ANZ Jumpstart Account is free from monthly maintenance charges.

Free electronic transactions: Unlimited free electronic transactions, including EFTPOS, ATM withdrawals at ANZ ATMs, and online banking.

ANZ Visa Debit Card: Access to a Visa Debit card for easy purchases and withdrawals.

Mobile banking: Use the ANZ goMoney app for convenient account management.

Apple Pay, Google Pay, and Samsung Pay: Compatible with popular digital wallet services.

Age-based transition: Automatically transitions to a Go Account when you turn 21.

International Transfer Services: Convenient option to send and receive money internationally. More on this below:

While ANZ does provide convenient way to send and receive payments with the Jumpstart account, it is important to understand their foreign exchange fees before availing their international services involving foreign currency exchange.:

For sending money abroad, ANZ charges NZD 28 when making a transfer through their staff (in branch or phone), NZD 9 through ANZ Direct Online, and NZD 5 through ANZ Internet Banking or ANZ goMoney app.

For receiving money from abroad, ANZ charges NZD 15 for international inwards payments above NZD 300.

ASB Bank published it's own foreign exchange rates and you can use their currency calculator to see the conversion amount.

You'll find that these rates are higher than the mid-market rates you see on Google — and the one used on Wise.

Here is a comparison of international money transfer costs between ANZ Bank and Wise:

As you can see, even with slightly higher transfer fees, Wise can help you save with international transfers by offering currency conversions at mid-market rates without any markups.

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

ASB Bank offers a free Visa Debit Card that you can use overseas anywhere Visa card is accepted. This can seem convenient for ANZ account holders when they travel abroad from New Zealand.

However, again, you must be vigilant of the currency conversion rates when using your card internationally:

As an alternative, we invite you to check out Wise card that help you save by converting NZD at the mid-market rate.

Note that Wise card costs a one-time fee of NZD 14. Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

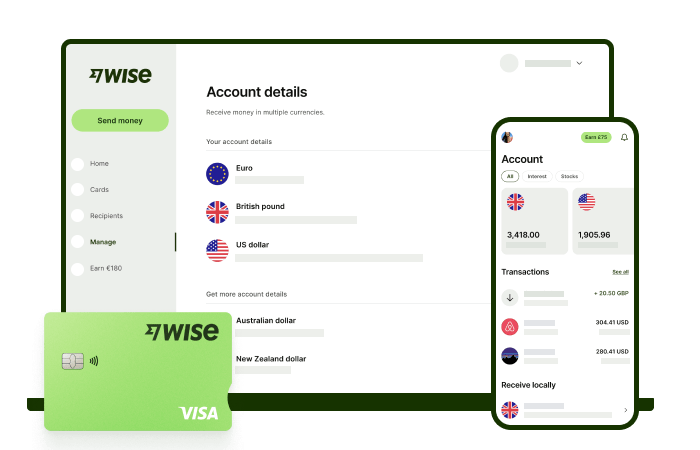

The ANZ Jumpstart Account offers a solid banking solution for young adults in New Zealand, with the advantage of physical branches, local banking infrastructure, and tailored features for those under 21. However, for those with international banking needs, or those looking for more flexibility in currency management regardless of age, the Wise Account presents an attractive alternative.

Multi-currency account: Hold and manage 40+ currencies.

Mid-market exchange rates: Get the mid-market rate with no markups when converting currencies.

Low-cost international transfers: Send money abroad at a with transparents fees.

Wise Debit Card: A linked debit card that automatically uses the best currency in your account.

No monthly fees: Free to open and maintain the account. (Debit card costs a one-time fee of NZD 14).

Local account details: Get local bank account numbers for NZD, AUD, USD, EUR, and more.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering if you can open a bank account online in New Zealand? Discover the options available and how to open a bank account online.

A guide to opening a bank account in Australia from New Zealand.

Wondering if you can open a bank account in New Zealand as a foreigner? This guide brings you through providers, eligibility and more.

Searching for a credit card with no international fees? This guide compares top providers, features, and fees available in New Zealand.

HSBC is closing its retail banking services in New Zealand. Learn about the closure, and discover alternatives.

The ASB Streamline Account is a popular option for New Zealanders looking to open a new account with ASB. This guide goes over all the features, and more.